RMB hub billed as 2nd gateway to Americas

Updated: 2015-04-16 04:42

By Wang Ru in Beijing(China Daily Canada)

|

||||||||

A new renminbi hub in Canada, the first in North America, could save businesses billions of dollars over the next decade, as well as provide a massive boost in exports, according to estimates by the Canadian Chamber of Commerce.

The hub "not only allows Canadian and Chinese companies to gain competitive advantages through settling trade accounts using RMB, such as cost savings, greater market access, and same-day currency settlements, but also enables direct RMB investment by qualified Canadian financial institutions into Chinese capital markets," Colin Hansen, CEO of AdvantageBC, said during an ongoing visit to Beijing.

AdvantageBC, a private organization dedicated to promoting British Columbia, and the Toronto Financial Services Alliance agreed last year to cooperate with industries and authorities to position Canada as an offshore hub for China's currency.

The move positioned Canada as a gateway for timely, efficient and cost-effective settlement and other RMB services throughout the entire Americas, said Hansen, a former deputy premier and finance minister for British Columbia.

The Canadian Chamber of Commerce said the hub could save businesses C$6.2 billion ($4.9 billion) over 10 years and increase Canadian exports by up to C$32 billion.

"Chinese investors in recent years have shown a growing interest in Canada, including in the fields of energy, real estate and tourism," said Yuan Zhangling, a former economic and commercial counselor at the Chinese consulate in Vancouver, capital of British Columbia.

"Of course, Chinese firms like to deal in RMB, as it is more convenient," he said, adding that Chinese firms sometimes offer discounts to foreign companies that are able to execute transactions in renminbi.

During a visit by Canadian Prime Minister Steven Harper in November, his government signed a bilateral agreement with China to become the first RMB settlement hub in North America. And on March 23, the Industrial and Commercial Bank of China officially launched its services as the official clearing bank for the Canadian hub.

The internationalization of China's currency has rapidly accelerated in recent years, in parallel with the country's growing global trade, supply chain integration and investment flows.

wangru@chinadaily.com.cn

Beijing film festival draws top moviemakers, Oscar winners

Beijing film festival draws top moviemakers, Oscar winners

Across America over the week (from April 10 to 16)

Across America over the week (from April 10 to 16)

Historic hotels offer more than a view

Historic hotels offer more than a view

Top 10 foreign holders of US Treasuries

Top 10 foreign holders of US Treasuries

Lost in sandstorms

Lost in sandstorms

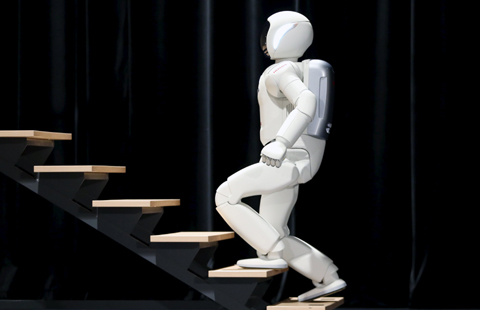

New roles for technology: Rise of robots

New roles for technology: Rise of robots

Strange but true: Getting ahead of the rest

Strange but true: Getting ahead of the rest

Top 10 industries with most job-hoppers

Top 10 industries with most job-hoppers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China and the 2016

US election

World Bank, IMF: will work

with AIIB

Ex-PM says US, China can be allies

Hainan Air links San Jose, Beijing

Carrying on a Chinese food legacy

America, Europe told to work with BRICS

Beijing film festival draws top moviemakers, Oscar winners

Chinese teachers mark progress

US Weekly

|

|