US loans climb by $19.3b in December

Updated: 2012-02-09 07:55

(China Daily)

|

|||||||||

WASHINGTON - US residents borrowed more than expected in December amid an increasing demand for auto and student loans.

The amount of credit increased by $19.3 billion to reach $2.5 trillion, Federal Reserve figures showed on Wednesday in Washington. The increase exceeded the median forecast of $7 billion that was made by economists surveyed by Bloomberg News and followed a $20.4 billion advance in the previous month.

US residents "are willing to take on this debt because there is some increasing degree of confidence in the economy", said Ken Mayland, president of ClearView Economics LLC in Pepper Pike, Ohio, who projected the amount of credit would climb by $15 billion, the highest in the Bloomberg survey.

"Consumers over the past several years have done a pretty good job of repairing their balance sheets."

An improving job market may be giving households the courage to take on more debt in order to sustain spending, which accounts for about 70 percent of the economy. At the same time, an increasing dependence on credit may be a sign that the increase in employment has yet to push wages high enough to give consumers the means to keep shopping.

The median forecast was based on a survey of 37 economists. Their forecasts predicted everything from a decrease of $8 billion to an increase of $15 billion.

The increases from one month to the next seen at the end of 2011 were the biggest since October and November 2001.

The amount of non-revolving debt, including educational and auto loans, increased by $16.6 billion in December, the biggest gain since November 2001, according to the report. The Fed's report doesn't track debt secured by real estate, such as home equity lines of credit.

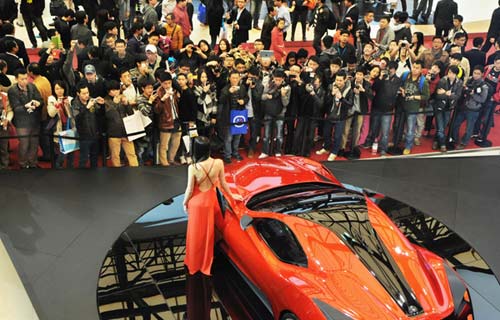

The number of cars and light trucks sold in 2011 was 12.8 million, a 10 percent increase from 2010, according to the researcher Autodata Corp.

And the demand for credit may keep increasing as demand keeps becoming stronger. The annual rate of auto sales climbed to 14.1 million last month, according to industry data. Excluding a surge in August 2009 that reflected the government's "cars-for-clunkers" program, that was the strongest month seen since May 2008.

General Motors Co and Ford Motor Co, the largest automakers by US sales, forecast deliveries in the industry will rise to as much as 14 million in 2012.

The amount of revolving debt, which includes credit cards, climbed by $2.76 billion, according to the Fed's statistics.

MasterCard Inc, the second-biggest payments network in the world, said last week that its fourth-quarter profit climbed by 24 percent as spending with credit and debit cards increased. Debit-card purchases increased 18 percent from the same time a year earlier, while those on credit cards rose by 6.6 percent. Shares of the New York-based company increased by 66 percent in 2011, the fourth-best performer in the Standard & Poor's 500 Index.

Employers added 243,000 workers to payrolls in January, exceeding all of the predictions of economists surveyed by Bloomberg, and the jobless rate unexpectedly dropped to a three-year low of 8.3 percent, figures from the Labor Department showed last week.

Bloomberg News

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|