Food delivery market shows tasty potential

A rising number of Chinese shoppers prefer restaurant food and delivery to their home or dining out, despite a five-year low in home consumption growth, according to an industry report.

According to Kantar Worldpanel and Bain & Company's 2017 China shopping report, "China's Two Speed Growth: In And Out Of The Home", the results show that "two-speed" home consumption is continuing and that instead of preparing food at home, there has been a significant rise in out-of-home consumption among Chinese consumers.

This year, in addition to the usual panel of 40,000 households for home consumption, the report analyzed 4,000 Chinese individual consumers in first and second-tier cities.

While food purchases for in-home meal preparation grew by 3 percent annually from 2013 to 2016, food deliveries rose by 44 percent and dining out grew by 10 percent over the same period, said the report. This was fueled by offline-to-offline (O2O) food delivery, which has achieved 40 to 50 percent annual growth over the past three years.

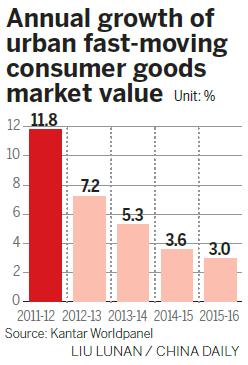

In comparison, annual growth in fast-moving consumer goods value for home consumption remained sluggish across all sectors studied in 2016, hitting a five-year low of 3 percent. This was due to a combination of almost flat volume growth and a deceleration of price growth, said the report.

"We knew it would be game changing in how brands and companies would need to adapt to succeed in China's retail sector," said Jason Yu, general manager of Kantar Worldpanel in China.

"This divergence in the market was a wake-up call to many companies that have now started to use it in their strategies and thankfully have recognized the importance of recognizing the two speeds and they can now also be prepared for this latest trend of out of home consumption."

Other findings include that e-commerce continued to skyrocket in China, growing by more than 52.6 percent in value.

Online now represents 7 percent of fast moving consumer goods sales, having doubled its share of the market in the last two years.

Hypermarkets declined by 2 percent and supermarkets or minimarkets decelerated to 2 percent, compared to convenience stores which increased by 7.4 percent, according to the report.

The health and hygiene-related category achieved high and growing penetration, along with personal care, which shows that more Chinese shoppers are willing to pay for higher-quality goods.

Local brands beat foreign brands in terms of growth as local brands grew by 8.4 percent and foreign brands grew by only 1.5 percent.