Yearender: Predictions for 2016 through 20 questions

Updated: 2015-12-31 07:53

(China Daily)

|

||||||||

|

|

Li Yiping |

5. Can China solve the problem of industrial overcapacity once and for all?

Li Yiping, a professor at the School of Economics, Renmin University of China

No. Solving the excessive production capacity problem is a long-term and difficult task, which cannot be performed in one year. Challenges such as cutting industrial overcapacity require unremitting and long-time efforts.

In recent years, local authorities have regarded the real estate sector, along with their large-scale infrastructure construction since the beginning of reform and opening-up, as the driver of rapid economic growth, which has resulted in the overcapacity of the steel and cement industries. Moreover, we have been over-dependent on overseas market demand for a long time, which has led to the overcapacity of low-price export products. And the recession in production has resulted in the overcapacity of coal and electricity sectors.

Economic structural adjustment is crucial to reducing overcapacity, which should be mainly decided by market mechanisms. Several Western countries eliminated overcapacity and encouraged innovation to counter economic crises, which helped their economies prosper.

So the Chinese government should intervene in the market as little as possible and let it decide the direction of adjustment and which outdated capacity should be eliminated-and only then China's industries and products can rise to the middle and high end of the global industrial chain through innovation.

|

|

Yang Zhiyong |

6. Is there likely to be a local government debt crisis?

Yang Zhiyong, a researcher at the National Academy of Economic Strategy, affiliated to the Chinese Academy of Social Sciences

No. The risk of China's local government debt is generally controllable, so a local government debt crisis is not likely next year. In 2015, China's overall local government debt added up to 16 trillion yuan ($2.5 trillion) and the national debt reached about 11 trillion yuan. The overall sum of government debt is less than 50 percent of the national GDP, which is lower than the generally accepted warning line of 60 percent.

However, there are three major problems that we should be aware of. First, local governments' capabilities to cope with debt risk are different. The central government, therefore, should take different measures accordingly, such as supporting areas with low incomes, to avoid the spread of debt risks.

Second, local government debt faces huge pressure of short-term repayment. In 2015, local areas issued 3.18 trillion yuan worth of replacement bonds, which effectively dealt with the short-term repayment issue and reduced the debt financing cost. Hence, in 2016, the authorities should issue more replacement bonds to ease the pressure of short-term payment.

Third, we should expedite the process of building an overall local government debt repayment plan to cope with both the incremental and existing debts. Part of the existing debt should be repaid by selling off government assets. And incremental debts should be repaid through the reasonable and normalized distribution of central and local governments' incomes.

- Top 10 policy changes in China in 2015

- Yearender: Ten most talked-about newsmakers in 2015

- Yearender 2015: Chinese athletes of year

- Yearender: 2015 auctions overview

- Yearender: China and US in 2015 - moving forward together

- Yearender 2015: Key words from stories that created buzz in China

- Yearender 2015: Stories that made headlines

- Yearender: 2015 auctions overview

- Yearender 2015: Natural disasters

- Top planner targets 40% cut in PM2.5 for Beijing-Tianjin-Hebei cluster

- Yearender: Predictions for 2016 through 20 questions

- Asia's largest underground railway station opens in Shenzhen

- Shanghai bans drug-using actors, drivers

- Clamping down to clean up the air

- Yearender: Ten most talked-about newsmakers in 2015

- Over 1 million refugees have fled to Europe by sea in 2015: UN

- Turbulence injures multiple Air Canada passengers, diverts flight

- NASA releases stunning images of our planet from space station

- US-led air strikes kill IS leaders linked to Paris attacks

- DPRK senior party official Kim Yang Gon killed in car accident

- Former Israeli PM Olmert's jail term cut, cleared of main charge

Yearender: Predictions for 2016 through 20 questions

Yearender: Predictions for 2016 through 20 questions

World's first high-speed train line circling an island opens in Hainan

World's first high-speed train line circling an island opens in Hainan

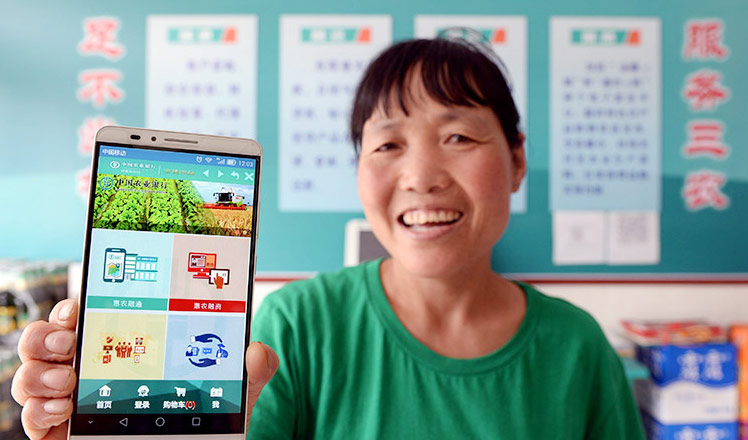

'Internet Plus' changes people's lifestyles in China

'Internet Plus' changes people's lifestyles in China

Rough waters on the sea front of West Wales

Rough waters on the sea front of West Wales

Beijng Zoo wholesale market to be relocated by 2016

Beijng Zoo wholesale market to be relocated by 2016

Iron woman: first female body builder in Egypt

Iron woman: first female body builder in Egypt

Yearender: Chinese athletes of year

Yearender: Chinese athletes of year

Yearender: Key words from popular China news stories in 2015

Yearender: Key words from popular China news stories in 2015

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

US Weekly

|

|