Investors celebrate three years of buying Chinese stock

Overseas fund managers have hailed the success of a stock connect between the Shanghai and Hong Kong exchanges on the third anniversary of its establishment.

The special arrangement lets international investors buy Chinese stocks and share the benefit of China's fast economic development.

The Shanghai Hong Kong Stock Connect, which was launched on Nov 17, 2014, allowed overseas investors to access Shanghai-listed Chinese shares mostly traded on Chinese mainland for the first time. The move was a significant milestone in China’s capital market liberalization process.

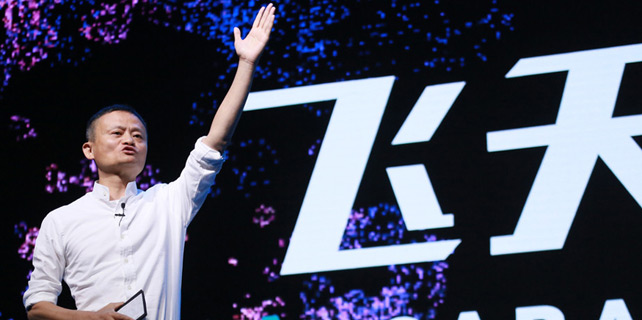

"Chinese companies offer high earnings and cash-flow growth opportunities, and the Chinese equity market is the second-largest in the world," said Ma Wenchang, a fund manager at investment company Investec Asset Management. "Valuation is still at a discount, compared to the global equity market and we continue to find new exciting ideas to invest in."

Eric Bian, client portfolio manager of emerging markets and Asia Pacific equity, at JP Morgan Asset Management, said: "The backdrop is positive for China equities, given a supportive outlook for corporate earnings, still accommodative liquidity conditions, and strong external growth supporting the macro-economy."

As of the end of last month, the Shanghai Hong Kong Stock Connect had enabled international investors to trade 3.35 trillion yuan ($509 billion) of shares listed in Shanghai.

Its success has encouraged the launch of a similar stock connect linking the stock markets of Hong Kong with Shenzhen. It was launched in December.

Meanwhile, a feasibility study into a potential link between Shanghai and London’s stock markets is under way.

Despite the Chinese equity market being the second-largest globally, foreign investors currently only hold 1.5 percent of its value. This situation is expected to dramatically change when the United States index provider MSCI includes China A-shares in its emerging markets index in June, meaning many international investors who benchmark against the MSCI index will naturally buy into Chinese shares.

William Fong, investment director of Hong Kong China Equities at Barings, said he expects stock prices to rise as more international investment comes into the market.

According to the latest data from the Hong Kong Stock Exchange, international investors are diversified in their stock selection, with consumer-facing, and "new economy" sectors, such as technology, healthcare, and energy, being top picks.

These statistics are confirmed by fund managers. Fong of Barings said his team is keen on "new economy" stocks because these companies represent the future of China's economic growth as its economy experiences a structural shift.

Kathy Xu, investment manager of China equities at Aberdeen Standard Investments, said her team is keen to invest in sectors including travel, healthcare, and consumer goods, because they have stocks driven by strong domestic consumption and a rising middle class.

Despite overall optimism, fund managers have also cautioned against risks in China's stock market arising from some Chinese companies' transparency and governance issues and the potentially irrational investment decisions of retail investors.

Xu emphasized the importance of companies’ trustworthy transparency and governance, "that underlines the importance of due diligence".