Richard Kramlich: Bridging cultures with business and art

Updated: 2014-06-20 07:32

By QIDONG ZHANG in San Francisco(China Daily USA)

|

||||||||

|

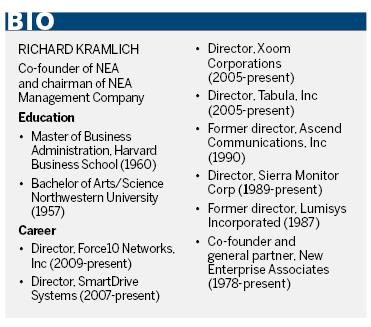

| Chairman and cofounder, New Enterprise Associates |

C. Richard Kramlich, co-founder and Chairman of New Enterprise Associates (NEA) Management Company, leads a venture capital firm that has ranked among the top in portfolio IPOs every year in the past decade. One hundred ninety-two NEA-backed companies have gone public since its establishment in 1978, and 315 were acquired, which helped to create more than one million jobs.

Kramlich's collection of Asian art and new media also ranks him as one of the top 10 collectors on "Larry's List", whose database tracks more than 3,000 art collectors around the world.

Recognized for transforming US-Asia relations by creating the culture of innovation at the 2014 Asia Society's annual dinner in May in San Francisco, Kramlich said he anticipates expanding NEA's investment portfolio in China since this is "the century of Asia". His Asian art collection, he said, is a way of letting the world know that it is "terribly important we understand much more about Asian cultures".

His connection to China started early in his childhood, when his father Irvin Kramlich told him an amazing story of his experience as a University of Virginia student visiting China on Franconia, a ship with the Gunard Line in 1929. He befriended a young Chinese student in Hong Kong named Henry Hsue and treated him to a Captain's dinner. When the two friends met again after WWII in 1956, Hsue had since become president of a bank and invited his American friend and his wife to his wife's birthday party at their home, where Kramlich was served the exact dinner courses from the Captain's dinner 25 years earlier.

"That story had a lot of impact on me, and I was so touched by the way the Chinese honor friendship, loyalty, respect, and hospitality," said Kramlich, who subsequently met all of Hsue's children when they attended Princeton and Harvard in the US.

Kramlich said he has witnessed China's development in the past two decades, especially experiencing the 2008 Olympic Game in Beijing, when he and his wife Pamela were living in Shanghai for a year and half in an effort to better engage his venture capital business in China.

"I was amazed at how the government cleaned up the air during the Olympic Games, which tells us that once China makes up its mind, things can be done and done well," he said. "And businesswise there are just so many ways we can collaborate, especially in the green energy and environmental protection areas, from fuel cells to electric cars. Last year China dismantled over 1,000 coal mines. They are trying hard to make a difference in improving air quality, and that means opportunities for business along the way."

Visiting China since the 1970s, Kramlich said he has always been trying to convince younger partners at his investment firm to station themselves and work in China, where the company is looking to increase its investment portfolio and capacity.

With about $500 million currently invested in China, NEA's recent hits there includes CITIC Pharmaceuticals, which was acquired in 2011 for $535 million; and Speadtrum, which was acquired by a Chinese government entity.

NEA also funded BioVeda Technologies, a Chinese medical and life science fund, and Novast Technologies, another promising company funded by BioVeda and NEA.

His recent US successes include Xoom Corp, which went public in 2012, Financial Engines (2010); Force10 Networks (acquired in 2011 by Dell); and Wayport (acquired by AT&T in 2008).

Kramlich says NEA takes a relatively conservative investment approach in China on medium-sized companies that have healthy growth and big market cap potential. The fields he is most optimistic on are telecommunications, healthcare and big data. On the personal side, he is a seed investor of Apple and Xiaomi, one of China's biggest electronics companies.

In early 1980s, the Kramlichs started a new media art collection and founded New Art Trust (NAT) in 1997, providing scholarship and financial aid to support new media artists who have made important achievements in the field of media art.

In 1999, the San Francisco Museum of Modern Art (SFMOMA) organized Seeing Time: Selections from the Richard and Pamela Kramlich Collection of Media Art, the first major exhibition of their groundbreaking collection. In November 2002, P.S.1 Contemporary Art Center, a MoMA affiliate, presented Video Acts: Single Channel Works from the Collections of Pamela and Richard Kramlich and New Art Trust, a comprehensive exhibition of performance-related single-channel video works.

More than 180 single-channel works have been collected by NAT since its establishment, and the Kramlichs have made it one of the richest archives of media art in the world with video, slides, film, audio, and computer based installations by artists broadly considered to be pioneers in film and video art. NAT's consortium members are the Museum of Modern Art, New York (MoMA); SFMOMA; and the Tate in London, plus nonprofit media-art center Bay Area Video Coalition (BAVC).

Their interest in electronic art originated from a commitment to support contemporary art practice, combined with a belief in the potential of new technology. Although long-term care of these media remains fairly new, the Kramlichs have assembled their collections piece by piece, making them both a living collection and an example of a particular period of time for the benefit of future generations.

"Life is an experience of art itself. And I want to make it beneficial to mankind in every way possible, if I can," he said.

kellyzhang@chinadailyusa.com

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Premier pushes innovation on German visit

Beijing to keep the lid on air pollution for APEC

Li arrives in Germany, first leg of Europe trip

China's economy surpasses US

IMF: Shadow banking filling gaps

China's status prominent at 'Big Four' firm Ernst & Young

US Ebola patient dies

China's role grows in Gates Foundation tech push

US Weekly

|

|