'Made in China' to 'Made in USA'

Updated: 2015-03-27 11:03

By Dong Leshuo(China Daily)

|

||||||||

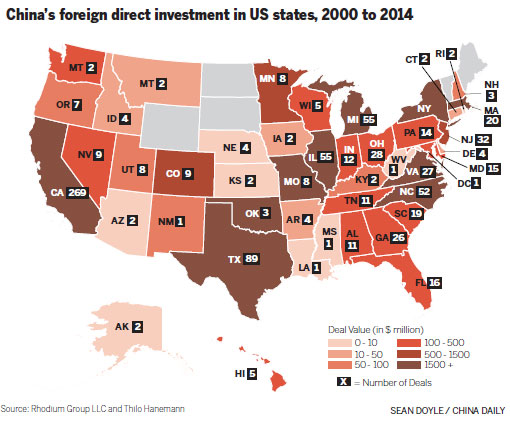

China's FDI

Though China is still not among the top 15 largest sources of foreign direct investment in the US, it has been the fastest-growing source in the past five years, with annual growth of 41 percent, according to the US Bureau of Economic Analysis. According to the Rhodium Group, Chinese foreign direct investment in the US reached $12 billion in 2014, topping the $10 billion mark for the second year in a row. That economic tie is expected to be further strengthened with a Bilateral Investment Treaty, which China and the US are speeding up negotiations to reach.

"The United States has become the third-largest destination of China's foreign direct investment," said Cui Tiankai, China's ambassador to the US, at a welcoming reception held on Monday evening at the Chinese embassy. The pace of Chinese companies "going out" is speeding up, which will bring tens of billions of dollars' opportunities for the two sides, said Cui.

On a large screen in the front of the Potomac Bp> "I have three goals in participating in this summit," he said. "The first is to get inspiration. There are so many great thinkers here, from entrepreneurs, scholars to political leaders. The collision of ideas can generate inspiration. The second is to make friends. The third is to accomplish a deal."

Wang said that Wanda is very interested in the culture industry and entertainment industry in the US. "We are negotiating some other acquisitions in the US entertainment industry," he said, adding that Wanda will look at the projects in New York, Washington and San Francisco.

"Of course we will increase investment, that's why I came," Wang told China Daily. "I'll realize my promise two years ago, which is to invest at least 10 billion dollars in the US within 10 years."

In addition to Wanda, among the 70 Chinese enterprises at the conference included representatives from e-commerce giant Alibaba Group Holdings Ltd, real-estate developers, pharmaceuticals, energy, technology and auto-related companies.

Sun Jiong, vice-president and special assistant to Alibaba CEO Jack Ma, said the company's record $25 billion initial public offering on the New York Stock Exchange last year helped Americans understand Alibaba better.

He said many US states are seeking cooperation with Alibaba, and he attributed interest in the company to business opportunities in the Chinese market. "So we are grateful for the opportunities presented by the Chinese market," he said.

Luan Shaohu, vice-president of the China Association of Small and Medium Enterprises, attended the summit with a group of Chinese entrepreneurs, who are members of his association. For some it was their first trip to the US. He said members of his organization have shown increasing interest in "going global and I believe with better guidance, their business endeavors will be even brighter".

Li Min from Goldin Properties, a developer specializing in the Chinese mainland high-end property market, said that his company is thinking about investing in the US: "I have been to the US several times; now it's the opportunity. We are thinking about the sports industry."

p>"My company has just started investing in the US this year, " said Frank Jao, chairman of Bridgecreek International Corp, a full-service real estate firm specializing in domestic and international development.

"We have a little investment in the US," said Yin Shenping, CEO of Recon Technology, Ltd, a provider of hardware, software and on-site services to the petroleum mining and extraction industry in China. "Now we are thinking of expanding our business in the US, like buying oilfields."

"We are doing energy business. We are thinking of investing here because we see opportunities as the price of gasoline is going down," Wei Hong, president of Xin-Jiang Guanghui Petroleum, Ltd, told China Daily.

Li Chengrong, senior vice-president of California-based East West Bank, said, "We have seen an increase in Chinese companies 'going out' of their country to come here." The Chinese-American bank has more than 130 branches in Greater China and the US, including in Texas, Nevada, Massachusetts and other states.

"The areas they are interested in investing in have been expanding from New York and California where the Chinese population is big, to other states, like Virginia and North Carolina," she said. "They are doing all kinds of businesses. For example, manufacturing. If they produce the parts of the cars here, it is 'Made in the USA', so that they can sell their products to the American automobile companies. They have been expanding their market in this way. This kind of business model has been adopted by many Chinese companies."

Paul Swenson, managing director of the state of Georgia's department of economic development, said China's investors are now becoming more mature, "so they are learning more about how to use the overseas market to grow their business, both in China and around the world".

- 'Behind-the-scenes' visit at Paris Zoological Park

- Migrants risk lives crossing into Europe

- US denies visa to young man for transplant

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

- Germanwings' co-pilot 100 percent fit to fly: Lufthansa CEO

- Voice recordings show one pilot locked out cockpit

World leaders open Boao Forum for Asia 2015

World leaders open Boao Forum for Asia 2015

Buildings covered by fog in China's Qingdao

Buildings covered by fog in China's Qingdao

Across America over the week (from March 20 to 27)

Across America over the week (from March 20 to 27)

Walking tall

Walking tall

Press photo competition winners announced

Press photo competition winners announced

Strange but true: Gator takes a stroll on Florida golf course

Strange but true: Gator takes a stroll on Florida golf course

Top 9 hot-selling foreign products for Chinese babies

Top 9 hot-selling foreign products for Chinese babies

French photographer captures Beijing in the '80s

French photographer captures Beijing in the '80s

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asian countries to seek win-win co-op: Xi

'Made in China' to 'Made in USA'

More countries to join China-backed investment bank

Grassland city looks to cloud computing

Scenic Hohhot wants to be smart based on emerging industries

Motive examined after

'deliberate crash'

Chinese CEO compares Apple Inc to Hitler

China's investment opportunities lauded

US Weekly

|

|