Chinese insurers invest in Boston Seaport site

Updated: 2015-04-09 11:30

By Paul Welitzkin in New York(China Daily USA)

|

||||||||

Two mainland life insurance companies are investing in a Boston redevelopment project as Chinese insurers continue shopping for American real estate.

China Life Insurance Co Ltd and Ping An Insurance Co will serve as co-investors in Tishman Speyer's prime waterfront site at Pier 4 in Boston's Seaport District. The Pier 4 project represents the first time that China Life and Ping An, China's two largest insurance companies, have made equity investments in US real estate, and is also the first time they have co-invested in real estate outside of China.

"Tishman Speyer has been an active investor and developer in China for more than a decade," Tishman Speyer Co-CEO Rob Speyer said in a statement Wednesday. "In that time, we have forged strong, productive relationships with both China Life and Ping An."

|

China Life Insurance Co Ltd and Ping An Insurance Co will serve as co-investors in Tishman Speyer's waterfront site at Pier 4 in Boston's Seaport District. The project will include a 13-story office building and a nine-story condominium tower. Provided to China Daily |

This deal is the latest example of State-owned Chinese insurers investing in US real estate. Last year, China's Anbang Insurance Group Co acquired New York's famed Waldorf Astoria Hotel for about $1.95 billion.

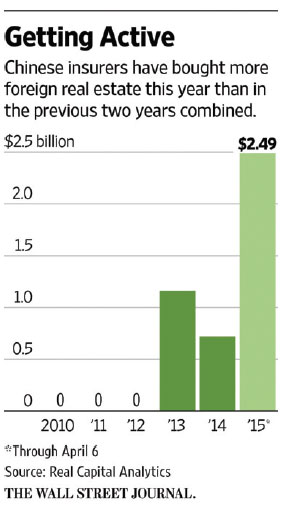

China started to loosen restrictions on overseas investments by its insurance firms in 2012. According to Real Capital Analytics, Chinese insurance companies have purchased $2.5 billion in overseas property so far this year. Last year, Chinese investors acquired about $13.6 billion in foreign real estate.

The Boston Pier 4 development is set to include a 13-story office building and a nine-story condominium tower. The project is located in the city's Seaport District that for many years included Anthony's Pier 4, a popular restaurant. According to Robert Buckley, an attorney who focuses on land use and development at Riemer Braunstein in Boston, the area has experienced a rebirth.

"About 15 to 20 years ago, I remember negotiating some deals in that area and then having trouble getting a cab to take me back to my office," he told China Daily. "The Seaport District is now one of the most dynamic and evolving areas in the city."

Buckley described Boston's commercial property market as strong. "Boston is becoming more of a residential city. One of Boston's principal resources is talent, and for many years talent left the city because there was a lack of quality housing in the inner city. That has changed and brought more development into Boston," he said.

Buckley said he is unaware of any other major commercial development in Boston that has attracted Chinese money " but I have heard of a lot of foreign investors and Chinese nationals buying high-end residential real estate in the city."

Vivien Li, a Chinese American, is president of the Boston Harbor Association, a waterfront advocacy group in the city. "To have the Chinese work with Tishman to develop this project will be phenomenal. This is a unique site because there will never be another building that will block the harbor views from the buildings in this development," she told China Daily.

Li said there will be an acre park next to the condominium building. "The parcel will be divided into three phases for development. The first one was for apartments and just opened," she said.

Li, who has lived in Boston for more than 30 years, said the Seaport District and the city will continue to attract more residents. "I see many Chinese nationals who come to the area for schooling, and they end up staying here after they graduate. This project continues the rebirth of the district and the city."

Tishman Speyer, whose properties include Rockefeller Center and the Chrysler Building in New York, is a major property manager and developer overseeing a portfolio valued at nearly $70 billion. It has been working in China for some time. In 2013, Tishman Speyer formed a joint venture with Shanghai Lujiazui Group to build a mixed-use development in Shanghai's New Bund area.

paulwelitzkin@chinadailyusa.com

(China Daily USA 04/09/2015 page2)

Last batch of Chinese peacekeeping infantry arrives in S.Sudan

Last batch of Chinese peacekeeping infantry arrives in S.Sudan

With high property prices, is it OK to rent forever?

With high property prices, is it OK to rent forever?

Top 7 glass producers in China

Top 7 glass producers in China

China, Vietnam work to build ties

China, Vietnam work to build ties

Louis Vuitton Series 2: Past, Present, and Future

Louis Vuitton Series 2: Past, Present, and Future

Buddhist ritual held on Jiuhua Mountain in E China's Anhui

Buddhist ritual held on Jiuhua Mountain in E China's Anhui

Photographer focuses lens on China's rail history

Photographer focuses lens on China's rail history

Phone booths are given Baymax makeover

Phone booths are given Baymax makeover

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bomber convicted, may face death penalty

US mulls major arms sales to Egypt

Zhou trial likely to serve as model

Energy security, goodwill top Obama agenda in Jamaica visit

Chinese insurers invest in Boston Seaport site

Chinese billionaire buys vase for $14.7 million

Survey: China bests Japan on economic ties

World Bank welcomes AIIB

US Weekly

|

|