Age-old financial question poses a pension dilemma

Updated: 2012-03-28 08:02

By Li Jing and Chen Jia in Beijing (China Daily)

|

||||||||

Providing funds for the future may be a problem, report Li Jing and Chen Jia in Beijing.

China's rapidly aging population is a ticking time bomb. Not only in terms of a predicted decline in the numbers of people available for work, but, equally importantly, in paying the vast pensions bill.

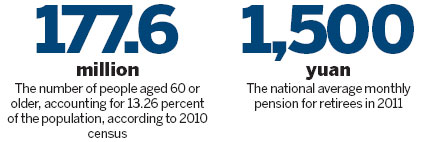

A census carried out in 2010 showed that the number of people aged 60, the official retirement age, or older was 177.6 million, accounting for 13.26 percent of the population. That figure is projected to exceed 200 million in 2014.

In 2011, the national average monthly pension for the retired reached 1,500 yuan ($238), according to Finance Minister Xie Xuren, but pension levels vary according to the region in which the recipient lives.

For example, Beijing has said it will soon increase the average pension to about 2,510 yuan per month, while Urumqi, the capital city of the Xinjiang Uygur autonomous region, has this year set a target of raising its average pension to a monthly 1,900 yuan and the Ningxia Hui autonomous region will pay pensioners 1,785 yuan.

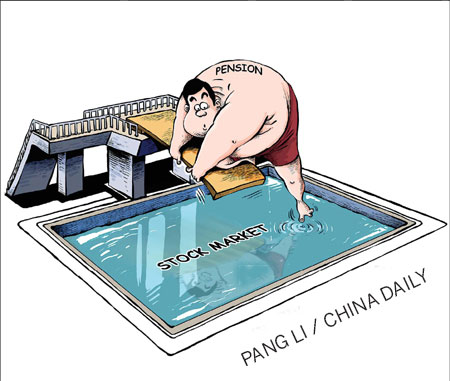

In response to the problem, China has just taken the first steps in reforming the way it manages the massive pension fund by beginning a trial investment in the country's stock market, in a move aimed at better preserving the value of the funds and supporting the country's aging population.

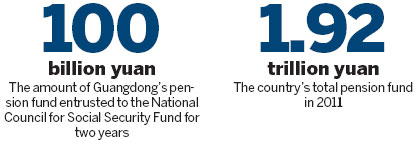

Last week, the southern province of Guangdong won approval from the State Council to entrust 100 billion yuan of its pension fund to the National Council for Social Security Fund for two years. The NCSSF said that most of the money would be placed in savings accounts or used to buy government and corporate bonds and other fixed-income securities. These financial vehicles may not be the most exciting on the planet, but they do have the advantage of security, and safety is the major priority for those operating the nation's pension fund.

Last week, the China Securities Journal reported that as much as 30 billion yuan of those funds is likely to be invested in the nation's equity markets. The council's rules forbid it from putting more than 40 percent of its total fund into equity investments.

Heated debate

The move comes against a backdrop of heated debate, lasting several months, over the wisdom of entrusting the nation's retirement funds to the volatile market, with critics arguing that the stock market needs urgent reform before such huge sums are invested.

Previously, most of Guangdong's 441 billion yuan pension fund was held in low-yield savings accounts, according to Ding Sanbao, chief accountant of the Guangdong provincial social security fund.

"As a result, the rate of return during the past five years has been just 2 percent," Ding was quoted as saying in the 21st Century Business Herald. "With the NCSSF managing the 100 billion yuan fund, we hope to increase that rate to about 4 percent," he said.

Nationally, the management of the pension fund, which totaled 1.92 trillion yuan in 2011, is not in good shape. Zheng Bingwen, head of the Global Pension Fund Research Center at the Chinese Academy of Social Sciences, also estimated that the rate of return during the past decade has been about 2 percent, the lowest in the world.

"In 2011, the nominal yield rate of the pension fund was less than 2 percent, but at the same time the country's consumer price index rose by 5.4 percent. So in real terms, the fund actually suffered a loss of nearly 100 billion yuan last year," said Zheng.

Since the beginning of the year, the China Securities Regulatory Commission, the country's top securities watchdog, has expressed a desire to absorb this huge pension pot into the stock pool. Analysts say that the move would likely boost investor confidence and could help the A-share composite indexes rise to bull-market levels, but the proposition has also prompted accusations that the CSRC has an ulterior motive and is merely intent on "saving the market".

The commission's chairman, Guo Shuqing, has strenuously refuted the accusations saying, "The capital market will (also) help to maintain and increase the value of the pension fund, which would protect the interests of investors."

