Brics and mortar

Updated: 2013-03-22 07:09

By Yan Yiqi (China Daily)

|

||||||||

|

President Xi Jinping gives a joint interview to media from BRICS countries ahead of his first state visit to four countries. Besides his trips to Russia, Tanzania, South Africa and the Republic of Congo, Xi is also scheduled to attend the fifth leaders' meeting of BRICS. Lan Hongguang / Xinhua |

Four years after the bloc was born, experts talk about what it needs to do to grow

If the global financial crisis had not broken out in 2008, the nifty acronym BRIC, and everything it stands for, might still be lying dormant in a Goldman Sachs report somewhere, waiting for a chance to see the light of day.

And were it not for the relatively steady economic growth in the BRICS nations - Brazil, Russia, India, China and South Africa - people worldwide might still be agonizing over the slow recovery of the world's most advanced economies.

Eight years after Jim O'Neill, chairman of Goldman Sachs Asset Management, coined the term BRIC to refer to the emerging-market nations of Brazil, Russia, India and China, the economic bloc eventually came into reality in 2009.

A lot has happened since then, and China's newly elected President Xi Jinping is due to attend the fifth BRICS summit in Durban over two days from March 26, where he is expected to put ideas on the table for the bloc's development. An economic development bank, a business council and a joint think tank are among the possibilities.

When the bloc was set up four years ago, the timing, economists said, indicated that the global economy was becoming multi-polar, with emerging economies starting to become drivers.

"It is clear that a clear shift in economic momentum and influence away from Western exclusivity, toward a wider arc of nations including the East (and increasingly the South) has continued since the collapse of Lehman Brothers triggered a global recession," says Jeremy Stevens, a research analyst in Beijing with Standard Bank of South Africa.

Martyn Davies, chief executive of Frontier Advisory, a strategy and research company in Johannesburg, says this is the post-crisis new economic world order, a reality that the BRICS represents.

"What began as a loose grouping of emerging and populous economies is rapidly morphing into a more coherent power grouping that reflects the shifting balance of power in the global economy, away from the traditional world to the new."

Rather than causing this shift, the financial crisis in the Western economies has merely accelerated it, Davies says.

"The emerging world's ascent has not abated in recent years."

Last year, the GDP of emerging markets rose 7.4 percent to $29.1 trillion (22.56 trillion euros), compared with the G7's combined GDP of $33 trillion, Standard Bank says. Five years ago, the G7's GDP was about double that of the emerging markets.

The International Monetary Fund has forecast that emerging-market and developing economies will grow 5.5 percent this year, compared with 1.2 percent for advanced economies, and Stevens says emerging markets are more important than ever before.

"The gap in trend growth between emerging markets and rich countries has widened. In fact, while G7 total output in 2011 was roughly the same as in 2007, the 10 largest emerging markets have seen output nearly double."

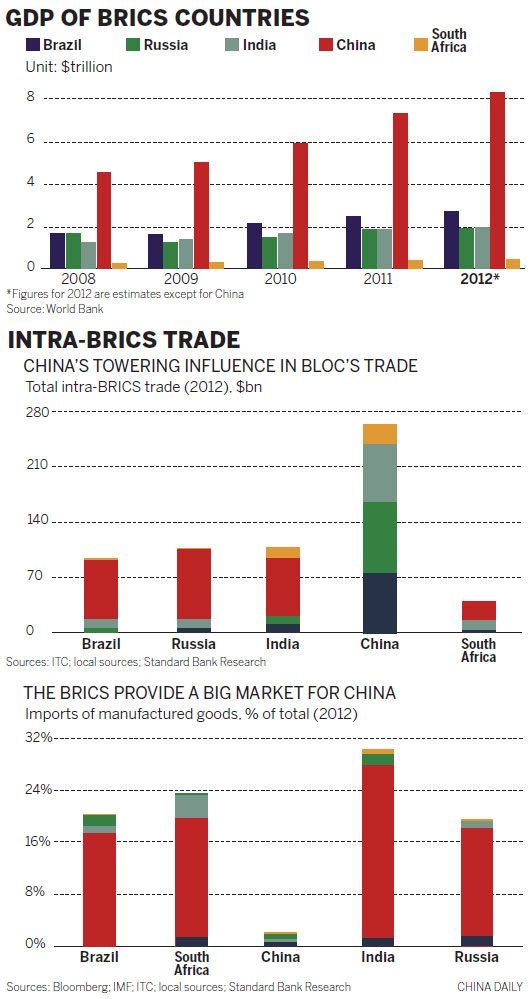

BRICS has become the global ranking standard for the first tier of emerging markets. Four BRICS nations were in the top 11 of national GDP rankings last year, and South Africa was not that far outside the list. GDP in China, the world's second largest economy, was worth $8.3 trillion, 7.8 percent higher than in 2011; Brazil's GDP was worth $2.4 trillion; India's and Russia's about $1.9 trillion each; and South Africa's $391 billion.

