Expats in US pay high price

Updated: 2012-01-10 08:24

By Zheng Yangpeng (China Daily)

|

||||||||

BEIJING - Just three months after becoming a permanent resident of the United States, Zhang Jianwu (not his real name) has already begun to feel the pain of being wealthy in his new country of residence.

As a businessman in the foil making industry, he is frequently exhausted from his trips between the US and China, where he must wine and dine his clients and associates to maintain the health of his business.

What burdens him the most, however, are the heavy taxes imposed on the country's top earners. According to the US tax code, he must pay nearly 30 percent of his income to the Internal Revenue Service (IRS), the country's taxation authority.

|

|

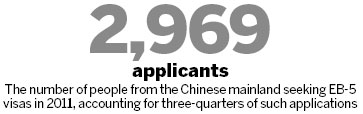

In addition, the IRS's new requirement for the 2011 tax year will add another headache for him and thousands of other Chinese citizens who invested in the US with the promise of permanent resident permits, or "green cards".

Foreign assets

Under the new requirement, US citizens and permanent residents must disclose detailed information about their foreign assets, including stock holdings, retirement pensions and life insurance policies. The policy directly affects Chinese immigrant investors, who usually hold considerable assets in China.

Taxing the worldwide income of its citizens and permanent residents has long been a practice of the US government. But the Foreign Account Tax Compliance Act (FATCA), in an effort to prevent overseas tax evasion, and stipulates harsh punitive measures for those who fail to report their foreign assets, intentionally or not.

What's more, the law demands foreign financial institutions register with the IRS by 2013, release account holder information and annually declare their compliance. Noncompliance will be punished with up to 30 percent on income and capital payments the company gets from the US, the New York Times reported.

"As result, some foreign financial institutions may no longer wish to have customers who are US residents or citizens," Mark Goldsmith, practice group leader and partner of the tax division at Troutman Sanders LLP, told China Daily. "Immigrants to the US from China may find that the Chinese financial institution with whom they did business for many years no longer wants them as a customer."

There has already been an outcry from US expatriate advocacy groups, claiming the new rules will cause foreign financial institutions to view them as "pariahs".

But for investors such as Zhang, who applied for US green cards with the hope of providing a better education for their kids and a safer place to park their tremendous capital, the act threatens to scoop their assets from underneath, making those seeking US green cards consider alternative destinations for emigration.

"Given the tense economic situation in the US, I think it's understandable that the government wants to increase its fiscal revenue by implementing a much stricter tax policy," Guo Zhihui, executive president of the US-China Legal Exchange Foundation, told China Daily.

According to Goldsmith, pursuant to the exchange of information article in the income tax treaty between China and the US, Chinese immigrant investors might also be concerned that they will be required to disclose information previously not available even to the Chinese government.

Qi Lixin, president of the Beijing Entry and Exit Service Association and president of East J&P Star Consulting Co Ltd, an emigration consulting company, said FATCA highlights the risks of being an immigrant investor in the US - risks that most actual and potential applicants are unaware of.

"Unlike other wealthy economies, the US' immigration policy is exceptionally one-sided," Qi said.

"The details of the new requirement publicized to an unprecedented degree the once-hidden risk of being a US immigrant investor," he said.

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|