However, the poor performance of China's share market in 2011, when the Shanghai Composite Index declined by 21 percent, the third-biggest fall in its 21-year history, has raised investor concerns about the security of the pension fund if it were to be invested in equities.

Li Qingyun, a professor at the School of Economics at Peking University, has expressed concern about the pension fund being invested in the opaque domestic stock market. "Because of the lack of transparency, there are many instances of illegality, such as market manipulation or insider trading," he said. "Would we be too hasty in putting our lifeline into a stock market such as this?"

Moreover, the immature issuing process for initial public offerings, combined with ineffectual regulation, has provided opportunities for some companies with unsound finances to "circle money", a situation where speculative capital chases high prices on IPOs and shares of non-profitable companies, which can cause wide market fluctuations and result in big losses for ordinary investors.

The situation led the Chinese economics commentator Wang Fuzhong to warn that the CSRC should not risk the pension fund simply to make the domestic stock market look better.

Market reforms

Huang Zemin, head of the International Financial Research Department of East China Normal University in Shanghai, said that reform of the capital market is a precondition for investment of the pension fund. Listed companies need to improve both the transparency of information and the delisting mechanism for those on the verge of bankruptcy, as well as reforming the procedure for IPO issuance to make it more market-oriented, said Huang.

Dai Xianglong, chairman of the NCSSF, said that the pension fund will insist that any investments should be long term, rather than simply short term and speculative. His organization manages about 800 billion yuan in social security funds, raised in part from the sale of shares in State-owned companies and also by central government grants. Over the past 10 years, its investments in equities and corporate and government bonds have realized an average annual rate of return of 9.17 percent, easily outstripping the country's average annual inflation rate of 2.14 percent over the same decade.

The pension fund can achieve a higher return from the share market than from fixed-income instruments, providing that the investment decisions are rational, Dai said.

However, Ye Tan, a noted financial columnist who writes for several news outlets, said the transparency and efficacy of the NCSSF's investment might not be easily duplicated by local pension funds, which are managed by what she refers to as a "black box system", because of the lack of transparency.

In 2006, several members of the Shanghai municipal government, including the local Party chief Chen Liangyu, were dismissed from their posts after it was discovered that roughly 3.2 billion yuan of local pension funds had been embezzled and used to finance a series of projects ranging from real estate development to roads.

"I'm afraid that those who support the move to give pension funds more access to the capital markets are not telling the whole story," said Ye. "The record of pension fund misuse at the local level makes it unclear whether investment of the fund will generate any real public benefits."

On Monday, the Ministry of Finance issued a notice reiterating a ban on local governments making any investments, direct or indirect, with pension funds, other than the purchase of government bonds or depositing the cash in savings accounts.

'Empty accounts'

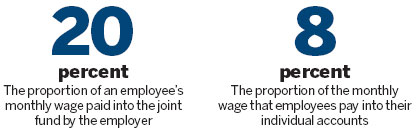

China started its pension system in 1997, combining joint social funds with individual accounts. The system is designed to allow the State to pay pensions with money collected from the younger generation: Employers pay the equivalent of 20 percent of an employee's monthly wage into the joint fund, while the employees themselves pay about 8 percent of their monthly wage into their individual accounts. The original plan was to pay pensions from the joint fund, while the money in individual accounts was to be managed and invested for future use.

However, the process has proved costly. The country is still in the process of increasing pension coverage and the amount received by retirees has been raised several times during recent years, meaning that the government has had to use money from individual accounts to cover the expense, resulting in a large number of "empty accounts" (accounts with no money), according to Zheng.

In 2004, the Ministry of Labor and Social Security (later renamed the Ministry of Human Resources and Social Security) announced that the individual accounts had a deficit of 740 billion yuan. Those are the only official statistics available, but Zheng Bingwen from the CASS has estimated that the current scale of empty accounts is 1.3 trillion yuan, despite a decade of, largely unsuccessful, attempts to refuel them through government subsidies.

Northeast China's Liaoning province, for instance, faced a pension shortfall of 14.65 billion yuan in 2010 and had to borrow money from individual accounts, despite receiving an annual central government subsidy of 1.44 billion yuan since 2001.

Although some analysts argue that it is not unusual to see "nominal accounts" - that is, pension funds devoid of real cash - in other countries, the huge deficit should set alarm bells ringing and prompt China to reform the existing pension fund management system to support the growing number of elderly people in the coming decades, said Zheng.

In 2010, each pensioner was supported by the combined contributions of five workers, but by 2020 three workers will have to provide the funds, further increasing the tax burden and potentially storing up another problem that will have to be dealt with by future generations.

Contact the reporters at lij@chinadaily.com.cn and chenjia1@chinadaily.com.cn

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|