Overcoming the second major steel crisis

Updated: 2016-09-19 07:47

By DAN STEINBOCK(China Daily)

|

||||||||

|

|

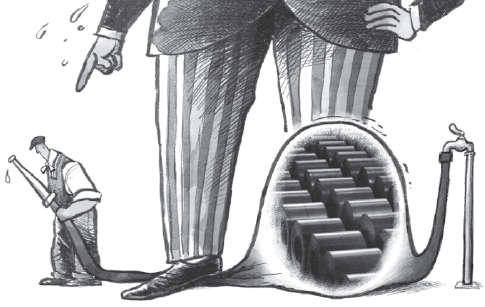

LUO JIE/CHINA DAILY |

Today, advanced economies blame China for steel overcapacity. Yet, four decades ago the United States and Europe were the ones that opted for bad policies, which China is seeking to transcend.

At the G20 Summit in Hangzhou, some world leaders criticized China for its steel overcapacity. Before the summit, US lawmakers, and trade unions and associations had urged President Barack Obama to blame China's trade practices for US mill closures and unemployment and to stress the need for "aggressive enforcement of US trade remedy laws".

In Brussels, European Commission President Jean-Claude Juncker echoed US concerns. In Canada, steelworkers and producers urged Prime Minister Justin Trudeau to push China for the same reasons. In Japan, Prime Minister Shinzo Abe called for structural reforms to address China's steel overcapacity.

Yet, as history shows, the first major steel crisis broke out in the 1970s, starting in the US and Europe.

In the postwar era, crude steel production has grown in three quite distinct phases. In the first phase-often called the "golden era" of the advanced economies-global steel production grew an impressive 5 percent a year, driven by Europe's reconstruction and industrialization, and catch-up growth by Japan and the Soviet Union.

As this growth period ended with two energy crises, a period of stagnation ensued and global steel demand barely grew 1.1 percent a year. In the US, the challenges of the "rust belt" led to labor turmoil, offshoring and the Ronald Reagan era. In the United Kingdom, similar turmoil paved way to the Margaret Thatcher years.

The third phase ensued between 2000 and 2015. China's entry into the World Trade Organization in 2001 initiated a period of massive expansion in steel production and demand fueling output growth by 13 percent a year.

While China's industrialization and urbanization is likely to continue another 10-15 years, the most intensive period of expansion is behind. As a result, the steel sector is facing overcapacity and stagnation.

Are Washington and Brussels now urging Beijing to resolve overcapacity by resorting to the kind of policies they used to tackle the first postwar steel crisis? No. After the mid-1970s, the open trading regime took a step back as aggressive trade practices arose in the US and Europe. The two adopted fairly similar external policies but different domestic measures.

In the US, policymakers avoided direct intervention in the domestic market and allowed domestic enterprises to suffer large losses, which resulted in many plant closures. That translated to substantial reductions of least efficient integrated producers and the rise of more efficient players, including mini-mills. In contrast, Brussels administered a de facto domestic cartel.

Economically, the European capacity reductions proved less effective than those in the US. Socially, Europe was able to smooth the process of transformation, but mainly in the short term.

As the US and Europe sought to protect their markets through non-tariff barriers, they opted for protectionist external policies, which imposed substantial costs on economies and consumers.

In the next two years, China hopes to allocate $15.4 billion for the coal and steel sectors to help up to 3 million laid-off workers find new jobs, particularly in the service sector. But unlike the US and Europe in the 1970s, China today is eager to sustain globalization and intensify world trade and investment, as evidenced by the Hangzhou G20 Summit, the Belt and Road Initiative, as well as the creation of the Asian Infrastructure Investment Bank and the BRICS New Development Bank.

Beijing remains committed to resolving the overcapacity problem but not at the cost of the living standards of people in China or other emerging economies. The objective is to sustain China's economic rise, while supporting the industrialization of other major emerging economies. And that is very much in the interest of Washington, Brussels and Tokyo as well.

The author is a guest fellow at the Shanghai Institutes for International Studies. This commentary is based on his SIIS project, China and the multipolar world economy.

- Merkel faces setback in Berlin vote due to migrant fears

- Anti-TTIP protesters take to streets in Germany

- Death toll of Friday's suicide blast in NW Pakistan rises to 36

- In photos: Explosion rocks Chelsea in New York City

- UN General Assembly kicks off 71st session

- Britain records warmest September day since 1911

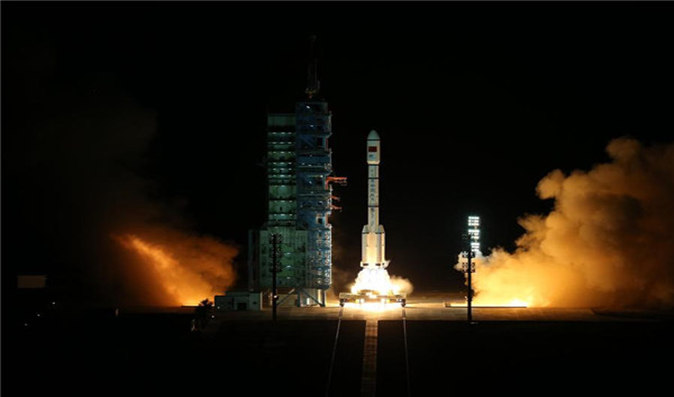

China launches second space lab into orbit

China launches second space lab into orbit

Riding on smart cycles in Nanjing city

Riding on smart cycles in Nanjing city

Britain records warmest September day since 1911

Britain records warmest September day since 1911

Island retreats you may not want to miss for holidays

Island retreats you may not want to miss for holidays

Industrial-style canteen surprises university students

Industrial-style canteen surprises university students

Cute animals share a bite of moon cake festival

Cute animals share a bite of moon cake festival

Orphaned Chinese marries American at SOS village

Orphaned Chinese marries American at SOS village

French royal porcelains shine in Xi'an

French royal porcelains shine in Xi'an

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|