Economy

Egyptian uncertainty hits Chinese companies

Updated: 2011-05-18 08:20

By Ding Qingfen (China Daily)

|

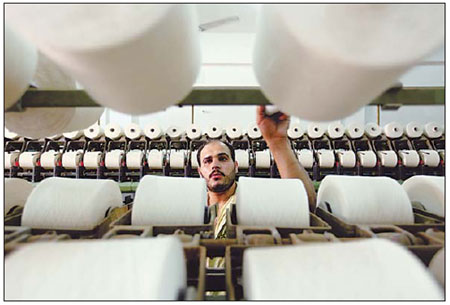

An employee watches cotton being wound onto spools at a factory in Mahalla, Egypt, in September 2010. Egypt mainly exports crude oil and cotton. Shawn Baldwin / Bloomberg |

Period of transition has seen many Chinese companies delaying deals

CAIRO - China's investment in, and exports to, Egypt will probably decline sharply this year.

That's after the recent turmoil in the African country dampened investor confidence and added the specter of trade protectionism, said a senior official from China's Ministry of Commerce.

However, from a long-term perspective the prospects for Sino-Egyptian economic and trade ties will become more positive, when the political situation in Egypt stabilizes and the investment environment improves for foreign companies, said Ma Jianchun, a minister counselor at the Chinese embassy in Cairo.

Egypt's former president, Hosni Mubarak, stepped down after 18 days of anti-government protests. The ensuing political uncertainty has sent the nation's economy into a tailspin.

"Ambiguous political prospects and a sliding economy raised concerns among Chinese companies, and they have either laid aside or delayed their investment projects. China's investment in Egypt will see a large decline this year," said Ma.

Egypt's use of trade protectionism against Chinese exports will probably increase as the Egyptian government comes under growing domestic pressure to limit imports and protect home-based industries, he added.

Egypt's economy shrank by about 7 percent in the period between January and March, and a report by the International Monetary Fund has predicted growth of a mere 1 percent this year. That's a huge contrast with 2010, when the economy grew by 5.1 percent.

In the days following the outbreak of anti-Mubarak protests in late January, the Egyptian pound fell more than 2 percent against the dollar to its lowest level in six years. The nation's unemployment and inflation rates both rose above 10 percent, and have remained stubbornly high.

Although the transitional government is rolling out measures to resume foreign investment, "political instability, a deteriorating macroeconomic situation and rising public calls to raise incomes are presenting challenges to many Chinese companies, such as inefficient operations, rising labor costs and safety risks", said Ma.

Liu Aimin, general manager of China-Africa TEDA Investment Co Ltd in Cairo, told China Daily that many Chinese companies are adopting a "wait-and-see" attitude, and are unlikely to invest more in Egypt in the short term.

Liu's company and the Egyptian government set up the Suez Economic and Trade Cooperation Zone in 2009. It's one of seven industrial parks China has built in Africa with the aim of facilitating investment.

The zone has absorbed 90 percent of the Chinese investment flowing into Egypt since it began operations.

China's investment in Egypt has surged in recent years. From 2007 to 2009, it went from $5.36 million to $90 million. But the figure dropped by 44 percent to $50.23 million last year.

Most Chinese investment goes into sectors such as textiles, auto manufacturing, petroleum refining and electrical power.

Ma is confident about future Chinese investment in Egypt. "When the new government comes into office, the investment environment will be more transparent and standardized and China's investment will recover and grow."

China Daily

(China Daily 05/18/2011 page13)

Specials

The song dynasty

There are MORE THAN 300 types of Chinese operas but two POPULAR varieties are major standouts

Sino-US Dialogue

China and the US hold the third round of the Strategic and Economic Dialogue from May 9-10 in Washington.

Building communities

American architect John Portman and his company have developed more than 30 projects across China.