Into the future

Updated: 2015-04-10 15:56

By Oswald Chan(China Daily USA)

|

||||||||

|

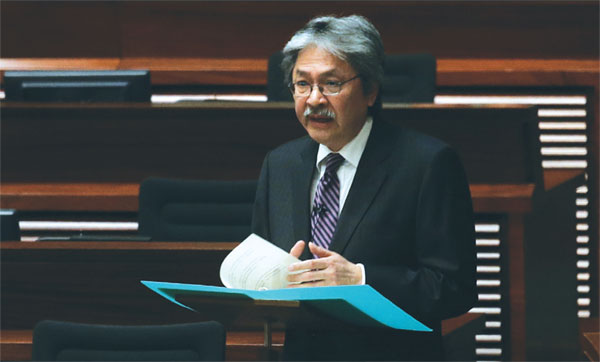

In his 2015-16 Budget speech, Financial Secretary John Tsang Chun-wah said the Future Fund will serve as long-term savings. [Roy Liu / China Daily] |

Managers of the planned Future Fund must be open to taking risks and be more flexible on asset allocation if they want higher returns, experts believe. Oswald Chan reports.

The Hong Kong government has agreed to establish a Future Fund within this year as a long-term savings program. The aim is to boost returns through long-term investment to fund future government spending.

In his 2015-16 Budget speech, Financial Secretary John Tsang Chun-wah said he had requested Financial Services and the Treasury Secretary Ceajer Chan Ka-keung to work with Norman Chan Tak-lam, chief executive of the Hong Kong Monetary Authority (HKMA), to hammer out specific management and investment mechanisms for the planned fund.

"The Future Fund will serve as long-term savings and be placed in long-term investments for higher returns," Tsang said.

That comes after the goverment's Working Group on Long-Term Fiscal Planning (Working Group) late last year suggested that the government establish a Future Fund to proactively tackle the projected structural deficit due to slow economic growth and an aging population.

The government plans to transfer the entire HK$220 billion in the Land Fund to the new pool, along with 25 percent to 33 percent of each annual budget surplus. This Future Fund will then be invested for higher returns in the Exchange Fund - run by the HKMA and used to back the Hong Kong dollar.

The Future Fund should remain an integral part of the fiscal reserves and the fund proceeds will be held in the form of a notional account against the Land Fund through administrative means, the Working Group suggested.

The part of the fiscal reserves outside the Future Fund will be referred to as "Operating and Capital Reserves (OCR)".

Hong Kong's fiscal reserves are tipped to balloon to nearly HK$820 billion by the end of March. If the entire Land Fund is transferred to the proposed Future Fund, approximately 27 percent of government reserves will be the initial endowment of the new pool (See diagram above). "The Future Fund is a proactive saving and investment strategy to shore up government finances when the administration currently can still maintain a budget surplus," Elizabeth Tse Man-yee, Financial Services and the Treasury permanent secretary and chairperson of the Working Group, said at their press briefing in early March.

"The Future Fund is different from the current Exchange Fund, where the emphasis is more on short-term liquidity and safety to provide a buffer for the Linked Exchange Rate System in Hong Kong," Tsang said at a post-Budget 2015-16 news conference in February.

Long-term vision

The Working Group proposed an investment time frame of at least 10 years for the Future Fund in order to earn stellar investment returns. It did not specify the desired rate of return nor provide any details on deployment of the fund's proceeds.

About 50 percent of the Future Fund will be invested in the HKMA Exchange Fund's Long-Term Growth Portfolio, with illiquid assets in private equities and real estate. The remaining 50 percent will be invested in the Exchange Fund's Investment Portfolio, which mainly includes more liquid assets such as bonds, equities and foreign exchange.

The HKMA currently invests about HK$100 billion in the Long-Term Growth Portfolio.

At the end of 2013, the annualized internal rate of return of the portfolio since 2008 was around 16 percent, according to the Working Group report.

Actual asset allocation will depend on the Future Fund's investment objective, the government's liquidity needs, investment performance, market dynamics and product availability, the report said.

If the OCR is depleted to a level equaling six months' gross government expenditure, and other viable financial contingency options like debt financing or asset securitization are exhausted, then the government can consider withdrawing money from the Future Fund even at the risk of suffering a loss.

The Future Fund, just like the Exchange Fund, will be subjected to regulatory oversight by the Exchange Fund Advisory Committee.

The HKMA should consult the Financial Secretary as well as the Secretary for Financial Services and the Treasury at least once a year on the investment strategy and asset allocation for the Future Fund, the report suggests.

