Rogues to riches

Updated: 2014-11-21 16:29

By Luo Weiteng(HK Edition)

|

||||||||

As banking regulators wage an ongoing battle to control trading misconduct, industry intellects and university researchers are also seeking answers to the problem. Luo Weiteng reports.

Since February 1995 when Nick Leeson brought down Barings, one of the grandest names in British banking, by hiding an 830 million ($1.3 billion) loss in his supposedly lucky secret "five eights" account in Singapore, there have been repeated cases of rogue trading scandals hitting large financial institutions.

Financial giants, including Resona Holdings (formerly Daiwa), Societe Generale and JPMorgan, have been brought to their knees by these reckless gamblers. The magnitude of losses has grown from Leeson's $1.3 billion at Barings to 4.9 billion euros ($6.1 billion) blamed on Societe Generale trader Jerome Kerviel, and Bruno Iksil's $6.2 billion at JPMorgan.

In Hong Kong, foreign banks have been the major players so far in rogue trading, "while local and mainland banks, albeit seldom involved, are itching to have a go as foreign counterparts downsize their overseas business", said Dominic Wu, a Hong Kong-based managing director and senior risk manager at The Bank of New York Mellon (BNYM).

As chairman of the Asia Financial Risk Think Tank, an expert-led, not-for-profit organization set up in 2011, Wu has been working with a group of industrial experts and the Risk Management and Business Intelligence (RMBI) Student Association of the Hong Kong University of Science and Technology to conduct research into trading misconduct.

Local misconducts

Trading misconduct appears to have remained alive and well on Hong Kong trading desks during the past few years.

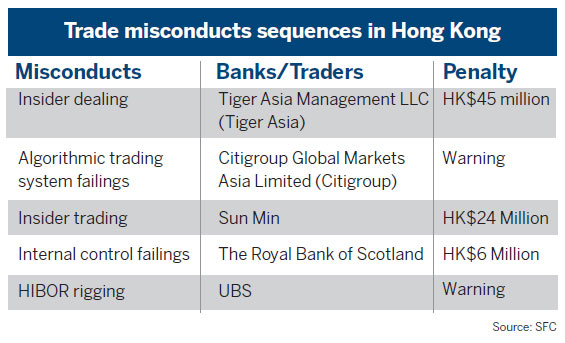

In May this year, the Securities and Futures Commission (SFC) reprimanded Citigroup Global Markets Asia (Citigroup) for failing to ensure its algorithmic trading systems functioned properly for certain securities orders between April 2009 and May 2010.

That move followed a reprimand issued to Royal Bank of Scotland, which was fined HK$6 million ($774,000) after failing to detect and prevent trading misconduct.

And one month before that, UBS was censured by the Hong Kong Monetary Authority for attempting to manipulate the Hong Kong Interbank Offered Rate (HIBOR) between 2006 and 2009.

No wonder, then, that in its report published last December, Risk-focused Industry Meeting Series: G-SIFI Trends in Risk, the SFC emphasized that trading fraud was a particular area of concern in view of spectacular cases in recent years that have carried high "operational tail-risk".

"Trading misconduct exists in nearly every bank almost every day," said Wu, adding that it becomes almost commonplace when the economy veers to the downside.

Very often, by taking advantage of loopholes in the market or financial institutions, the misbehavior is simply the pursuit of bonuses which depend heavily on traders' performance. Yet, as Wu notes, the misconduct sometimes stems from an unintentional error in a single transaction, which might then evolve into a desperate attempt across multiple transactions to cover up accumulated mistakes.

"How much you earn for the company is how much you are worth to them. Such a greedy, hero culture makes losses totally unacceptable for these over-confident traders," said Vincent Lam, chief financial officer of VMS Investment Group, a Hong Kong-based multi-strategy investment group.

"These super-smart traders, long enjoying privileged status in the banks, haven't got the slightest idea about how to deal with failures. Coming forward is the last resort (and) only when they can no longer dig themselves out of the hole," Lam said.

New tricks

Trading misconduct today is an extension of old tricks of the trade, reemerging in different forms.

Electronic trading, in theory, should have put an end to this misbehavior. However, Lo Cha-lung, chairman of the RMBI Student Association researching trading misconduct, pointed out that practices have simply taken on a different guise, through high-frequency trading (HFT) firms that use algorithms and powerful computers to execute huge numbers of trades instantaneously. HFT firms use their firepower to trade ahead of, and profit from, large orders likely to move share prices, according to Lo. "Never one to miss a trick, the market is 'rigged' in that sense."

Yet, local and mainland banks are still ill-equipped to front-run the market, said BNYM's Wu, adding that more than 70 percent of HFT so far is seen in the United States.

Secretive HFT was the culprit blamed for the 2010 "flash crash", but its evil cousin, dark pools - a significant player in the 2008 market crash - has also moved into the Hong Kong spotlight.

It is understood that Hong Kong regulators continue to meet with banks in this Asian financial hub to increase scrutiny of the marketing of dark pools to clients. This follows a legal wrangle concerning allegations of HFT fraud by Barclays via dark pools. The private share-trading venues allow investors to buy and sell stocks anonymously without disclosing prices or identities until deals are done.

"So far, these controversial trading arenas are not allowed in Hong Kong," said Wu. "A few years ago, some American and European banks used to have their own dark pool trading platform, which, however, ended up being suspended for good."

VMS Investment's Lam noted that trading misconduct cases in Hong Kong are much more negotiable than those in the US, where penalties can mount to astronomical figures, especially if the case takes a long time to be settled.

"If companies and banks never feel they are under close watch by the city's investigators, how can we expect to bring the rampant growth in trading misconduct under control?" asked Wu.

Citing the fake highway snapshots used to curtail drivers' urge to speed, he said a "faked snapshots mentality" needs to be developed among Hong Kong's market players.

"A sheet of final written warning is definitely far from effective and enough," Wu said.

Contact the writer at sophia@chinadailyhk.com

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China's tire firms urge govt to fight US action

Chinese men spending more on facial care

Goal to cut emissions can be met

PLA opens bidding to lower costs

WeChat turns to students to expand its presence in US

Graft fight dents overseas spending

Hagel move won't affect China-US ties: experts

China's nuclear power bid saluted

US Weekly

|

|