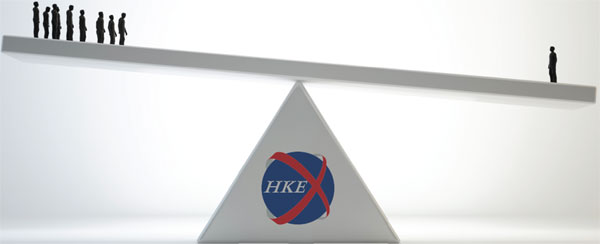

The rights balance

Updated: 2015-06-05 16:58

By Oswald Chan(China Daily USA)

|

||||||||

Relaxing corporate structure rules for initial public offerings (IPOs) could be a growth driver for the Hong Kong stock exchange as it strives to regain its IPO destination crown. But making fund-raising by tech firms easier is even more important. Oswald Chan reports.

The intentions of Hong Kong Exchanges and Clearing Ltd (HKEx) to proceed with the second round of consultation on a voting rights rethink has been thwarted, as its own Listing Committee did not approve the Weighted Voting Rights Concept Paper (Concept Paper) at their May 11 meeting. The committee's refusal to endorse the Concept Paper means that the HKEx may not start the second round of consultation in the third quarter as planned.

HKEx published the Concept Paper in August last year, shortly after mainland e-commerce giant Alibaba Group Holding Ltd announced plans to list in New York once it failed to reach a deal with the Hong Kong bourse over voting rights. That was because the company's proposed dual-class shares and later partnership structure clashed with the HKEx's "one-share, one vote" principle.

Results of the first round of three-month consultation concluded last November have yet to be released.

The Concept Paper seeks views on whether Hong Kong should change its listing rules to accommodate companies with dual-share and other weighted-voting-rights (WVR) structures.

Alibaba raised as much as $25 billion on the New York Stock Exchange last September, notching up the largest initial public offering (IPO) in global history.

WVR refers to a corporate governance structure that gives certain shareholders voting power or other related rights disproportionate to their stockholding. It is a form of dual-class stock structure that involves issuing various types of shares by the same firm to give specific shareholders voting control.

The primary concern over WVR is whether certain persons will misuse their power for personal benefit, at the expense of other investors.

In Hong Kong, the only corporate shareholding form currently permitted for listing candidates is the "one share, one vote" structure, or equal voting rights for all shareholders, a rule in place since 1989.

Rescuers mourn victims on seventh day since Eastern Star disaster

Rescuers mourn victims on seventh day since Eastern Star disaster

Rescuers enter Eastern Star hull in search efforts

Rescuers enter Eastern Star hull in search efforts

Gaokao held across China

Gaokao held across China

Man sues actress for staring at him

Man sues actress for staring at him

Students prepare to take national college entrance exams

Students prepare to take national college entrance exams

Across America (May 29- June 4)

Across America (May 29- June 4)

Operation underway to turn the ship over

Operation underway to turn the ship over

Prayers held for ship passengers

Prayers held for ship passengers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Heavyweight Zhang wins unanimous decision

China mourns Yangtze shipwreck victims as search continues

China signs $50m agreement with FAO to support developing countries

9.42 million students sit national college entrance exam

Death toll jumps to 396

as hopes of finding any

survivor in cruise fade

China, Japan reopen finance talks after delay over sour relations

Hacking claim isn't responsible, Beijing says

Startups return to China to battle pollution

US Weekly

|

|