Bullish feeling

Updated: 2013-02-22 08:42

By Xie Yu and Gao Changxin (China Daily)

|

|||||||||

Chinese bourses, long in doldrums, have shown signs of revival and are likely to extend their current winning streak

Stock markets are often considered to be synonymous with economic growth. But China has been an exception to this rule and is perhaps one of the few regions where one can find stock markets operating in splendid isolation, or in other words, not in tandem with economic growth.

|

||||

However, the initial disbelief soon gave way to renewed optimism as share prices firmed up sharply in the last two months and heralded the return of the bulls.

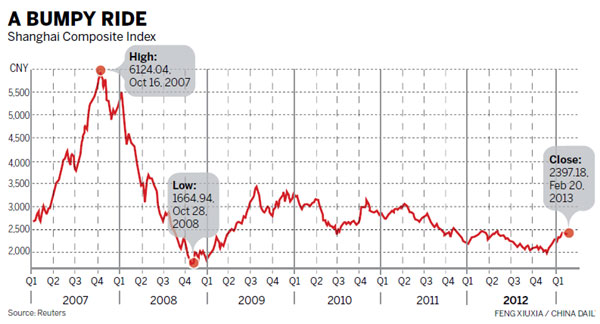

The benchmark Shanghai Composite Index exceeded the 2400 level for the first time in nine months after rising for five consecutive days in early February. The index has risen about 23 percent from early December, when it was at a four-year low of 1949 points.

Even more encouraging were the reports that trading volumes on the last Wednesday of December alone had reached 135.6 billion yuan ($21.74 billion; 16.3 billion euros), almost four times the daily turnover in late November.

Sentiments improved further when robust macro economic data dispelled the fears of an economic hard landing. The preliminary HSBC China Manufacturing Purchasing Managers Index, a gauge of the country's manufacturing activity, rose to 51.9 in January from 51.5 in December, a 24-month high.

The impetus for the stock market rally came after the elusive small, individual investors started returning to the bourses. Bargain hunters were back in business and so were new entrants eager to grab a slice of the pie.

According to data provided by the China Securities Depository and Clearing Corp, as many as 117,600 new accounts were opened between Jan 14 and Jan 18. More than 12.6 million accounts were active in trading during the same period, a 13.4 percent rise on the previous week.

Even as news of the market rally was still sinking in, came reports that more than 800 companies were lining up to raise funds from the capital market through initial public offerings, secondary offerings and bond issues.

A healthy stock market was not only big news for the army of demoralized investors but also a boon to the many cash strapped enterprises, considering easy credit to be a thing of the past.

Despite the improved economic fundamentals, many experts feel that the Chinese capital markets are still not ready for a massive revaluation. They contend that the latest earnings announcements have shown little improvement in overall corporate earnings potential.

The average stock market price to earnings ratio, or PE, has already adjusted upward to more than 12 times from about 10 times in the past few weeks. Further readjustment will depend on the projected performance of the major publicly traded enterprises in the key economic sectors, including property, finance, energy and telecommunications.

And that, many analysts says, is a big if.

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|