Uptown whirl

Updated: 2016-01-29 09:27

By Chai Hua(HK Edition)

|

||||||||

Prices of luxury homes in Guangdong's economic powerhouse are hitting new highs, prompting feverish speculation over whether Beijing and Shanghai have cause to worry. Chai Hua reports in Shenzhen.

The rocketing prices of upscale homes in Shenzhen have got local media debating over whether the southern economic powerhouse can overtake Shanghai and Beijing to lead the national luxury market, which is usually regarded as the weather vane of the overall real estate sector.

Many experts believe Shenzhen has the potential to edge into the top rungs, but doubts still linger when the market is compared to Beijing or Shanghai.

It is true that sales of some luxury housing projects are booming in Shenzhen.

Queuing is no longer unique to the opening of low-priced homes, queues are now par for the course also for homes priced at more than 10 million yuan ($1.5 million), the level that is generally regarded as one of the benchmarks for luxury property.

As many as 2,900 such units were sold in 2015 in Shenzhen, a year-on-year growth of about 190 percent, with average price reaching more than 75,000 yuan per square meter, the highest among first-tier cities, according to data from the Shanghai E-house Real Estate Research Center (E-house Center).

Its data also show that transaction of luxury houses accounted for 9 percent of the total sales, up by 2.5 percentage points from 6.5 percent in 2014, indicating strong market demand for expensive homes.

"The speed of luxury home sales left the deepest impression on me in 2015," said Zhang Hongyu, a sales director at Midland Realty with more than 10 years of experience in selling luxury projects in Shenzhen.

No matter whether it involved large, medium or small units, the market exhibited very strong purchasing power in 2015.

In 2016, the first project he represented was Signature Hill, located in the Jiangangshan area in Shenzhen's northwestern district of Bao'an. The project announced launch of sales on midnight on the last day of 2015.

At 2:52 am on Jan 1, Zhang posted on his WeChat Moments feed that a dozen units had already been booked through his company, with photos of many buyers driving to the project after receiving an urgent notice to sign contracts and settle payments.

He also said that some clients, upset at being woken up in the middle of the night, berated the developer for launching sales at such an inconvenient time but still rushed out to buy. Within 10 hours, all 72 apartments at the project had been snapped up.

The luxury project was priced at about 13 million yuan per unit, which was relatively cheap given that a neighboring plot had attracted the highest bid price in the nation just four days previously.

In 2015, the area was included in the world's top 10 luxury home zones by the US luxury magazine Robb Report.

Natural resources and the surrounding environment were the uppermost criteria for being featured on the list and Shenzhen was the only mainland city on it.

Moving on up

Carlby Xie Jingyu, director of research at Colliers China, attributed the area's sharp rise to the huge demand among many individual property owners to upgrade their previous housing facilities.

Xie explained that amid surging home prices and the relaxing of home loan policies, many people chose to cash in the value of their real estate property on hand and invested the money in more value-concentrated projects with higher return expectations.

Sara Wang, a Shenzhen resident in her 30s, bought a house at the average price of 120,000 yuan per square meter in the first weekend of January in order to move near a famous elementary school, as her two daughters start school this year.

As an ordinary white-collar mother, she made the down payment by selling her first property, which she bought in 2007 at the average price of 14,000 yuan per square meter.

After less than 10 years, she was able to sell the almost 100 square meter home at the average price of 61,000 yuan, more than four times its original cost.

Sara believes it was the right time to make an investment of higher value because "there is no doubt that it will offer greater returns in future". And quite a few experts agree. They say Shenzhen has the steam to become a top luxury home market and even surpass Beijing and Shanghai.

Song Ding, a senior researcher at the Tourism and Real Estate Industry Research Center at Shenzhen-based think tank China Development Institute, told the Shenzhen Economic Daily that the city's first-class luxury housing market has lagged behind those of Beijing and Shenzhen, but the situation is about to change, and it may happen as early as within the next two years.

However, Yan Yuejin, director of E-house Center, holds a more conservative view and told China Daily that Shenzhen can perhaps become the No 2 luxury market on the mainland by replacing Beijing, but not Shanghai.

Success begets success

E-house Center data indicate that Beijing in 2015 recorded the lowest figures in transaction units and average price among the three cities for luxury houses with average price of over 100,000 yuan per square meter.

