New IPOs may begin thaw for China firms

Updated: 2013-05-27 11:06

By Michael Barris in New York (China Daily)

|

||||||||

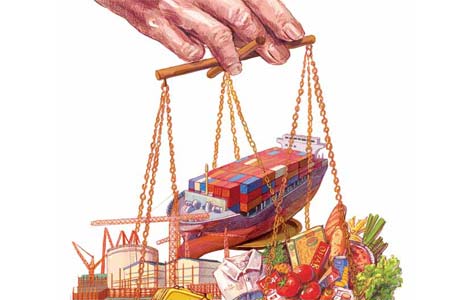

When its shares begin trading next week, online retailer Light In The Box Ltd will end a nearly seven-month drought of US stock market listings by Chinese companies tied to a long-running dispute between American and Chinese financial regulators that now appears closer to resolution.

American depositary shares of Light In The Box are expected to begin trading, under the symbol LITB, on the New York Stock Exchange on June 6, following the pricing a day earlier of an initial offering of stock valued at up to $87.2 million.

The Beijing-based seller of home improvement, fashion, electronics and other consumer goods said in a US regulatory filing on Thursday that it would sell 8.3 million shares at $8.50 to $10.50 each. The IPO will be the first by a Chinese company in the US since social-gaming operator YY Inc went public on Nasdaq in November.

The dearth of listings by China-based companies in recent years contrasts sharply with 2010, when 41 Chinese firms joined US stock markets. But the Light In The Box offering, and a $75 million float announced last week by digital cinema equipment maker GDC Technology Ltd - backed by US private-equity giant Carlyle Group LP - could signal that the market for US IPOs by Chinese companies is turning.

A series of accounting scandals and fraud allegations involving US-listed Chinese companies led the US regulators to reject IPO-related audits by Chinese affiliates of the Big Four accounting firms - Deloitte Touche Tohmatsu of the US, UK-based Ernst & Young and PricewaterhouseCoopers, and the Netherlands' KPMG.

In an apparent breakthrough announced on Friday, the China Securities Regulatory Commission said it would give the US Public Company Accounting Oversight Board access to documents from the Chinese auditors. The announcement follows a lengthy effort by the PCAOB and the US Securities and Exchange Commission to improve financial disclosure by Chinese companies trading on US exchanges.

The agreement will allow the accounting oversight board to see audit records and other documents maintained by the Chinese audit firms, but it falls short of the broad oversight the US regulator had sought. Still, the limited access could be used to investigate fraud allegations against the auditors.

Before Friday's announcement, the SEC had said it would accept the audits only if it could review underlying documents, but Chinese regulators said they can't release such information because domestic law considers such information a state secret. The impasse prompted the SEC to sue the Big Four affiliates in China for allegedly violating US securities laws and prevented Chinese companies that hire any of those affiliates from completing a US IPO.

The dispute has contributed to lower share prices for some Chinese firms already trading on US exchanges. More than two dozen companies, most of which got a US listing through a so-called reverse merger, have retreated from the market in the past year and a half. A reverse merger, which is much less rigorous than the IPO process, enables a private foreign company to obtain a US stock listing from an existing publicly traded shell company.

Also, negative sentiment and allegations of accounting irregularities by short-sellers have led a number of Chinese companies to agree to be taken private in deals with buyout firms. The largest such transaction to date has been Focus Media Holding Ltd's acceptance of a $3.7 billion offer in August from a private-equity group that included Carlyle and Fountain Vest Partners Co.

Jim Fink, an analyst for Investing Daily, an online investment advice website run by Virginia-based Capitol Information Group, is optimistic that American investors will warm to the two proposed Chinese IPOs.

GDC is majority-owned by Carlyle, "so that US-based imprimatur may be one reason the IPO is being accepted by US investors," Fink said.

He said Light In The Box receives 85 percent of its revenue from North America and Europe.

michaelbarris@chinadailyusa.com

(China Daily USA 05/27/2013 page2)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|