Spirited into the world of e-commerce

Updated: 2012-08-20 07:43

By Shi Jing in Shanghai (China Daily)

|

||||||||

|

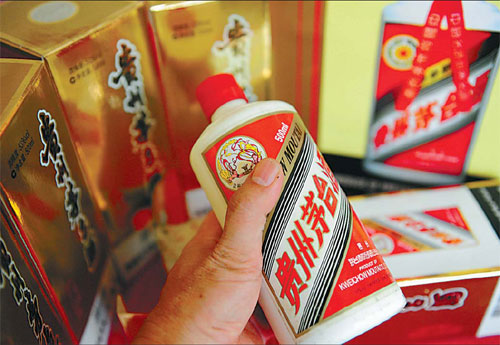

Moutai is again testing the waters of e-commerce after an initial trial saw poor sales because of logistical problems. Experts say the impact will be very limited as the liquor e-commerce market in China is still in embryonic form compared with mature online industries such as garments. Meng Zhongde / For China Daily |

Liquor makers look online for the next bonanza in sales

While several well-known Chinese liquor manufacturers bicker about which is the No 1 "State-banquet spirit" in China, the 61-year-old Kweichow Moutai Co has something else on its mind.

Instead of just courting its traditional customers in government and business circles, Kweichow Moutai, headquartered in Southwest China's Guizhou province, is taking a more down-to-earth attitude toward its business, planning to try its luck in the decade-old Chinese e-commerce market, taking the view it is never too old to learn.

Moutai Co put up a notice on its official website on July 23 saying the company will set up a wholly-owned subsidiary to be fully responsible for the new online Moutai shop.

"Prices for each type of the liquor have not been released on the website at present because some details are being ironed out. The website will be targeting individual buyers, thus group-buying dealers will not be affected," said Ou Guangliang, one of the directors of Moutai's online outlet.

Moutai tested the waters of e-commerce as early as 2010 but sales were poor due to logistical problems. However, the company is now determined to enter this new territory, hoping to be fully online in August.

"It is very hard to say whether liquor dealers' entry into e-commerce will stabilize the ultimate price of spirits. As far as I can see, the impact will be very limited as the liquor e-commerce market in China is still in embryonic form. Compared with mature online industries such as garments, the newly emerged business is quite unstable and of a fairly small scale," said Mo Daiqing, an analyst with Hangzhou-based China E-commerce Research Center.

But Mo said distributors of traditional channels should not feel threatened by the e-commerce dealers because the former have accumulated a stable supply of customers over the years. The two will also differentiate from each other in terms of the supply chain.

"There are some aspects that online liquor dealers should take into account, including delivery, storage and temperature, which will all greatly affect the quality of liquors or wines. And all these will add to their costs," said Mo.

However, Mo considered the move is being made at the right time because "the big picture is that almost all the companies are marching into the e-commerce industry when the traditional market is almost saturated".

She added: "The sales of liquor are fairly good nowadays, with stable consumer groups and steady demand. On top of that, the outlook for e-commerce is equally as good. So it is wise to enter the market as early as possible and seize the opportunity."

Wines imported from overseas entered the Chinese e-commerce industry as soon as they started to arrive in the Chinese market. Wang Jiaqi, business development director of Shanghai Wine Exchange, said she knew little of liquor being distributed online but overseas wine dealers were keen to approach online channels first.

"Costs are added because there are many processes to go through in the traditional distribution methods for wine, resulting ultimately in the soaring price of the drink. With the help of e-commerce, many redundant processes have been eliminated and so the wine prices we see on the websites have come down," said Wang.

"It seems to me that both wine and liquor dealers are now prepared to wave goodbye to the traditional bricks-and-mortar stores, a traditional branding method with the purpose of promoting sales. But unnecessary costs are incurred that way, including labor, maintenance and rent, the last of which accounts for the largest part of the operation of a store," she said.

There are, of course, different costs for online business, most significantly logistics. Special attention will be given to the inventory and delivery of wines and liquors. Nonetheless, Wang calculates the overall cost for e-commerce operators is definitely lower.

"Liquor dealers should note that the operation of their online market should differentiate from that of wine because the profit chains for the two alcohols are quite different on the Chinese mainland. However, the demand for such e-commerce has developed now as this emerging industry makes periodic huge leaps in this country," said Wang.

"Credit is at the core of the online purchase of wines or liquors. People used to be concerned about the integrity of dealers, considering the products have such a high unit price and were little known to the general public. But, over time, this skepticism has waned and customers have come to realize that there are reliable dealers," she said.

shijing@chinadaily.com.cn

(China Daily 08/20/2012 page14)

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|