Besides, many Beijing citizens are coming to Shenzhen to buy homes. Beijing Youth Daily on Jan 7 reported that a real estate project in Shekou, on the southern fringes of Shenzhen, offered 10 seaside luxury homes worth 80 million yuan, and six were picked up by buyers from Beijing.

Yan admitted that home buyers from other cities are boosting investments in Shenzhen city and their endurance threshold pricewise is increasing as the overall competitiveness of the city rises.

Shenzhen's excellent environment is also an advantage, Yan pointed out, especially when compared with Beijing, which has suffered from a severe air pollution problem for years.

But Yan argued that though Shenzhen is racing ahead, it still has a long way to go to catch up with Shanghai, which excels in terms of overall level of economic development, internationalism and per capita income.

In fact, Shanghai's luxury housing sector also rose aggressively in 2015.

According to data from Colliers International, demand was most evident in the high-end and luxury residential markets in Shanghai, with the transaction volumes of the two segments in 2015 surging by 95 percent and 156 percent, respectively, from the previous year.

Moreover, Shanghai sold 7,843 units in the over 10 million yuan category, more than double the 2,921 sold in Shenzhen. But that may be because Shenzhen's luxury housing market took off later.

The gap may get narrower soon, as Shenzhen aggressively speeds up its economy to catch up with first-class international finance centers.

In 2015, the city's annual gross domestic product growth reached about 8.9 percent, buoyed by the impact of the pilot free trade zone scheme and massive entrepreneurship.

Moreover, the city has attracted millions of high-end talents, who have fueled huge demand for upscale residential facilities.

But the growth of its real estate development is limited by land resources. The size of Shenzhen is only one-eighth that of Beijing and just a third of Shanghai.

This hard fact has on the one hand made some developers provide smaller but high-value homes, while on the other show a tendency to revitalize old buildings, or houses in "the village within the city", said He Qianru, director of the research center at Midland Realty.

These buildings, usually with poor living conditions and facilities, were constructed by private owners and rented out to low-income workers.

She pointed out that the houses built within such "villages" cannot be regarded as "luxury homes" in the real sense, even if they are located in a "golden" area or come with a high average price.

Investment in such luxury houses carries great risks, she warned.

Contact the writer at grace@chinadailyhk.com

- General strike against pension reform brings Greece to standstill

- Madrid airport sounds alarm after bomb threat on Saudi plane

- Obama proposes new oil tax to fund clean transportation

- UN special envoy announces temporary pause of intra-Syrian talks

- Taliban kill 10-year-old hailed as militia hero

- Obama slams anti-Muslim rhetoric during first visit to US mosque

Kindness walls bringing extra warmth to the needy

Kindness walls bringing extra warmth to the needy

A robot that grabs red envelopes

A robot that grabs red envelopes

Culture Insider: 9 things you may not know about Start of Spring

Culture Insider: 9 things you may not know about Start of Spring

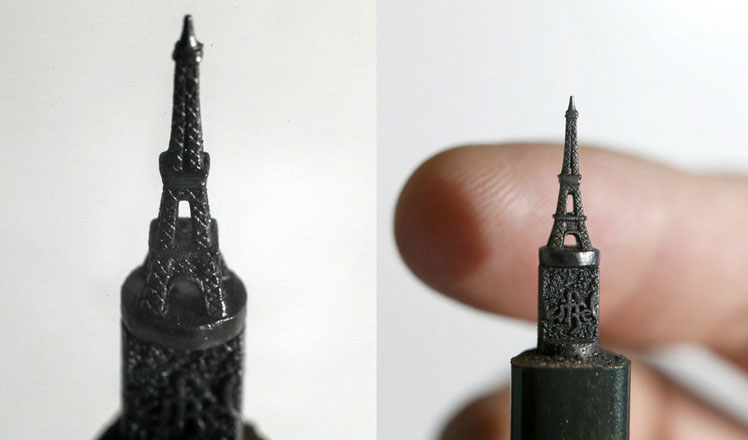

Talented artist makes tiny pencil lead sculptures

Talented artist makes tiny pencil lead sculptures

Ten most heartwarming stories about Spring Festival Rush

Ten most heartwarming stories about Spring Festival Rush

China's 'Moon Walker' sends back stunning HD photos

China's 'Moon Walker' sends back stunning HD photos

Starbucks, office rents and CEOs form alternative outlook on China

Starbucks, office rents and CEOs form alternative outlook on China

China's most beautiful wetlands

China's most beautiful wetlands

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|