Setting the price

Updated: 2012-09-28 08:47

By Wang Chao (China Daily)

|

||||||||

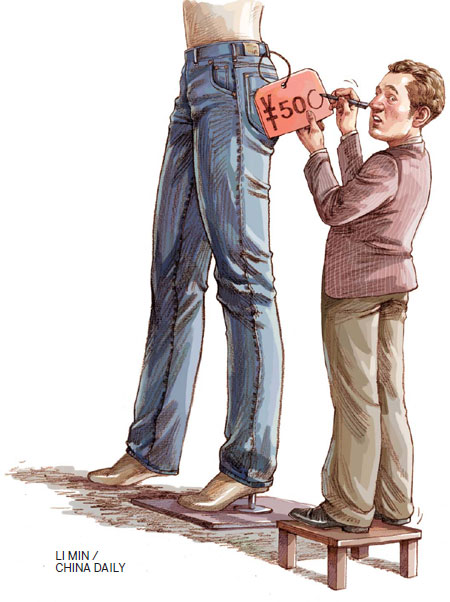

Changing economic landscape forces multinational companies to alter pricing strategies in China

Trawling through the various online shopping sites in China, one would be surprised to see the huge number of purchasing agents offering international products from reputed brands to Chinese customers. On Taobao, China's biggest online shopping site, at any given time one can find as many as 100,000 such agents of a varied scale offering diverse products such as cosmetics, garments, luggage, milk powder and health supplements.

|

||||

While that strategy has worked in the past, companies are now realizing that having a premium price tag alone does not ensure robust sales or continued success. The price is now seen more as a separator and not a differentiator in the huge Chinese consumer market.

There is no doubt that pricing is an important element in the overall marketing mix of a company as it is directly related to product positioning. At the same time, pricing also governs other elements like product features, marketing channels and promotional activities.

George Yip, professor and co-director of the Center on China Innovation at the China Europe International Business School, says that international brands have to take into consideration the extra expenses they incur when developing new markets, especially when the sales volume is far lower than that in the home markets.

In such situations, companies often raise product prices in overseas markets to recover these costs, he says. But that is only part of the overall pricing formula, says Yip, author of Managing Global Customers.

"Foreign companies generally sell to a higher level of the economic pyramid in developing countries such as China. So essentially their customers can afford the higher price," Yip says.

"This is also a typical foreign market penetration pricing policy: Start high and move down later to expand the customer base," he says. "These high prices are sustainable if customers pay and there is no other cheaper competitive alternative."

With the Chinese economy largely resilient to the global economic turmoil and the "higher level of the economic pyramid", or the upper and middle class in China, expanding quickly, there is now more than ever a desire among international companies to find the right pricing strategy to stay ahead of the competition in China.

Coach vantage

When people have higher purchasing power, it is natural for them to move up the economic ladder, says Gao Xudong, senior research fellow and vice-director of the Tsinghua University Research Center for Technological Innovation. "This is especially evident in the Chinese market," says Gao, former director of the MBA program at Tsinghua University.

"It is a rational choice for high-end brands to price higher in China," Gao says. "China is still a hierarchical society where people need brands to label their social status, and there is demand for every social class."

US leather goods maker Coach Inc was one of the first companies to realize the perception of Chinese customers and make hay from its early moves. Coach had 96 domestic retail locations in the Chinese mainland, Hong Kong and Macao as of June 30 this year and posted revenue growth in excess of 60 percent during its 2012 financial yearfrom July 2, 2011 to June 30, 2012.

The luxury goods maker says that there is a price disparity between the Chinese and US markets, but stresses that its products provide added customer values like essential luxury, status symbol and even a must-buy "local specialty", for those traveling to the US. Coach bags sell from upwards of 3,000 yuan ($475, 366 euros) in China, whereas most of the bags in US outlets are priced under $300 (233 euros), or even in some cases under $100.

Jonathan Seliger, president and CEO of Coach China, says the price disparities also stem from unavoidable factors.

"In fact, price discrepancies exist in all countries for all brands," Seliger says. "There are many reasons for the price difference. This includes the cost of transportation, marketing and the opening and operation of stores."

In addition, he says: "We have been in the US for over 70 years and are the overwhelming No 1 brand there. This automatically allows for scale efficiencies. We do not yet have that in many international markets, including China."

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese fleet drives out Japan's boats from Diaoyu

Health new priority for quake zone

Inspired by Guan, more Chinese pick up golf

Russia criticizes US reports on human rights

China, ROK criticize visits to shrine

Sino-US shared interests emphasized

China 'aims to share its dream with world'

Chinese president appoints 5 new ambassadors

US Weekly

|

|