Chinese credit agency forecasts future US downgrade

Updated: 2013-12-03 07:46

By Amy He in New York (China Daily USA)

|

||||||||

A potential ratings cut in US debt by the Chinese agency Danong would most likely not affect Chinese investors' outlook on the US or have an impact on the US doing business with China, according to Joseph Gagnon, senior fellow at the Peterson Institute for International Economics.

"We'd be better off if China wouldn't buy our bonds; we'd rather them buy our exports," he said. "China earns dollars when they sell exports to the US, and they have to spend those dollars somehow. They can either spend them on bonds, or they can spend them on US exports. I don't think China needs any more US Treasuries. I think we'd all be better off if China stopped buying US Treasuries."

Gagnon was responding to a Reuters story that quoted the chairman of Dagong Global Credit Rating Co, Guan Jianzhong, as saying in an interview that "the trend of rating cuts does exist if the US debt level continues to rise and its economic fundamentals don't improve."

Guan said that the Beijing-based agency is worried about the US economy since the government has yet to reveal a plan of action on how to solve its debt problem, and that there may be a chance the US will receive a B rating by 2020, according to Reuters.

Dagong made news in October after the US government shutdown ended when it downgraded the US' local and foreign credit ratings to A- from A, maintaining a negative outlook, despite the government coming to agreement about raising the country's debt limit just hours before.

The agency, one of the four biggest credit rating agencies in China, expressed concern then in a statement, saying that the US was merely paying down old debts by taking on new ones, which they said "constantly aggravates the vulnerability of the federal government's solvency."

Three years earlier in July, the privately-owned Dagong rated the US as a worse credit risk than China, and then downgraded the country to an A+ rating from AA in November the same year over worries about quantitative easing. It further cut the US' rating to an A with a negative outlook in August 2011, after the government announced it would increase the country's debt limit.

Guan told Reuters that the US will "not openly default, but it will print huge amounts of dollars to help repay its debt, which is risky."

"Normally, countries that borrow in their own currency don't default," Gagnon told China Daily. Rating the US, he said, is very different from rating a country like France, whose debt is in euros but can't print euros.

"We could default out of sheer stupidity if Congress didn't raise the debt ceiling, but that's just a self-inflicted injury," Gagnon said. He added that ratings are "meaningless," even ones from ratings giants like Moody's Investors Service and Standard & Poor's.

Gagnon has been a senior fellow at the Washington-based Peterson Institute since September 2009. He was visiting associate director, the division of Monetary Affairs (2008–2009) at the US Federal Reserve Board. He worked at the Fed as associate director, division of International Finance (1999–2008), and senior economist (1987–1990 and 1991–1997). Gagnon also served at the US Treasury Department (1994–1995 and 1997–1999). He is the author of Flexible Exchange Rates for a Stable World Economy (2011) and The Global Outlook for Government Debt over the Next 25 years: Implications for the Economy and Public Policy (2011).

He received a BA from Harvard University in 1981 and a PhD in economics from Stanford University in 1987.

Contact the writer at amyhe@chinadailyusa.com

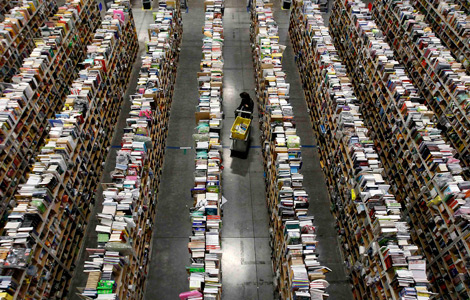

Amazon sees delivery drones as future

Amazon sees delivery drones as future

Amazon.com sees delivery drones in the future

Amazon.com sees delivery drones in the future

Simulated archaeology takes you back in time

Simulated archaeology takes you back in time

Pictures of Year 2013 by Reuters

Pictures of Year 2013 by Reuters

Thai PM calls for talks, protest leader defiant

Thai PM calls for talks, protest leader defiant

'Cyber Monday' sales set to hit record

'Cyber Monday' sales set to hit record

Tapping the power of youth volunteers

Tapping the power of youth volunteers

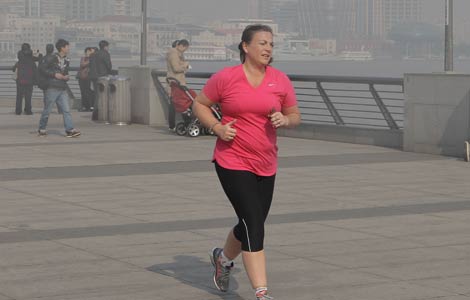

Shanghai braces for second day of severe pollution

Shanghai braces for second day of severe pollution

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US calls for release of American jailed in Cuba

Staggered flu shot plan best for China: study

Online shopping changing retail world

House hunting the world in Chinese

China-UK collaboration is about time: President Xi

Biden under pressure to calm tensions

FTZ OKs offshore accounts

'Go Global' pushing up China M&A

US Weekly

|

|