Zhang Huanbo, a researcher with the China Center for International Economic Exchanges, says that with the sluggishness of developed economies, the BRICS countries will continue to be a powerful force in driving the world economy.

"In the past three years, economic growth among BRICS nations accounted for nearly half of the world's total growth. Although it is possible that the BRICS nations may not keep up that pace in coming years, it will still be much faster than that of developed ones."

The BRICS group represents about 43 percent of the world's population and about one-fifth of global GDP. Last year its members accounted for $465 billion of global foreign direct investment flows, or about 11 percent, and about 17 percent of world trade.

Li Jinzhang, Chinese ambassador to Brazil, says he is optimistic about the BRICS nations and their leading role in the global economy. "All are influential developing countries with large populations and territory and rich in resources. Most importantly, they have been politically stable for years. I reckon the BRICS nations are well placed to develop at top speed for the next 10 to 20 years."

The vitality that BRICS economies have shown during the financial crisis has contributed to recovery, he says.

However, Lu Feng, a professor at the China Center for Economic Research affiliated with Peking University, says the influence of the BRICS on the global economy does not hinge solely on their efforts to achieve economic growth.

"As the global economy has had to be restructured as emerging markets strive to get ahead, BRICS has encouraged those markets to assert their rights. Working as a bloc they have been able to force Western developed economies to accept that the world economy is undergoing radical change and that they have to adjust their approach accordingly."

A post-crisis economic structure should include more voices from emerging economies, Lu says.

The Delhi Declaration of the fourth BRICS summit last year called for a more representative international financial framework that gives greater voice to developing countries, and a fair international monetary system that serves the interests of all countries and supports the development of emerging and developing economies.

"The power that has been given to emerging economies has not matched their economic growth," Lu says. "The main reason is that the developed economies are not willing to let go of power. In this regard it is time for the BRICS countries to assert their legitimate rights."

Davies also believes that as BRICS summits become more institutionalized, the group could well become a counterweight to established Western interests.

"We have heard of the need for a restructuring of the global economic architecture, one that gives greater cognizance to the needs of the developing world."

Challenges

While some see huge opportunities for BRICS, the optimism is far from universal, one of the doubts being that it may lack the cohesion to stick together.

Yevgeny Yasin, one of Russia's top economists, said in 2009 that he saw little future in the BRIC grouping. "I believe it will remain an informal club in form and essence," the Financial Times quoted him as saying.

Three years and an extra letter later, BRICS is a widely recognized player in global economics, but Yasin seems no less pessimistic about its future, saying that without a constitutional structure it cannot last long. "Apart from economic potential and scale, the five countries have nothing in common at all."

However, the more optimistic Lu says the biggest challenge lies within BRICS members' ability and will to lead the global economy together.

In addition, each country has its wares to sell and its demands to meet. Russia exports energy and metals, South Africa exports raw materials, too, and Brazil is a leader in global agriculture. Meanwhile, China and India gobble up commodities.

"It seems that each of the five countries has different economic structures and pillar industries, and they can complement each other," Lu says.

"However, on the way to becoming big emerging markets, manufacturing is what every country will try to develop. An overlap of interests will hamper BRICS from maturing."

Brazil is one of China's largest iron ore sources, but China's negotiations with Brazilian companies have not always been smooth.

Brazil and South Africa both export mostly raw materials to China while importing large amounts of value-added manufactured goods, and the rivalry between them for Chinese business is palpable.

Davies says it is ironic that South Africa's strategic political partners in the BRICS grouping are its greatest commercial competitors, especially in the African market.

Sectors where competition is most evident are construction, mining, engineering, chemicals, pharmaceuticals and IT, he says.

"This is especially the case with China and India. The management of South African commercial relations with both powers will be a delicate balancing act in the coming years."

Once the dynamics of politics are added to that balancing act, the precariousness of it all becomes all the clearer.

