Alibaba, ShopRunner partner to give Amazon, e-Bay a run for their money

Updated: 2014-05-09 11:47

By Amy He in New York (China Daily USA)

|

||||||||

E-commerce giant Alibaba, which filed on Tuesday to go public in the US, has partnered with US e-commerce platform ShopRunner in a deal that will allow Chinese consumers easier access to goods sold in the US.

ShopRunner will use Alibaba's logistics infrastructure to get products to Chinese customers from their thousands of retail partners, which include brands like Calvin Klein, GNC, and Kenneth Cole, as well as partner stores like Neiman Marcus and Lord & Taylor. The two companies will be creating a "joint brand" in China, according to Fiona Dias, ShopRunner's chief strategy officer.

"The history of US retailers going to China is one that's fraught with peril," Dias told Reuters. "This is a very low cost way to do it that doesn't require them to go to China to figure it out."

Alibaba has a 39 percent stake in ShopRunner, which it acquired in October for $202 million. Customers can search for goods on ShopRunner, check out through its partner sites and get unlimited two-day shipping on their purchases for $79 a year.

ShopRunner has been called an "Amazon rival" for its shipping options, which are similar to Amazon's "Prime" service, also a two-day shipping option for members who pay $79 a year. After news from Amazon that its Prime service will be increasing in price, ShopRunner offered pre-existing Prime members free one-year memberships to woo them over.

Amazon has an e-commerce store in China, but analysts said that Alibaba's partnership with ShopRunner in China might not necessarily hurt Amazon's business.

"They're not directly competing on the same products," said Ming Fan, an information systems professor at the University of Washington who has worked on Alibaba's Taobao, a platform similar to eBay. "Of course, it brings some competition and it will have some effect on Amazon, but I want to stress that they're focusing on different products."

Fan said that Amazon China's products are mostly offerings from the Chinese market, whereas ShopRunner will give a Chinese consumers access to US goods and who may be wary of counterfeits sold on sites like Taobao, something that Dias of ShopRunner echoed.

Brands "want access to Chinese customers and they want to do it on their own terms", Dias said, and that the partnership with Alibaba will satisfy a growing Chinese appetite for American brands.

"There is unsatiated demand for goods and brands from the US," said Justin Ren, professor of technology management at the Boston University School of Management. "It is also true that it is notoriously difficult for US retailers themselves to enter China."

Through the partnership, users under Alibaba's Alipay - a payments system similar to PayPal - will be able to order goods through ShopRunner's partners and have the goods delivered within 10 days, according to Dias. But Chinese customers don't have access to the two-day shipping that US residents have.

Alibaba's partnership with ShopRunner comes after investments in 11 Main and 1stdibs, two other e-commerce platforms based in the US, both seen as Alibaba's first forays into the US e-commerce space. Kelland Willis, an analyst at market research company Forrester, said that Alibaba's investment in ShopRunner could be helpful if Alibaba ever makes an official move in the US market.

"Immediately the partnership is to help Chinese consumers get products quicker, and it allows them operate on a lower operating margin because ShopRunner already has scale," Willis said.

amyhe@chinadailyusa.com

(China Daily USA 05/09/2014 page1)

Forum trends: How to bargain in China

Forum trends: How to bargain in China

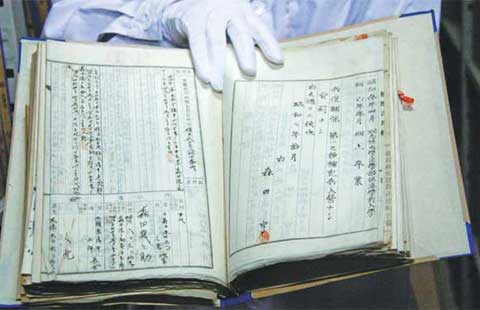

Countries mark end of WWII

Countries mark end of WWII

Mother's Day : Travel with mom

Mother's Day : Travel with mom

American wrestlers win Times Square event

American wrestlers win Times Square event

Chinese enrollment for US MBAs is rising

Chinese enrollment for US MBAs is rising

Confucius Institute marks 5th year at George Mason

Confucius Institute marks 5th year at George Mason

Chinese artists attend NY philanthropists' event

Chinese artists attend NY philanthropists' event

Chinese in 'orbit' over lollipops

Chinese in 'orbit' over lollipops

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US museum to return statue to Cambodia

Thai PM faces ban from politics

China tops Global 2000: Forbes

Putin to attend D-Day ceremonies

S. Korea detains head of company in ferry sinking

WHO report says Delhi has worst air pollution

Facebook 'aids' China's exporters

Top US school's offer puts youth into spotlight

US Weekly

|

|