Get ready for a three-year bull market

Updated: 2015-01-22 07:41

By Wendy Liu(China Daily)

|

||||||||

Over the past decade, Chinese households have for the most part preferred physical property, not A-shares, to house their savings or investments. But over the past year or so, price expectations on physical property have dimmed because of rising supply and declining prices in many parts of the country. As such, physical property is more prevalently viewed as an alternative to savings where people are unlikely to lose money, rather than an investment to make money.

Besides, increased oversight on various shadow-banking products and the likely arrival of deposit insurance could also persuade Chinese households to invest in A-shares. To curb shadow banking, the State Council, or the cabinet, released Directive 43 on Oct 2, 2014. The directive is aimed at strengthening management of local government debt issuance and repayment through two important rules. Existing local government financial vehicle debts have been re-classified, and the government will guarantee payment of such debts only if they are classified as government debts. Going forward, local government debt issuance can only be in the form of bond issuance.

On deposit insurance, the central bank issued a draft on Nov 30, 2014, proposing a coverage ceiling of 500,000 yuan ($80,423.34) per bank account for mainland depositors. Although theoretically, wealthy Chinese households may spread their savings over a few banks to gain full coverage of deposit insurance, the regulation could also persuade some to invest their money in A-shares to avoid having to deal with multiple banks.

Under China's current approval-based initial public offering (IPO) system, companies go through a complicated process that involves multiple rounds of reviews over several years before getting the green light. Under this system, the regulator decides which company qualifies for IPO and how much can be raised, leading to rent seeking and inefficiency.

And given that China's IPO system approves all A-share IPOs, it also puts pressure on the regulators to bail out retail investors. Among other factors, the outcome is the very low de-listing ratio of A-shares and plenty of speculative investment in reverse-mergers and asset injections that bring phantom stocks back to life.

The author is head of China equity research at Nomura.

- Inspection teams to cover all of military in anti-corruption drive

- Tornado, heavy rain batters Central China's Hunan

- Beijing's five-year plan: Cut population, boost infrastructure

- Palace Museum discovers relics buried for over 600 years

- Disney promises ‘safe, pleasing service of high quality’

- Couple detained for selling their two sons

- Rousseff: Accusations against her 'untruthful'

- Almost one-sixth of Brazil's confirmed microcephaly cases linked to Zika

- Impeachment trial against Rousseff recommended to senate

- With nomination secured, Trump to aim all guns at Hillary Clinton

- Obama sips Flint water, urges children be tested for lead

- Massive protests against Abe mark Japan's Constitution Memorial Day

Raging wildfire spreads to more areas in west Canada

Raging wildfire spreads to more areas in west Canada

World's first rose museum to open in Beijing

World's first rose museum to open in Beijing

Teapot craftsman makes innovation, passes down techniques

Teapot craftsman makes innovation, passes down techniques

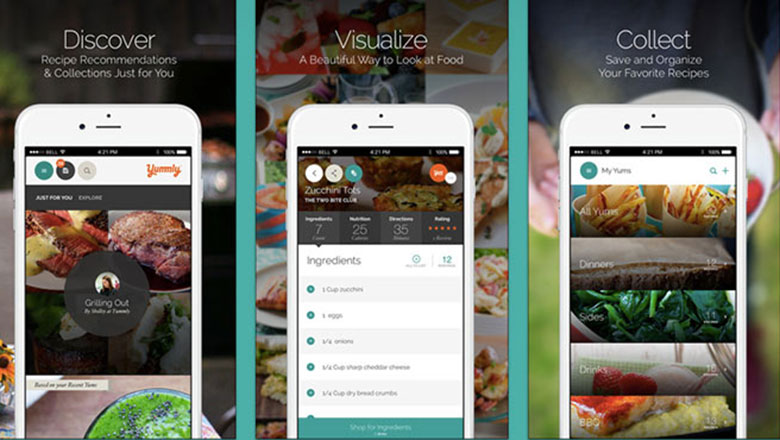

Top 8 iOS apps recommend for mothers

Top 8 iOS apps recommend for mothers

Five things you may not know about the Start of Summer

Five things you may not know about the Start of Summer

Art imagines celebrities as seniors

Art imagines celebrities as seniors

Japanese animator Miyazaki's shop a big hit in Shanghai

Japanese animator Miyazaki's shop a big hit in Shanghai

Star Wars Day celebrated around world

Star Wars Day celebrated around world

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|