Americans win Nobel prize in economics

Updated: 2011-10-11 08:10

By Simon Johnson and Veronica Ekreuters (China Daily)

|

|||||||||

|

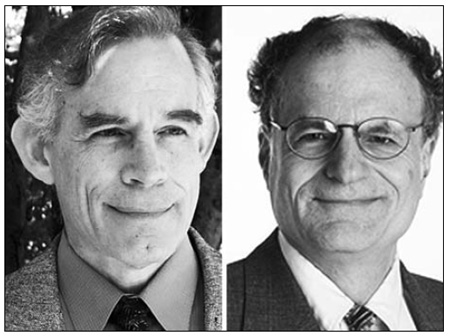

US researchers Thomas Sargent (left) and Christopher Sims were named as the winners of the 2011 Nobel prize in economics on Monday in Stockholm. New York University, Princeton University / Agence France-Presse |

STOCKHOLM - Americans Thomas Sargent and Christopher Sims shared the Nobel prize in economics on Monday for work that helps governments and central banks weigh up responses to crises - though it offers no immediate answer to current global problems.

"The methods that I have used and that Tom has developed are essential to finding our way out of this mess," Sims said over a satellite link to the announcement event in Stockholm.

But he warned that the measurement tools he and Sargent had independently worked out in the 1970s to assess the impact of policy changes and of shocks to the economic system provided no quick or simple solutions to the global crisis:

"If I had a simple answer to that I would have been spreading it around the world," said Sims, 68, from Princeton University. "It requires a lot of slow work looking at data, unfortunately."

The Royal Swedish Academy of Sciences, which made the award, said the 10 million crown ($1.5 million) prize recognized their "empirical research on cause and effect in the macroeconomy" and said their work laid the foundation for modern macroeconomic analysis.

"One of the main tasks of macroeconomic research is to comprehend how both shocks and systematic policy shifts affect macroeconomic variables in the short and long run," the academy said in a statement about the award.

"Sargent's and Sims's awarded research contributions have been indispensable to this work."

Sargent's work focused on systemic policy shifts, while Sims was more interested in shocks to the economy, such as surging oil prices, or a sharp drop in household consumption.

Sargent, 68, who is professor of economics and business at New York University, developed a mathematical model in his work and described it in a series of articles in the 1970s.

Sims, a professor of economics and banking at Princeton, wrote an article in 1980 which introduced a new way of analyzing data using a model called vector-autoregression.

Torsten Persson of Stockholm University, who sits on the prize committee, said it was unclear that their work was of immediate remedial use, as ministers and central bankers try to balance efforts to promote a growth in output and employment with concerns about cutting state debts and rising inflation.

"That's a big question," Persson said.

"I'm not sure there's any immediate help. Crises like the one we're experiencing today - a global financial crisis - don't happen every year, not even every decade.

"When we're trying to understand how the economy works, we have to rely on the historical patterns in the data.

"One can see attempts to understand what happens in today's crisis ... with methods such as those Sergent has designed. But it is a little bit early to know the results yet. But they could be very useful, absolutely."