Survey shows young savers value security above return

Updated: 2014-11-05 07:44

By Wu Yiyao in Shanghai(China Daily)

|

||||||||

Young Chinese are still more likely to put their money into straightforward savings accounts than any other form of investmentproduct and they are happier to trust their parents before financial institutions when doing so, a survey shows.

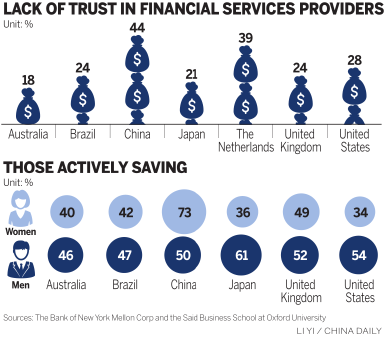

The study, by investment bank The Bank of New York Mellon Corp and a team from Said Business School at the University of Oxford, polled 1,178 individuals born after 1980-often called millennials-from seven countries: China, Australia, Brazil, Japan, the Netherlands, the United Kingdom and the United States.

The results showed 68 percent of the Chinese polled said they already had deposit accounts, a higher rate than in any of the other six countries, and 78 percent of those said they were happy with their returns. Some 73 percent of the Chinese females polled said they were savers, against just 34 percent of American females.

A higher proportion of Chinese millennials (44 percent) than any other group ticked the option "I don't trust financial services providers with my money"-a clear reflection of the lasting impact of recent banking scandals on the reputation of the financial services industry, said Li Jin, a professor with Said Business School.

As a result, the majority of young Chinese said they still look to their parents for financial advice (52 percent) while less than one-third said they would consider contacting a financial consultant.

"Chinese people have not been dealing with investment and savings products companies for long enough and so do not have a sufficient idea of how they operate," said Lin.

"But there are also stories of people being taken advantage of, and sometimes even outright fraud taking place in some situations."

The survey concludes, however, that young Chinese do appear to understand one of the basics of prudent financial management: that accumulating savings is the first step toward making more aggressive wealth management decisions in the future.

Sun Kaiqi is a 29-year-old machinery engineer from Shanghai who has been saving hard for a down payment on an apartment. He said that after saving enough to hit his first target he may then consider investing in other products, such as currency-backed investment funds, or the stock market.

"The fact I cannot afford to lose any of my investment makes savings my priority," he said.

Janet Smart, an undergraduate course director at Said Business School, said the study highlighted just how disconnected the financial services industry has become from the millennial generation, and that the challenge now for companies is to find new ways of engaging with them, to encourage a commitment to long-term savings and wealth management, such as retirement planning.

Just more than half of the Chinese polled said they did not know how the pension system works, and that jumped to 78 percent for those under the age of 23.

Vicki Doyle, head of retail and corporate superannuation at BT Westpac Banking Corp, said: "Savings industry advertisements in the past pictured people walking down the beach with their dog, which is largely irrelevant for this age group.

"As an industry, we are in transition about how we really communicate and engage with customers of different age groups in how to offer them something with value, right now."

Robert Kung, country executive of BNY Mellon's China operations, said the survey was valuable in understanding Chinese young people's attitudes toward financial services, adding that financial institutions need to be aware of the challenges being presented by the new generation.

|

|

| Internet a shot in the arm for financing | China banking on a more worldly financial sector |

Republicans capture control of Senate in US midterm elections

Republicans capture control of Senate in US midterm elections

Chinese students compete in real estate challenge

Chinese students compete in real estate challenge

Trending across China: Abortion lesson horrifies kids

Trending across China: Abortion lesson horrifies kids

8 things you should know about 'Double 11'

8 things you should know about 'Double 11'

Rehearsal of firework show for APEC staged in Beijing

Rehearsal of firework show for APEC staged in Beijing

Culture Insider: What books do politicians like?

Culture Insider: What books do politicians like?

WTC reopens with six-floor China Center

WTC reopens with six-floor China Center

John Kerry speaks about US-China relations

John Kerry speaks about US-China relations

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Republicans gain seats in Senate

Chinese Americans run in elections across US

Mobile gains buoy Alibaba earnings

Kerry, Cui reaffirm bilateral ties

Republicans capture control of Senate

China develops laser system against drones

Students compete in real estate challenge

FDA beefs up China office

US Weekly

|

|