News in review Friday, September 27 to Thursday, October 3

Updated: 2013-10-04 09:19

(China Daily)

|

||||||||

Tuesday - October 1

Citigroup becomes first US bank in free trade zone

Citigroup Inc is set to launch a branch in Shanghai's new free-trade zone, making it among the first foreign banks to seek business in China's new economic experiment.

The New York-based bank - the third-largest US lender by assets - won regulatory approval for its Citibank China Co Ltd on Sunday to start preparations for a branch in the new trade zone in Shanghai's Pudong district.

Citigroup's interest in the new free trade zone - which the Chinese government has described as a test site for broader reforms such as allowing companies to convert yuan more easily to foreign currencies and freeing up the setting of interest rates - comes as the Asia-Pacific region continues to drive revenue for the bank despite slowing economic growth in China.

Beijing floral firms in slump over policy change

The ban on extravagance is causing Beijing's flower companies to experience a business slump.

Authorities banned floral displays in front of government buildings during the National Day holiday from Oct 1 to 7. The number of flowers on display in Tian'anmen Square has also been reduced.

Sun Lei, a manager at the flower display department of the Green Garden Group, said the company could suffer a loss of more than 80,000 pots of flowers in government orders for the National Day.

Shi Yi, sales manager with the Qianxi Flowers and Trees Corp in Beijing, said his company's flower display business is expected to drop by 40 percent year-on-year for the National Day holiday. (Photo 3)

|

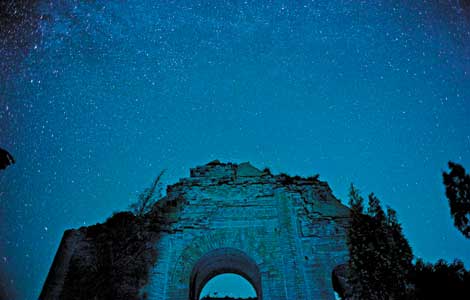

Performers practice martial arts at Yuefei Temple in Tangyin county, Central China's Henan province. The temple was the scene of a series of performances during the National Day holiday, which runs from Oct 1 to 7, and is also called golden week in China. CFP |

Wednesday - October 2

Haier's stake sale is expected to boost revenue

Qingdao Haier Co's deal to sell 10 percent of itself to US buyout firm KKR & Co for $552 million will put China's dominant appliance-maker on track to reap a windfall from the country's push for urbanization, a KKR executive said.

KKR Greater China CEO David Liu said the private-equity company would assist the Shanghai-listed unit of Haier Group "in its next phase of growth by capitalizing on the opportunities created by China's continued urbanization and increasing consumer-income trend".

China is moving a quarter of a billion rural residents into newly built cities to boost domestic consumption and revive a slowing economy. The government's goal is to fully integrate 70 percent of the country's population, or roughly 900 million people, into city living by 2025.

New orders, exports spur manufacturing

Growth in new orders and exports drove manufacturing higher for the third consecutive month in September.

The National Bureau of Statistics and the China Federation of Logistics and Purchasing reported on Tuesday that the manufacturing Purchasing Managers' Index climbed to 51.1 in September from 51.0 in August, the highest since May 2012. If the reading is above 50 it signals expansion in the manufacturing sector, while below 50 shows contraction.

The September PMI showed a contrary situation between small and bigger manufacturing firms. For the small-scale businesses, the PMI was 48.8, down from 49.2 in August, which showed a more serious contraction.

Driver shot dead in car chase at US Capitol

Driver shot dead in car chase at US Capitol

NY SUV driver's wife: We were in 'grave danger'

NY SUV driver's wife: We were in 'grave danger'

Death toll in sunk boat off Italy could top 200

Death toll in sunk boat off Italy could top 200

A southern staple

A southern staple

Tropical Storm Karen aims for US Gulf Coast

Tropical Storm Karen aims for US Gulf Coast

City rush, island time

City rush, island time

Death toll in Italy migrant boat wreck rises to 94

Death toll in Italy migrant boat wreck rises to 94

Lang Lang: First Chinese winner of Classic Brits Award

Lang Lang: First Chinese winner of Classic Brits Award

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US hints Iran could get some sanctions relief

Hundreds dead as boat sinks off Italy

Twitter unveils IPO filing, aims to raise $1 b

Gunfire forces brief lockdown at US Capitol

NY driver's wife says in danger

Call for new 'maritime silk road'

Shutdown in third day

Plane crash kills 15 in Nigeria

US Weekly

|

|