RMB's inclusion in SDR called significant

Updated: 2016-10-06 11:27

By Chen Weihua in Washington(China Daily USA)

|

||||||||

The inclusion of the Chinese currency into the International Monetary Fund's Special Drawing Rights (SDR) basket will not only help China's financial reforms but the evolution of the international financial system, according to IMF officials and think tank economists.

Zhang Tao, the new deputy managing director of IMF, said inclusion of the Chinese currency, the renminbi (RMB), makes the composition of the SDR basket more representative of the currencies being traded in the world.

"The RMB's inclusion will make it more attractive as an international currency, contributing to greater risk diversification," Zhang told a forum on Chinese economics on Wednesday at the Peterson Institute for International Economics in Washington.

Zhang assumed the current post on Aug 22, replacing Zhu Min, also from China.

A former deputy governor of the People's Bank of China, the central bank, Zhang said the inclusion of the RMB will also strongly support China's continued efforts to reform its monetary, foreign exchange and financial systems. "It will help facilitate the country's increased integration in the global financial community," he said.

He believes the inclusion will help consolidate the process of RMB internationalization, adding that experience shows that currency internationalization can encourage the development of deeper and more liquid financial markets. "It can deliver more predictable macroeconomic outcomes, assist the development of strong and credible institutions, and secure the integrity of the markets," he said.

Zhang noted that while these will be not achieved overnight, they can be crucial for China's continued emergence as a source of economic growth and financial stability.

In November 2015, the IMF Executive Board announced its decision to include RMB into the SDR basket, effective on Oct 1, 2016. The decision makes the yuan a new member in a basket of four other currencies - the US dollar, Euro, British pound and Japanese yen.

Fabrizio Saccomanni, a distinguished visiting fellow at the Peterson Institute, described the inclusion of RMB as an important recognition of China's growing role in the world economy and international monetary system.

"It is an important gesture by the international community in the process of rebalancing the distribution of power in international financial institutions,” he said, adding that it has been pursued for some time.

The Italian economist, who had served as deputy governor of the Bank of Italy and as Italy’s Minister of Economy and Finances from 2013-2014, also described the move as a commitment by China to continue to move toward financial integration and opening its capital markets.

Fred Bergsten, senior fellow and director emeritus of the Peterson Institute, said the US should warmly welcome the accession of RMB into the SDR basket.

“This is a historic development. It’s a very important part of China’s overall rise as a global economic power, a reflection of China’s willingness to accept increased responsibilities as the leader of the international economy and international monetary system. I think it’s wholly desirable,” he said.

Bergsten believes it’s historic for another reason. It’s the first case in which a national currency is becoming a global currency very much at the behest and initiative of the issuing country. He said that the US dollar, pound sterling, Japanese yen and euro all are chosen by the markets, adding that some issuing governments were even reluctant to see their currency playing much of an international role.

“So I think China is breaking new territory here in actively seeking various responsibilities in an orderly and timely way in an international role for its currency. I think it’s historic in that sense…” he said.

Bergsten warned his Chinese counterparts in the audience to be ready for some unanticipated consequences. “Somebody might even start manipulating your currency one of these days as you play the international role,” he said.

Bergsten made an institutional proposal for the creation of an SDR Council, or SDR5. He said that people who worry about international governance have thought for many years about how to form a new governing organization that includes many advanced countries but also China. “They talk about expanding the G7, but China does not like that. Some G7 don’t like that either,” he said.

“But this is a natural opportunity,” he said, adding that the council could be either inside or outside the IMF to work for the evolution of the international monetary system. It’s a very important part of China’s overall rise as a global economic power.

chenweihua@chinadailyusa.com

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

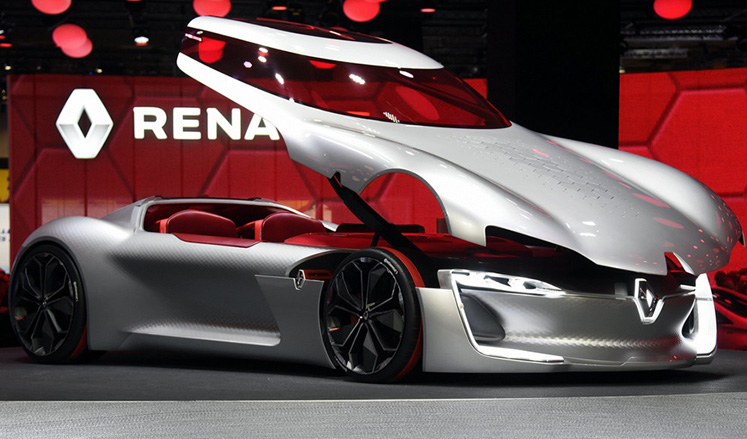

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|