RMB developing quickly as major world currency

Updated: 2014-07-21 07:21

By Jiang Xueqing (China Daily USA)

|

||||||||

The renminbi is on track to become the third-largest international currency behind the US dollar and the euro within five years as China accelerates its promotion of the yuan, said a Renmin University of China report released on Sunday.

Last year, RMB cross-border trade settlement amounted to 4.63 trillion yuan ($746 billion), up 57.5 percent from 2012. It accounted for 2.5 percent of cross-border trade settlement worldwide, the report said.

By the end of the fourth quarter of 2013, direct investment settled in renminbi amounted to 533 billion yuan, 1.9 times the same period in 2012.

The RMB is currently the fifth-most widely used currency internationally. The British pound is third and the Japanese yen fourth.

The offshore yuan market has been developing rapidly in recent years, and this year the People's Bank of China signed a memorandum of understanding regarding yuan clearing and settlement arrangements with the central banks of the UK, Germany, Luxembourg, France and South Korea.

Chen Yulu, president of Renmin University and member of the central bank's monetary policy committee, said the offshore yuan market in Europe has huge potential since major European financial centers are competing for the market.

Wei Jianguo, vice-chairman of the China Center for International Economic Exchanges, suggested the government establish additional centers in places such as Dubai, South Africa and Latin America.

In spite of the rapid expansion of the RMB, its internationalization still faces many challenges including technical difficulties using the currency globally.

"To resolve the problem, China has to build a safe, efficient and low-cost offshore RMB clearing system as soon as possible," Chen said.

"In addition, the regulators must create a legal framework for the offshore RMB market and make sound regulations to stop money laundering and tax evasion via offshore yuan transactions."

At present, Chinese financial institutions are relying mainly on traditional offshore yuan businesses such as RMB trade settlement and deposit.

They have to innovate on products to deepen and widen the offshore RMB market, Chen said.

By the end of 2013, the outstanding volume of international bonds and bank notes denominated in renminbi rose 24.9 percent year-on-year to $71.9 billion.

The issuers of RMB-denominated bonds started to expand out of Hong Kong, with countries such as Japan and Canada joining in.

As Chinese economic power continues to grow, an increasing number of countries have become willing to accept the renminbi as a reserve currency. By the end of 2013, the PBOC had signed currency swap agreements involving a total of 2.57 trillion yuan with 23 countries and regions, the report said.

jiangxueqing@chinadaily.com.cn

(China Daily USA 07/21/2014 page1)

Chinese business leader feels at home in Cuba

Chinese business leader feels at home in Cuba

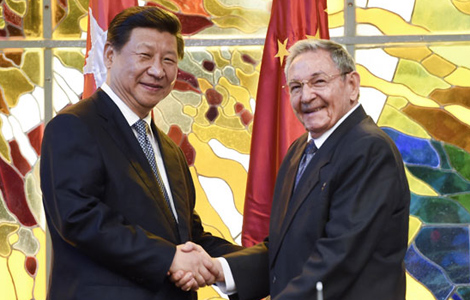

China, Cuba ink cooperation pacts

China, Cuba ink cooperation pacts

Rebels hand over black boxes

Rebels hand over black boxes

Cuban artist seeks threads of humanity

Cuban artist seeks threads of humanity

Jasmine Ballet Group shows talent

Jasmine Ballet Group shows talent

President Xi honored in Venezuela

President Xi honored in Venezuela

A bike ride helps Cuban editor fit into Chinese society

A bike ride helps Cuban editor fit into Chinese society

Chinese students fall for Cuba

Chinese students fall for Cuba

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

TransAsia crash while landing in Taiwan

Meat supplier in global crisis

Death toll in Gaza mounts to 701

Dogs 'capable' of feeling jealousy

36 bodies found from Taiwan plane crash

Xi visits old friend Fidel Castro

Li: The US should adopt 'open stance'

Food scandal pulls in Starbucks, Burger King

US Weekly

|

|