The Working Group cautioned last year that a structural deficit will emerge in Hong Kong in 2021 at the earliest - if government expenditure grows at 7.5 percent annually while revenue is estimated to grow 4.5 percent per year.

"As the HKMA is also managing its financial assets through the Exchange Fund, it will have the incentive to earn higher investment returns. So it would be safe to endow the Future Fund for the HKMA to manage," Liu Pak-wai, Working Group member and professor at the Chinese University of Hong Kong's Institute of Global Economics and Finance, told the March press conference.

"If the investment horizon is set in a longer time frame, it has much higher probability of capturing higher returns. But if the time frame set is one to two years, chances of suffering a huge investment loss can be very high," Liu warned.

"The returns generated from the Exchange Fund can already satisfy the need to support the Linked Exchange Rate System. To shore up government finances in the future, the administration needs an investment fund that can bring higher returns.

The investment strategy can be more aggressive than the current Exchange Fund," noted Michael Dai, senior economist at Bank of China (Hong Kong).

The Exchange Fund in 2014 suffered a 46 percent plunge in investment returns to HK$43.6 billion, due to heavy losses in foreign-exchange investment and falling returns on all other asset classes - such as Hong Kong equities, overseas equities, as well as real estate investments and private equity.

Flexibility is key

The return rate for the Exchange Fund in 2014 was only 1.4 percent, or 3 percentage points lower than the city's inflation rate in the same period.

The Exchange Fund only yielded an average return of 3.7 percent for the last 10 years (2005-2014), according to HKMA figures.

"The HKMA must be flexible in its asset allocation, swift to accommodate new market environment and willing to delegate to other asset managers the management of Future Fund assets if it wants to earn a higher investment return," Patrick Shum Hing-hung, investment manager at Tengard Fund Management, told China Daily.

"It depends on whether the HKMA is willing to take more risks in managing Future Fund assets," Shum added.

The HKMA is extremely conservative in managing the Exchange Fund as the bulk of the assets are invested in low-yield but liquid financial assets such as high quality short-term US dollar debt securities.

"The HKMA can work out a ratio of long-term and short-term asset allocation, for example, 70 percent for long-term and 30 percent for short-term assets. The long-term asset allocation is for capturing long-term capital value growth while the short-term portfolio would aim to obtain short-term capital gains based on market timing," Shum suggested.

"The government can consider making real investments in various infrastructure projects such as roads, bridges or railways to boost long-term investment returns and facilitate the city's economic development through these infrastructure developments," Billy Mak Sui-choi, finance and decision science associate professor at Hong Kong Baptist University, told China Daily.

"The main hurdle is that the government needs to outsource appropriate managers to manage these infrastructure projects, and to enhance these projects' market value to enable the government to exit these investments," Mak said.

"This means a specialized team of project management staff will be required, and the administration should devise a framework of regulation to administer these infrastructure project investments."

The Exchange Fund, with assets totaling HK$3.2 trillion as of January-end, was set up by the government in 1998 and invests in a diverse portfolio of financial assets to defend the Hong Kong dollar.

The January figure was HK$67 billion higher than the total at the end of December, with foreign currency assets and Hong Kong dollar assets rising HK$14.2 billion and HK$52.8 billion respectively, the city's de facto central bank said in a statement.

Contact the writer at oswald@chinadailyhk.com

- Bird flu outbreaks reported in two Mexican states

- Failed developer shoots dead 3, injuries 2 at Milan courthouse

- People rescue beached dolphins in Japan

- Indonesian children's risky shortcut to get to school

- S.Korea, US to hold joint exercises

- Last batch of Chinese peacekeeping infantry arrives in S.Sudan

Ten photos you don't wanna miss of today

Ten photos you don't wanna miss of today

Amur tigers come back from the brink

Amur tigers come back from the brink

Guns prepared to mark Anti-Fascist War anniversary

Guns prepared to mark Anti-Fascist War anniversary

Tibetans' viral wedding photos contrast city with country life

Tibetans' viral wedding photos contrast city with country life

Strange but true: Three times a lady

Strange but true: Three times a lady

Road to Cuba

Road to Cuba

Trending: 'Gateway to hell' found in Urumqi

Trending: 'Gateway to hell' found in Urumqi

Last batch of Chinese peacekeeping infantry arrives in S.Sudan

Last batch of Chinese peacekeeping infantry arrives in S.Sudan

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Celebrating a relationship

Chinese police return favor for ill US officer

Battling the language barrier

US, Cuba hold highest-level talks since 1961

UN official praises new website that engages Chinese public

Hillary Clinton expected to announce presidential run soon

Shooting outside Washington DC leaves 1 injured

Blocking of chip exports could backfire: scientist

US Weekly

|

|