Evergrande's Hui close to becoming China's richest man

|

|

Hui Ka Yan, chairman of Evergrande Group [Photo/VCG] |

Hui Ka Yan, chairman of real estate developer Evergrande Group, is close to becoming China's richest man.

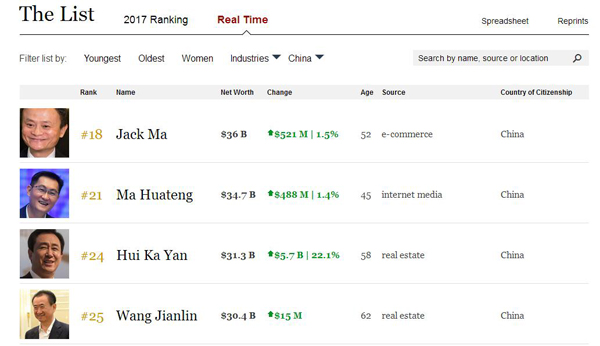

Hui's net worth overtook that of Wang Jianlin, chairman of Dalian Wanda Group, and was second only to Alibaba's Jack Ma and Tencent's Ma Huateng, according to Forbes' real-time ranking of Chinese billionaires on Thursday.

Analysts expect Hui to take the richest Chinese man's crown if Evergrande's shares rise another 20 percent.

Wang was China's richest man in Forbes' 2017 ranking of billionaires released in April, with net worth of $31.3 billion.

|

|

A clip of Forbes' real time ranking [Photo/forbes.com] |

Hui's wealth bulged as a result of the strong rise of the company's equities. Evergrande's shares surged 18.08 percent on the Hong Kong stock exchange to close at HK$20.90 ($2.68) per share on Wednesday.

The rally continued on Thursday as it jumped 6.7 percent higher at opening to HK$22.30 per share.

Compared with the start of HK$5.04 per share on the first trading day this year, the stock had soared more than 340 percent as of opening Thursday.

Xu currently holds 10.16 billion shares or 77.87 percent of the company's shares, according to publicized data.

The share surge came after a better-than-expected first half forecast. The company predicted on Tuesday that first half net profits will triple year-on-year to HK$21.38 billion over rises in average property sales price and total floor space.

The real estate developer raked in HK$7.129 billion net profits in the first half last year.

Hong Kong-listed Chinese property companies have staged robust rally since the beginning of this year. Sunac China Holdings Limited, for instance, saw its share price more than triple and Country Garden saw the price more than double.

Wanda, which has been seeking for an IPO of its property unit Dalian Wanda Commercial Properties, is moving forward with what it calls "asset-light" model with big asset sale deals.

Earlier this month, it entered into agreement to sell its 91 percent equity in 13 tourism projects to Sunac China for 43.84 billion yuan ($6.52 billion) and 77 hotels to Guangzhou R&F Properties for 19.9 billion yuan, in a bid to reduce liability.