Tesla could change China auto industry: Observers

|

|

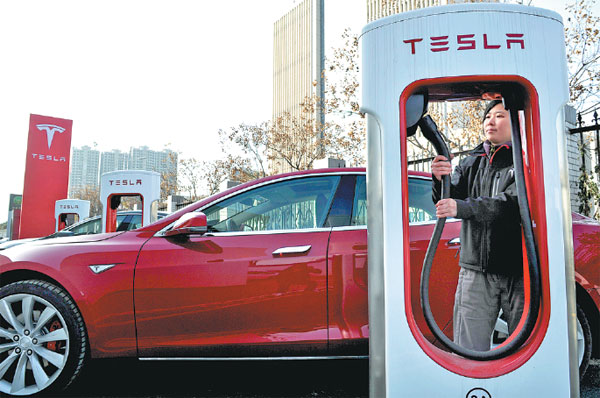

A driver uses Tesla's charging station in Xi'an, capital of Shaanxi province. LIU QIANG / FOR CHINA DAILY |

If Tesla Inc has reached an agreement with Shanghai's government to build a fully owned manufacturing facility in the city's free trade zone, then other automakers will seek approval and that could change the dynamics of the auto industry in China, according to US auto analysts.

Tesla Inc on Monday again confirmed it is talking with the Shanghai municipal government to set up a factory in the region and expects to agree on a plan by the end of the year. But the electric car maker declined to comment on a Wall Street Journal report over the weekend that it and the Shanghai government have reached a deal to allow Elon Musk's company to become the first foreign car maker to own a manufacturing plant in China.

Most foreign auto companies partner with Chinese companies in a joint venture (JV) and share their technology.If Tesla strikes a deal with Shanghai's government for a wholly owned plant, it would allow Tesla to slash the production and shipping costs of its cars sold to China. But since the cars would be manufactured in the city's free trade zone, it would not get an exemption from the import tax of 25 percent.

"Other foreign companies will try to follow the same path or use this opportunity to push removing the JV requirements. Chinese policy makers have been debating the pros and cons of the restriction anyway. I will not be surprised to see the policy change in the near future," Qiang Hong, a senior research scientist at the Center for Automotive Research in Ann Arbor, Michigan, said in an email.

Stephanie Brinley, industry analyst with IHS Marki, agreed that other automakers would seek to follow Tesla's move. "China has indicated it will consider granting these requests as a measure to increase production of new-energy vehicles," he said in an email.

David Keith, a professor at the Massachusetts Institute of Technology (MIT) Sloan School of Management, said in an interview that Western auto companies have been concerned about their intellectual property rights in the joint ventures with Chinese firms.

"You can understand why Tesla would not be interested in a joint venture," Keith said. If Tesla gets to own its plant it would "signal an opening of the industry at a time of dramatic change in the automotive industry," he added.

Arthur Wheaton, an automotive expert with Cornell University's School of Industrial and Labor Relations, wrote in an email that having "100 percent ownership is highly unusual in China. For internal combustion cars the law requires about 50 percent Chinese ownership for cars to be sold in China. Honda has a plant with 100 percent ownership but it is export only."

Wheaton said the Chinese facility would help Tesla to meet current demand. Keith agreed and noted that the company is producing vehicles in a small number of countries.

"This would give Tesla an opportunity to increase production, bring down costs and perhaps help the company expand its sales in Asia," Keith said.

Tesla delivered 13,500 cars in the first nine months of 2017 in China, more than double from a year earlier, according to the China Passenger Car Association.

Tesla has just one manufacturing facility, in California, which has been facing several production bottlenecks.

Li Fusheng in Beijing contributed to this report.