Structural reforms highlighted in China's 2016 economic policies

Updated: 2015-12-15 22:06

(Xinhua)

|

||||||||

BEIJING - Structural reforms are expected to draw more attention from China's policy makers next year as an industrial glut and lack of high-quality supply beset the economy.

China should continue to keep economic growth at a proper range and advance structural reforms in 2016, according to a statement released after a meeting of the Political Bureau of the Communist Party of China (CPC) Central Committee presided over by President Xi Jinping on Monday.

"While improving domestic demand, the country should raise the quality and efficiency on the supply side," the statement said.

The meeting, economists say, signaled the direction of China's 2016 economic policies. While spurring investment and consumption, the leaders will prioritize reforms to digest excessive capacity and foster new growth engines.

The former measures can stimulate short-term demand, but the structural reforms, by making enterprises more vibrant, efficient and upscale, can generate growth in the long run and help upgrade the economy.

A focus of those reforms will be eliminating "zombie companies" and increasing the productivity and competitive edge of Chinese firms, according to Liu He, deputy chief of the country's top economic planner, the National Development and Reform Commission.

Diminishing orders and a severe oversupply has created some "zombie companies" that can survive only on bailouts, particularly in industries like steel and cement, which saw hectic expansion in the past decade.

Those companies, along with other heavily indebted firms and a high inventory of unsold houses, are a road block for reforms targeting the economy's supply side, said Liu Yuanchun, an economist at Renmin University of China.

China's factory activity hit a 39-month low in November, official data show. The profits of major industrial firms fell 4.6 percent year on year in October, worsening from the 0.1-percent decline posted in September.

Monday's statement said the government will encourage mergers, reorganization and, in some cases, companies filing for bankruptcy to clear up the market.

While redundant, backward supply capacity should be allowed to exit the market, a slew of reforms are urged to help companies adapt and upgrade.

Chinese leaders have pinned hope on mass entrepreneurship and innovation. The CPC meeting on Monday vowed to promote that by relieving financial strain for companies. Measures promised include reductions to transaction costs, taxes and social insurance fees.

"The persisting high cost of financing is hurting business sentiment," said Li Daokui, an economist at Tsinghua University. He suggested reforms of the financial system to allow companies to expand the issuance of long-term debts and rely less on bank credit.

To improve the business environment, reformers were also urged to further delegate government power and give the market a bigger say.

Thanks to streamlined administrative procedures, the number of newly-registered companies in China rose nearly 20 percent year on year in the first three quarters.

Other key reforms include that of the country's colossal state-owned enterprises (SOEs). Broad-stroke guidelines on SOE reform have been rolled out this year, restructuring plans for several conglomerates have been announced, and private investment has been encouraged to enter previously monopolized sectors.

Li urged faster implementation of SOE reform, saying there should be some successful cases to serve as encouraging examples.

An overhaul of the household registration system also needs to be accelerated so that it can facilitate urbanization and create new areas of growth, he noted.

"With those moves, China's economy will hopefully stabilize and start to recover in the second half of next year," Li predicted.

China's economy expanded 6.9 percent year on year in the third quarter of 2015, the lowest quarterly growth in six years, but still in line with the government's target of around 7 percent.

- Saudi Arabia announces 34-state anti-terror alliance

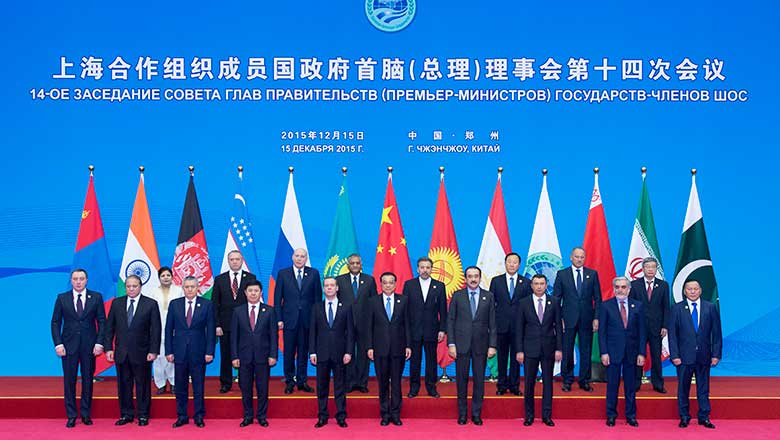

- Premier greets SCO leaders ahead of meeting

- Bus crashes in northern Argentina, killing 43 policemen

- California shooter messaged Facebook friends about support for jihad

- Obama says anti-IS fight continues to be difficult

- Washington's cherry trees bloom in heat wave

Leaders pose for group photo at SCO meeting

Leaders pose for group photo at SCO meeting

Washington's cherry trees bloom in heat wave

Washington's cherry trees bloom in heat wave

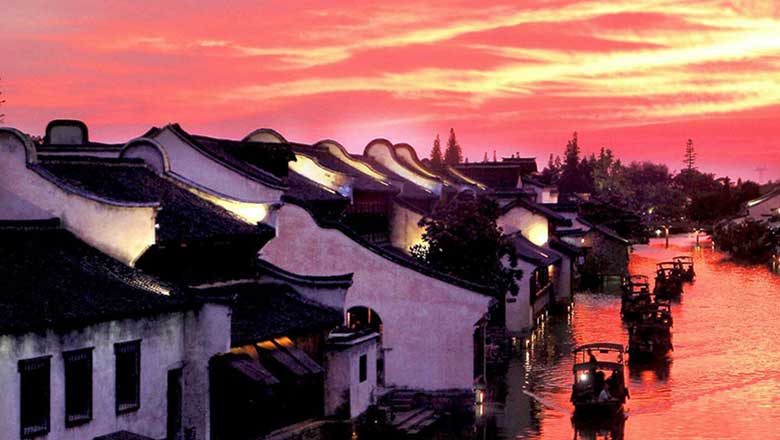

Wuzhen ready for Internet conference

Wuzhen ready for Internet conference

Fairy tale tunnel of love in south China

Fairy tale tunnel of love in south China

Beautiful moments of 2015 in China's great outdoors

Beautiful moments of 2015 in China's great outdoors

Student volunteers wear qipao for World Internet Conference

Student volunteers wear qipao for World Internet Conference

China marks Memorial Day for Nanjing Massacre victims

China marks Memorial Day for Nanjing Massacre victims

Six major archaeological discoveries in 2015

Six major archaeological discoveries in 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|