BRICS to play summit role

Updated: 2011-11-04 07:49

By Wu Jiao (China Daily)

|

|||||||||

International community should provide eurozone support, Hu says

Cannes, France - Leaders of the major developing countries met in Cannes on Thursday to forge a united front ahead of the G20 summit.

Addressing a meeting of leaders from the BRICS, that also groups Brazil, Russia, India and South Africa, President Hu Jintao said that as the EU is the largest economy in the world, global recovery is dependent on a European recovery.

|

|

Leaders of the five major developing countries, Brazil, Russia, India, China and South Africa, meet ahead of the G20 summit in Cannes, Nov 3, 2011. [Photo/Xinhua] |

Stressing China's confidence in the EU's ability to solve the debt problem, Hu said that the "international community should provide support and help" to the debt-ridden eurozone, urging all countries to unify their approach.

Hu also suggested that the financial departments of the BRICS should consult closely to keep track of the changing situation and enhance coordination.

Indian Prime Minister Manmohan Singh, Brazilian President Dilma Rouseff, Russian President Dimitri Medvedev, President Hu Jintao and South African President Jacob Zuma are all in Cannes for the summit.

Medvedev was quoted as saying that the meeting discussed "the difficulties in the eurozone" and "the necessity for the BRICS to come up with a common stance".

No details of the meeting, or any possible measures to be taken on the EU debt crisis, have been revealed.

The Cannes summit, slated for Thursday and Friday, will address major problems facing the world economy and the stability of the global financial markets.

Issues to be discussed at the summit include, among others, the eurozone debt crisis, reform of the international monetary system and the strengthening of financial regulations.

European leaders hoped other countries, especially some emerging economies, would buy European Financial Stability Fund (EFSF) bonds, by injecting capital in the region's financial markets.

The EFSF was one part of a three-pronged rescue plan put together to solve the eurozone debt crisis.

Last week, eurozone leaders agreed to boost the EFSF capacity to 1 trillion euros ($1.38 trillion).

Agence France-Presse (AFP) cites figures saying that Asian countries already hold 40 percent of EFSF debt, in testament to the BRICS' huge reserve stockpiles.

Zhu Guangyao, vice-minister of finance, said on Wednesday that "the fund has not established details of its investment options so we still can't talk about the issue of investing".

Brazilian government officials last week said they would consider using a portion of Brazil's $350 billion in foreign reserves to help aid the EU through bilateral agreements at the International Monetary Fund (IMF). Russia has also reportedly decided to offer $10 billion through the IMF.

Top Kremlin economic adviser Arkady Dvorkovich told a news conference in Moscow on Monday that the BRICS would continue to lobby for wider clout in international financial institutions such as the IMF and the World Bank.

|

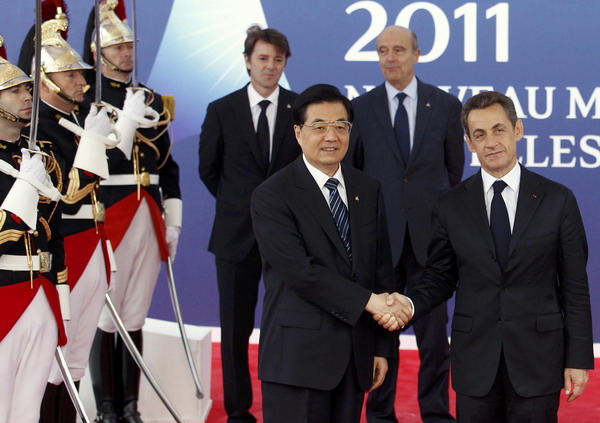

President Hu Jintao is welcomed by French President Nicolas Sarkozy on his arrival on Thursday at the G20 summit in Cannes. [Photo by Christian Hartmann/Reuters]

|

Leaders of the BRICS agreed that their finance ministers and officials should work out a common position on the eurozone crisis, Dvorkovich said.

He also said in a statement to Russian media that the BRICS agreed to carry out regular consultations in the IMF and other forums.

An agreement was reached at the 2009 G20 summit to grant emerging markets increased voting rights at the IMF, but progress has slowed due to the financial turmoil.

Since the financial crisis, the IMF has implemented two rounds of reform, in 2008 and 2010, to boost the emerging economies' quota shares and voting shares. Yet so far the US still holds veto rights, and the combined quota shares of the BRICS are still less than that of the US.

The AFP reported that this G20 summit could mark a shift in economic power.

"If other BRICS come into the deal (of helping the eurozone), it would only make the shift more momentous."

Daniel Bradlow, a law professor at American University in Washington, called it "a first in modern history" that developing countries would be directly bailing out their advanced counterparts.

"Formally, they don't get anything in return," Bradlow told AFP.

"Informally, I suspect there must be discussions about what the quid pro quo would be," he said, such as possibly a greater role in running the IMF.

Some Chinese experts remain cautious on the BRICS' role in helping the EU.

Xia Zhanyou, professor of Beijing-based University of International Business and Economics, said there were legitimate concerns.

"Honestly, I don't think we should get involved too much. The chances of us getting our money back are relatively low, it's a dangerous game," Xia said.

But it is also unlikely for a responsible China to just stand by and watch, he said.

"We should help at the right time in an appropriate way. Actually the crisis also presents an opportunity for the BRICS to fight for a larger say at the IMF."

Under such circumstances the BRICS should develop clear lines of communication, among themselves, to ensure the best outcome, he added.

Su Hao, director of the Asia-Pacific Research Center at China Foreign Affairs University in Beijing, said Europe has asked emerging economies for help behind the scenes.

But to reduce risk, China should ask for financial reform in Europe which will enable future bonds to be guaranteed by the EU instead of a single government, he said.