Hopes voiced for next five years

Updated: 2016-02-29 07:35

(China Daily)

|

||||||||

|

|

Sung Won Sohn, professor of economics at California State University Channel Islands in Camarillo, California |

A1 The change in the composition of output from an industrial to service-oriented economy has been impressive. Chinese consumers will begin to enjoy the fruits of their labor. The service sector of the economy, which has exceeded 50 percent of GDP, includes sectors such as healthcare, social services, sports and entertainment.

Financial market liberalization is further significant progress. Interest rate controls have been relaxed and some of the shackles in the currency markets have been removed, even though capital movements are still controlled.

A2 Whenever there are economic issues to be resolved, the government tends to turn to government rules and regulations. China's financial market is in the no man's land between the market and government control. The uncertainty emanating from the hybrid system undermines confidence in the financial markets. In the foreign-exchange market, for example, the authorities are not comfortable with leaving everything to the market. The governor of the People's Bank of China has stated, "China will adopt the concept of managed convertibility," not allowing the market to dictate the value of the yuan.

A3 Progress toward economic and financial liberalization will continue. As rebalancing continues, consumption and services will become more and more important. As investment growth falls faster than consumption, economic growth will continue to decelerate.

A4 There are a number of long-term issues facing China, including rebalancing, financial reforms, debt and the environment. Will the government of China tackle the tough issues and be able to execute the reforms necessary to improve the long-term health of the economy? The leaders in Beijing face difficult choices. If reforms are implemented too quickly, the economy could slow rapidly, leading to a hard landing. If the reforms are dragged out slowly over a long period, the debt-to-GDP ratio would continue to rise beyond the already high level, followed by a long period of stagnation. Neither option is palatable, especially because they could engender social and political problems. How the government chooses to navigate the turbulent economic waters over the next few years will be important for the long-term future of the economy. What is at stake is China's ability to get out of the middle-income trap that so many other nations have fallen into.

A5 Would he be supportive of the kind of massive SOE reform initiated by former premier Zhu Rongji?

- Seeds planted in Five-Year-Plan pay off for Hechi's farmers

- Consul general explains 13th Five-Year Plan

- A Clear Understanding of Difficulties and Challenges during the 13th Five-Year Plan Period: Build a Moderately Prosperous Society in an All-round Manner with New Development Ideas

- Advisers’ words for 13th Five Year Plan

- Chinese academic spells out latest five-year plan for EU

- Cuba intensifies fight to fend off Zika virus

- UN chief calls for 'prompt, impartial' probe into airstrike on Yemeni market

- Ex-TEPCO executives over Fukushima nuclear disaster

- British PM threatened with 'no confidence vote' over EU referendum

- 70,000 may become trapped in Greece

- Venezuela, Qatar, Saudi Arabia, Russia to meet to stabilize oil market

Stars arrive at 88th Academy Awards in Hollywood

Stars arrive at 88th Academy Awards in Hollywood

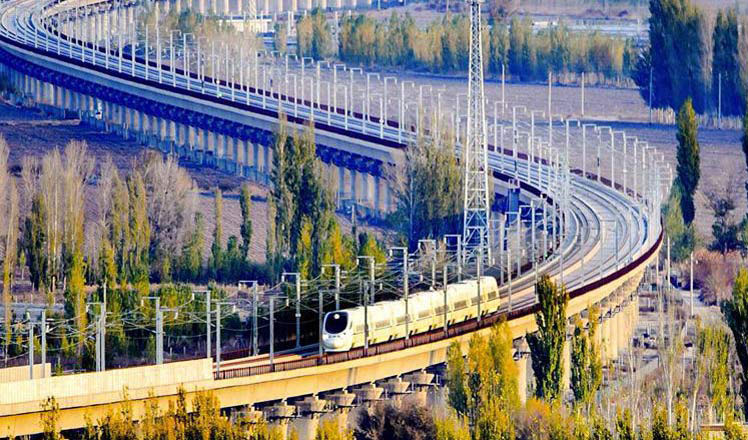

China has world's largest high-speed rail network

China has world's largest high-speed rail network

Top moments from Oscars 2016

Top moments from Oscars 2016

China Daily weekly photos: Feb 20-26

China Daily weekly photos: Feb 20-26

People view plum blossoms at scenic area in E China

People view plum blossoms at scenic area in E China

Rural e-commerce developed to promote local products in SW China

Rural e-commerce developed to promote local products in SW China

Things you should know about the 2016 G20 meeting

Things you should know about the 2016 G20 meeting

Walk down memory lane: Rural China in 1980s

Walk down memory lane: Rural China in 1980s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

US Weekly

|

|