In love with luxury amid global gloom

Updated: 2012-01-16 08:03

By Karl Wilson (China Daily)

|

||||||||

Asia-Pacific has emerged as the key contributor to global wealth growth. While in 2000 it accounted for 36 percent of all global wealth creation, the Credit Suisse Research Institute said the figure rose to 54 percent between January 2010 and June last year. Its second annual Global Wealth Report says total global wealth increased 14 percent from $203 trillion during the same period.

"Emerging markets remain the main wealth growth engine, with the fastest growth seen in Latin America, Africa and Asia," the report said. "In the next five years, global wealth is expected to rise by 50 percent to $345 trillion and wealth per adult to increase 40 percent to $70,700, led by growth in emerging markets."

In the 18 months to June 2011, the fastest growth in wealth was registered in Latin America, Africa and Asia. While the US, despite its economic problems, was still the world's largest wealth generator in the period, adding $4.6 trillion to global wealth, China came second, followed by Japan, Brazil, Australia and India.

"Over the next five years, the wealth of emerging economies is expected to leapfrog the developed world, due to their more promising growth prospects," the Global Wealth Report said. "Wealth in China and Africa is projected to rise by more than 90 percent to $39 trillion and $5.8 trillion in 2016 respectively, while wealth in India and Brazil are forecast to more than double, (to) $8.9 trillion and $9.2 trillion (respectively)."

The projected increase in wealth in fast-growing emerging economies, compared with the growth of wealth in the US over the course of the 20th century, points to a dramatic effect.

Total wealth in China is currently $20 trillion, equivalent to that of the US in 1968, according to the report. In the next five years, it is expected to reach $39 trillion, a level the US took just over two decades to achieve.

At $4.1 trillion, India's total wealth in 2011 is comparable to the US in 1916. However, it is expected to reach $8.9 trillion in the next five years, equivalent to what the US achieved between 1916 and 1946.

Similarly, Brazil's total wealth is forecast to grow from $4.5 trillion in 2011 to $9.2 trillion by 2016, equivalent to the level of wealth gained in the US from 1925 to 1948.

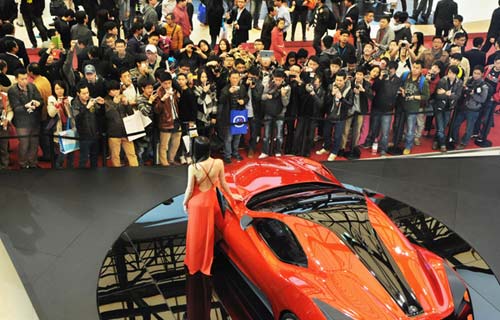

There can be no denying that in recent years the Chinese mainland has become the mainstay of the global luxury goods market, says Erwan Rambourg, HSBC's head of consumer brands and retail.

"Since the Chinese luxury market became relevant in 2003, when China started to account for more than 1 percent of luxury groups' sales, it has grown at rates above 30 percent without interruption," he told the Australian Financial Review.

Rambourg added that Chinese luxury-conscious consumers will continue buying, too; not only due to their increasing purchasing power but also because of deeply ingrained social and cultural factors. "Displaying wealth has become a trend in China and we think this will continue to translate into growing purchases of luxury goods," he said.

In an interview with China Daily Asia Weekly, Claudia D'Arpizio, analyst and partner at Bain, summed up the luxury market situation by saying: "The US is luxury's largest market, Japan ... still remains a large market in terms of absolute size.

"However, China is the true star of the region."

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|