Zhang says the political concerns of the five countries will, to a large extent, dictate how the BRICS countries work with one another.

"China and India have territorial issues, while Brazil, located close to the US, has to be very careful with every decision it makes. As for South Africa, it has to grapple with the question of whether it really qualifies for membership."

How the member countries can balance their ambitions within the political structure at the same time as accommodating ideological differences and setting development goals are questions that the five member countries' leaders will eventually need to sort out, Lu says.

Stevens says any failure to establish a more binding institutional apparatus to govern the BRICS grouping would damage it. "A sober appreciation of this potential challenge should thus frame deliberations."

Just as bricks are of limited use without mortar, there is increasing awareness that if BRICS is to live up to its name its members have to do a lot more to make it function as a cohesive and effective economic unit.

"In many ways, the BRICS act more as competitors than collaborators," Stevens says. "Despite the grouping's best intentions it has yet to carve out a clear and collaborative agenda. The convergence between the BRICS superficially highlights areas of collaboration, which counteracts the assertion that the BRICS is a relatively rudderless group."

As world growth chugs slowly along, held back by weak demand in advanced economies, the pressure is on the BRICS to pitch in and add fuel to the engine.

Trade and investment, financial services and resources are seen as three key areas for collaboration.

Last year the Development Bank of Brazil, the State Corporation Bank for Development and Foreign Economic Affairs of Russia, Exim Bank of India, China Development Bank Corp and the Development Bank of Southern Africa signed a "master agreement in extending credit" in local currencies to reduce the demand for fully convertible currencies for transactions among BRICS members, and thereby help reduce the transaction costs of intra-BRICS trade.

China and Brazil then signed currency swap deals, considered the first step toward a broader agreement, with Russia, India and South Africa to allow BRICS members to pool resources as a bulwark against financial crises outside their borders.

Zhang of the China Center for International Economic Exchanges, says the BRICS countries should speed up signing currency swap deals.

"The currency swap deals are aimed at narrowing the influence of US-dollar domination in the world financial system," he says. "The financial crisis has proved that the domination of the US dollar in the global financial system is the root of the crisis. A more dynamic financial structure should be built as soon as possible."

Nikita Maslennikov, an expert with the Institute of Contemporary Development in Russia, says there is great scope for the five countries to work together in the resources area.

"That can be split into two categories: Russia, Brazil and South Africa belong to the resource-reliant economy category, while China and India are in the resources demand group," Maslennikov says. "Mutual projects based on the exploration of resources and the value-added manufacturing chain are foreseeable. Each country can find their position in the projects."

In all joint projects, planned or expected, experts believe that China is an essential ingredient in the mortar of intra-BRICS cooperation.

"Inside the BRICS, China's influence is more pronounced than even these macroeconomic metrics would suggest," Stevens says.

Standard Bank says China accounts for 67 percent of BRICS trade with the world, and China is a party in 85 percent of intra-BRICS trade.

"It is not surprising because China's economy accounts for around 55 percent of total BRICS GDP, and China is the world's largest trader," Stevens says.

China is Russia's, Brazil's and South Africa's largest trading partner and India's second largest. Last year China accounted for 20 percent of Brazil's exports, 10 percent of India's and Russia's and for more than 30 percent of South Africa's.

Davies of Frontier Advisory foresees challenges for BRICS but seems to be relatively optimistic about its future.

"BRICS indicates future consumer demand. Future growth of consumer demand comes from emerging economies. With further and more profound collaboration, the future is still bright."

Outlook

The summit in Durban from March 26 will convene under the theme "BRICS and Africa partnerships for integration and industrialization", focusing on BRICS nations' economic activities in the continent. Standard Bank predicts BRICS-Africa trade will be worth $500 billion by 2015, and discussions about business opportunities are likely to figure in the Durban summit.

South Africa's International Relations and Cooperation Minister, Maite Nkoana-Mashabane, says that viewing Africa as the new global growth center, BRICS countries are emerging as the largest investors and trade partners to the continent, and there is potential for huge growth.

Many economists say BRICS will continue to have an impact on the global economy. "Without doubt the BRICS is a varied group with different advantages and interests," Stevens says. "However, the differentiation gives versatility to the broader BRICS thrust, providing durability to commercial cords."

yanyiqi@chinadaily.com.cn

(China Daily 03/22/2013 page8)

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|