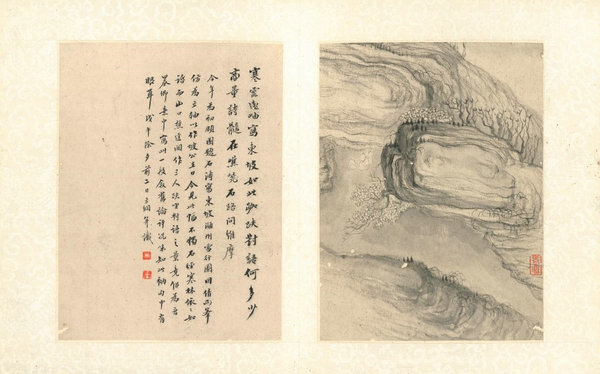

Classical Chinese art on the block

Updated: 2016-05-24 09:25

By Lin Qi(China Daily)

|

||||||||

The practice follows its launch of classical Chinese paintings sales in New York in 2011, which generated some high prices. A calligraphic album of Ming Dynasty Buddhist sutras sold for $14 million to Shanghai collector Liu Yiqian in 2015.

Steven Zuo, head of Sotheby's classical Chinese paintings department in Asia, tells China Daily that the salesrooms in both New York and Hong Kong attract global bidders, while the Hong Kong auctions highlight the appetite of Asian buyers.

The category of classical Chinese paintings, normally referring to works executed before the 20th century, has performed steadily in the market, while modern ink art has dropped in value amid a market reshuffle since 2014.

A calligraphic letter by Song politician Zeng Gong fetched 207 million yuan ($31.85 million) at a Beijing auction on May 15.

The most expensive classical Chinese ink art sold at auction so far is Di Zhu Ming, a calligraphic hand scroll by Song master Huang Tingjian that grossed 436.8 million yuan in Beijing in 2010.

Zuo says classical paintings, as an important bearer of Chinese cultural traditions, have a mature, stable collecting group. Generally speaking, this is less affected by economic changes than other categories.

The classical Chinese art market doesn't create a lot of bubbles like modern and contemporary art because its "higher threshold" turns away speculators seeking short-term profits, says Tu Xin, a Beijing-based art dealer.

"When you want to know whether a Zhang Daqian piece is genuine or counterfeit, quality or ordinary, you have a stack of his other works for reference," she says, adding that for classical art, few examples are available today, making it difficult for people to judge right from wrong, excellence from a bunch of commonplace works.

"To collect classical pieces, one has to invest much time and energy to increase knowledge and be discerning. A devoted collector is sensible when bidding at auction, and he is unlikely to resell his collections for instant profit."

Contact the writer at linqi@chinadaily.com.cn

- Wildfires continue to rage in Russia's Far East

- Eiffel Tower to become rental apartment for first time

- US lifts arms embargo on Vietnam

- At least 17 schoolgirls killed in boarding-house fire in N Thailand

- Russia to build first cruise liner in 60 years

- LinkedIn, Airbnb match refugees with jobs, disaster survivors with rooms

Striking photos around the world: May 16 - May 22

Striking photos around the world: May 16 - May 22

Robots help elderly in nursing home in east China

Robots help elderly in nursing home in east China

Hanging in the air: Chongqing holds rescue drill

Hanging in the air: Chongqing holds rescue drill

2.1-ton tofu finishes in two hours in central China

2.1-ton tofu finishes in two hours in central China

Six things you may not know about Grain Buds

Six things you may not know about Grain Buds

China Beijing International High-tech Expo

China Beijing International High-tech Expo

Highlights at Google I/O developers conference

Highlights at Google I/O developers conference

Nation celebrates International Museum Day

Nation celebrates International Museum Day

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|