China demand for coal stokes world market

Updated: 2013-05-24 07:31

By Du Juan (China Daily)

|

||||||||

|

A coal factory in Anhui province. The United States will pursue opportunities to increase coal exports to China, says Platts' Coal Trader International. Provided to China Daily |

US expected to increase exports to China and Europe as power plants close

China's coal imports will continue from a more diversified number of sources over the long term, exerting a major influence on international coal prices, according to Platts, a leading source of benchmark price assessments in the energy, petrochemicals and metals sectors.

James O'Connell, the editor-in-chief of Platts' Coal Trader International, which delivers price assessments for coal trading in the Atlantic and Pacific markets, says that the US in particular will pursue the opportunity to increase coal exports to the country.

He adds that other countries are also expected to export more coal to China, including Indonesia, Australia and Russia.

According to data from Platts, US coal exports will increase from 50 million metric tons in 2012 to 270 million tons by 2016, as the country sees a rapid development of its shale gas resources, with more bound for China and India especially.

O'Connell says: "In the next 10 years, India will become China's biggest competitor in coal imports from Indonesia, which provides thermal coal at the best prices."

The US imported about 40 million tons of coal mainly from Colombia in 2008, but it is now shutting down its coal-fired power plants, and has quickly become a major coal exporter to Europe and China, he adds.

The US energy shift is similar to that in other coal-producing countries such as South Africa, which now exports about 62 million tons to Europe, India, Japan, South Korea and China.

O'Connell says the real positive for China is that as nations shift their emphasis away from coal-powered generation, supply choices open up for China, reducing coal import prices.

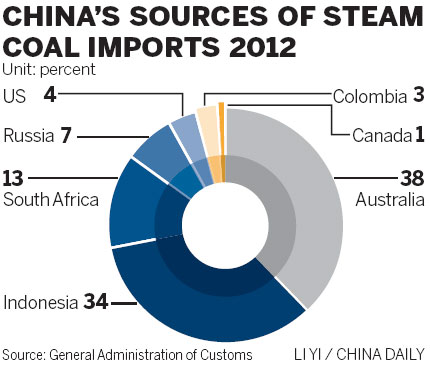

In the past year, 38 percent of China's coal imports were from Australia and 34 percent were from Indonesia.

It also imported from South Africa, Russia, Colombia, Canada and the US, meaning it has become the center of global coal demand, O'Connell says.

Europe is also expected to see a huge reduction in the installed generation capacity of coal-fired power plants by 2020, as it increases its solar power and wind power consumption, again beneficial for Chinese coal-fired power generation companies, price-wise.

China imported 290 million tons of coal in 2012, a 59 percent rise year-on-year, ranking it as the world's biggest coal importer, according to the General Administration of Customs.

Its average imported coal price dropped 7.4 percent to $99.5 a ton in the past year.

Meanwhile, it exported 9.28 million tons of coal in 2012, a record low since 1986.

"China has become an important buyer in the international coal market over the past four to five years," O'Connell says.

"Its seaborne coal demand accounted for 20 percent of global seaborne coal trading, which was about 1 billion tons in the last year. China usually purchases its coal when prices are low, but its large purchases, caused by its demand, will continue to push prices higher," he says.

"Thus, we can clearly see a regulated fluctuation of international coal prices in past years."

With China's coal demand from its power generation companies expected to continue until 2020, the country's coal-buying business with other markets such as Australia and Indonesia is expected to rise too.

A decade ago, China produced about 1.4 billion tons of coal annually at an average cost of $11 a ton. Last year, its annual output reached 3.7 billion tons, but the cost for each ton of coal rose to $37.

The unit cost for Indonesian coal production is currently about $30, according to Platts.

As Chinese coal-fired power generation companies benefit from increasing amounts of cheaper imported coal, the domestic coal industry is suffering serious overcapacity, weak demand and a huge decline in profits.

In the first four months of 2013, China imported 110 million tons of coal, a 25.6 percent rise year-on-year, at an average price of $91.6 a ton, down 17.8 percent year-on-year.

"Coal imports will continue to increase this year, and demand for imported coal will remain higher than for domestic coal," says Dai Bing, director of the coal industry information department at JYD Online Corp, a Beijing-based bulk commodity consultancy.

"Imported coal prices are a lot more appealing than domestic ones. In the second half of the year, domestic overcapacity will become even more serious, and a destocking process may lead to another round of coal price cuts."

The National Energy Administration is reported to be working on the drafting of new policies on the import of thermal coal as a way of helping domestic coal producers. However, analysts suggest the policies would do little to aid the struggling coal production industry.

"The overcapacity in the domestic market cannot be eased by limiting these imports because the new rules will stop the import of inferior coal, not that of good-quality coal at better prices," says Liu Dongna, an analyst at Sublime China Information Co Ltd, a commodities consultancy in Shandong province.

dujuan@chinadaily.com.cn

(China Daily 05/24/2013 page17)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|