Renminbi strong enough to withstand currency war

Updated: 2016-01-29 08:13

By Mei Xinyu(China Daily)

|

||||||||

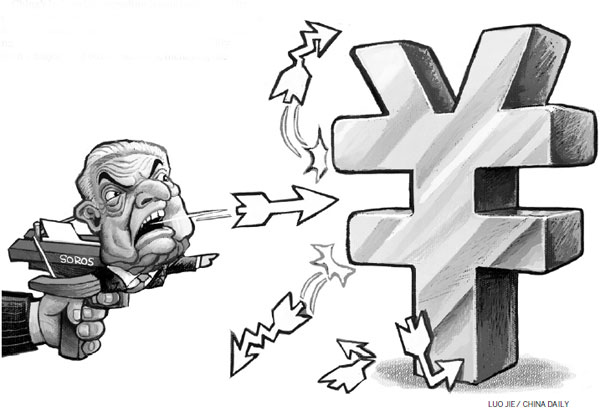

Billionaire hedge fund manager George Soros has made news at the World Economic Forum in Davos. This year, he declared an "open currency war", saying he was short selling Asian currencies, including the renminbi. Due to his financial influence, his short selling remarks have added to the already volatile international financial market and increased the pressure from speculative at tacks on the Asian currency market.

Soros is unlikely to achieve victory in challenging the Chinese renminbi. Despite its economic downturn since last year and its volatile stock market, as well as the renminbi's depreciation against the US dollar, China is still among the countries that boast good economic fundamentals at a time when the global economy as a whole is suffering. The 6.9 percent economic growth China registered in 2015 was two times that of the United States. In 2015, China's exports declined by 1.8 percent, while global trade fell by 10 percent.

China's industrial up grading is continuing, and its emerging advanced manufacturing is beginning to gain an upper hand in an increasing number of areas. China still enjoys far better macro economic stability than a majority of other countries, including the other members of BRICS: Brazil, Russia, India and South Africa.

The better economic shape China is now in compared with other countries means there is no possibility for pure economic shocks to upset it. True, the renminbi has depreciated slightly since the middle of 2015. But it save rage exchange rate against the US dollar has exhibited a strong up ward tendency for 20 consecutive years.

After such considerable appreciation, it is natural for the renminbi to depreciate moderately. China is now the world's second-largest economy and it is unlikely the country will permanently peg the renminbi to the single currency of the US dollar.

To maintain an independent monetary policy in a world with a high degree of capital liquidity, China is willing to see a mode rate exchange rate fluctuation of the renminbi. Investors will surely realize this trend sooner or later and reduce their excessive reactions to it as in the previous months.

- Global health entering new era: WHO chief

- Brazil's planning minister steps aside after recordings revelation

- Vietnam, US adopt joint statement on advancing comprehensive partnership

- European border closures 'inhumane': UN refugee agency

- Japan's foreign minister calls A-bombings extremely regrettable

- Fukushima impact unprecedented for oceans: US expert

Stars of Lijiang River: Elderly brothers with white beards

Stars of Lijiang River: Elderly brothers with white beards

Wealthy Chinese children paying money to learn British manners

Wealthy Chinese children paying money to learn British manners

Military-style wedding: Fighter jets, grooms in dashing uniforms

Military-style wedding: Fighter jets, grooms in dashing uniforms

Striking photos around the world: May 16 - May 22

Striking photos around the world: May 16 - May 22

Robots help elderly in nursing home in east China

Robots help elderly in nursing home in east China

Hanging in the air: Chongqing holds rescue drill

Hanging in the air: Chongqing holds rescue drill

2.1-ton tofu finishes in two hours in central China

2.1-ton tofu finishes in two hours in central China

Six things you may not know about Grain Buds

Six things you may not know about Grain Buds

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|