Wells Fargo is banking on China's prospects

Updated: 2012-06-29 11:02

By Zhang Qidong in San Francisco (China Daily)

|

||||||||

|

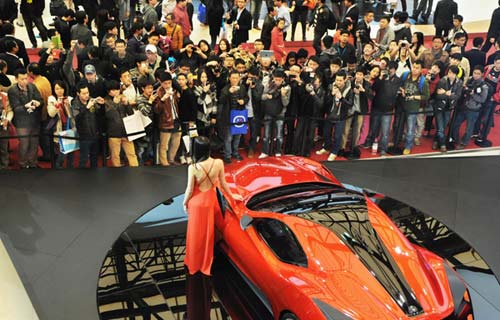

Wells Fargo executive Richard Yorke displays the medal he received upon being named an Honorary Citizen of Shanghai in 2009. It is the Chinese city's highest honor for a foreigner. Zhang Qidong / China Daily |

Richard Yorke remembers vividly the moment China took a big step toward becoming a financial giant.

The British-born banker, who is now head of Wells Fargo & Co's International Group, was in Hong Kong on July 1, 1997, when the territory was returned to China.

"The celebration was an emotional moment," Yorke told China Daily. "With this and China's subsequent accession to the [World Trade Organization], we could already feel the incredible increased vibrancy of the economic growth in Hong Kong and the rest of China.

"Everybody expected that China was going to be even more important for Hong Kong's economic development, but nobody could foresee how remarkable the city's growth was going to be in the years to come," he said.

Yorke has had a front-row seat as Chinese growth over the past 15 years surpassed even the most optimistic early predictions. The veteran of HSBC PLC moved to Shanghai, where from 2004 to 2010 he was CEO of the UK bank's China business. He won the 2007 Magnolia Award from the city government for contributing to Shanghai's development as a financial-services center. That was followed two years later with being named an Honorary Citizen of Shanghai, the city's highest honor for a foreigner.

In 2007, Yorke also became the first director of the China Banking Association's foreign bank working committee.

But his ascendancy in international banking has taken an unconventional path.

Born in Kent, England, in 1967, Yorke spent his early childhood in Switzerland, where he learned to appreciate people and cultures in that country's melting pot.

"Each culture has its unique characteristics, and there's so much to learn from each other," he said.

After attending boarding school back in Britain at age 8 and later majoring in German and economics at the University of St Andrews in Scotland, Yorke was pleased to accept his first job with what was then Hong Kong and Shanghai Banking Corp.

Moving from St Andrews (population: 11,000) as a young man in 1990, Yorke was exhilarated to suddenly be living in a city of several million.

After 20 years with HSBC, Yorke left to join Wells Fargo in 2010, tasked with developing international products and services for the California-based bank's customers, including those abroad.

"I was always attracted to Wells Fargo's footprint in the US, its tradition of looking after its customers and its significant growth potential for international services, driven by its customers' evolving needs," he said. "The culture of Wells Fargo is long-term and about strong relationship-building, which is very similar to the Chinese tradition of valuing long-term relationships. So I felt like coming home to Wells Fargo."

In addition to its US branches, Wells Fargo now has over 30 locations overseas, including Shanghai, Beijing, Hong Kong, Singapore, Taipei, Tokyo and London.

"The key reason to build out our international capabilities is because more and more of our customers in the United States are doing business in China and globally, and they expect us to support them. This is a true customer-driven strategy."

Through its merger with Wachovia Bank during the height of the 2008 financial crisis, Wells Fargo's international presence grew, including the Shanghai office with 65 employees and the Beijing office with eight.

"China is a large market for our customers, especially corporations that have a manufacturing base over there," Yorke said. "We will certainly continue to build our presence there to serve our existing customers' needs."

At the top of his priority list is support for US companies doing business in China and Chinese companies operating in the US as well as delivering trade-financing services to international banks and companies.

Differentiating Wells Fargo, which was founded 160 years ago, from many other big banks engaged internationally are its criteria for expansion, Yorke said.

The bank, he said, "continues to achieve 'organic' growth - delivering on the increasing international needs of existing customers and supporting them in every way we can is the foundation of our international strategy. Our customers are doing business in China, including selling into China or buying from it, so we need to be there for our customers."

Asked which industry has seen the most growth in China, Yorke said the nation's economy has developed significantly over the past 30 years and continues to evolve from a manufacturing and export base to a more balanced economy that provides a variety of US companies' needs - construction, machine tools, clean technology and electronics.

Importantly, China has also become a large domestic-consumption market given higher incomes among its citizens and demand for a variety of goods. China is becoming an increasingly important export market for US goods and services in agriculture, commodities, machine tools, heavy equipment and other sectors.

"I believe that there remains the opportunity for an even wider range of cooperation and business between the two countries, and as a full-service bank, we are uniquely positioned to help our customers participate in this growth," Yorke said.

Wells Fargo is the biggest US bank by market value (about $162 billion based on its shares' closing price Thursday on the New York Stock Exchange). It has $1.32 trillion in assets and provides services in banking, insurance, investments, mortgages, and consumer and commercial finance through 9,000 branches and 12,000 ATMs and the Internet across North America and abroad. The bank also serves more than 3,000 banks globally.

Yorke said the bank's office in Palo Alto, California, near San Francisco, has lately seen significant interest from Chinese companies looking to benefit from Wells Fargo's expertise in financing projects in clean technology and the "green" economy.

Wells Fargo is also focused on working with non-US companies, including Chinese enterprises seeking to invest on its home turf. These opportunities include wind and solar energy, clean technologies, energy-efficient buildings and environmental innovation as well as more traditional investments.

Yorke, who is modest about his career accomplishments, said he's most proud of having had the privilege of working in China at a time of economic dynamism. His personal goal is a work-life balance that, he says with a smile, he has yet to perfect.

kellyzhang@chinadailyusa.com

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|