China train giants mull Bombardier stake: report

Updated: 2015-05-01 00:04

By PAUL WELITZKIN In New York(China Daily Canada)

|

||||||||

China North Railway and China South Railway companies reportedly are looking at acquiring a controlling stake in Bombardier Inc's railway unit, but Canada could act to block a sale to gain political support in the company's home province of Quebec, according to a former Canadian diplomat in China.

Reuters quoted unidentified sources on Wednesday as saying that the Chinese rail companies have held talks with Bombardier over the purchase of the company's train unit. Representatives of CNR and CSR told Reuters they had no knowledge of the matter, and a spokesman for Bombardier, based in Montreal, declined to comment.

A purchase of Bombardier's rail assets would "open the doors for the Chinese to all Western train markets," Reuters quoted one of the sources, which said it had direct knowledge of the situation.

Bombardier announced it "will explore initiatives such as certain business activities' potential participation in industry consolidation in order to reduce debt" in its fourth quarter 2014 results, David Tyerman, an analyst at Canaccord Genuity Group Inc in Toronto, said in an e-mail. "So it is willing to consider actions (sale, joint venture, etc.) to pay down debt and to improve the prospects for the units," he wrote.

Charles Burton, a former Canadian diplomat in China who is now a professor of political science at Brock University in St. Catharines, Ontario, wrote in an e-mail that Bombardier enjoys an "iconic status" in its home province of Québec because "it was the first French-Canadian owned business to achieve significant international success'' and its global operations are "a source of great pride for Québec nationalists''.

"For this reason the government of Canada could well act to block the sale of Bombardier's railway unit as a means to curry political support for the Conservative Party in that province," he added.

"The negotiations of the sale may involve commitments on the part of the foreign purchaser to maintaining the presence of Bombardier's rail operations in Canada. But it has proven hard for the government of Canada to enforce these commitments once the foreign acquisition has taken place. In the case of major Canadian acquisitions by US Steel and CNOOC, the parent firms were unable to maintain the commitments made at the time of purchase when market conditions rendered the Canadian assets less profitable after the sale, resulting in their consolidation outside of Canada," Burton wrote.

Burton also said that "the political sensitivity of the acquisition of Bombardier's railway unit by Chinese state enterprises is much less than foreign state acquisitions in Canada's natural resources sector like mining and oil''.

"With respect to the Canadian government, I couldn't say," wrote Tyerman. "There are usually net benefit tests that have to be passed. However, other jurisdictions may be more important as Bombardier Transportation is based in Europe (headquarters are in Berlin) and it has the majority of its operations and sales there. I would think Siemens, Alstom and other candidates" might evaluate Bombardier Transportation, he said. "Again, this could be for much smaller actions than a full sale – for example, JVs in specific areas or projects. And antitrust regulatory concerns would have to be considered."

Tyerman said it is possible that there would benefits from combining with other players in the rail sector, including improving technology across the combined entity or improving market access or the financial capability of the combined group.

Reuters said CNR and CSR may not be able to move forward on any discussions with the Bombardier unit until the two concerns complete a $26 billion merger. The high-speed rail manufacturers announced their merger late last year to compete more effectively against global rivals and as part of the central government's plan to consolidate some State-owned enterprises.

Bombardier Transportation also has a plant in Thunder Bay, Ontario, that makes street and subway cars and employs about 1,300. According to a report in the Toronto Star last year, Bombardier Transportation was the world's third-largest maker of railway equipment in 2013, after CNR and CSR according to European market research firm Xerfi Global. It had sales of $8.8 billion in 2013.

paulwelitzkin@chinadailyusa.com

Across America over the week (from April 24 to 30)

Across America over the week (from April 24 to 30)

Across Canada (May 1)

Across Canada (May 1)

China's top 10 GDP provinces in Q1

China's top 10 GDP provinces in Q1

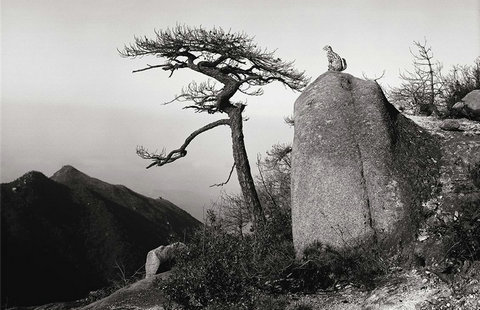

Photos capture marvelous landscapes of China

Photos capture marvelous landscapes of China

Mass exodus from Kathmandu

Mass exodus from Kathmandu

Running on water: a nearly impossible feat

Running on water: a nearly impossible feat

Ten photos you don't wanna miss - April 30

Ten photos you don't wanna miss - April 30

'Comfort women' survivor attends protest of Japan PM

'Comfort women' survivor attends protest of Japan PM

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe protests continue in SF

Abe betrays history's conscience

The 'nightmare' everyone saw coming

Vancouver property developer identified as Chinese fugitive: report

Freddie Gray tried to hurt himself in police van

China trainmakers seek control of Bombardier's rail unit

New rich set sights on tech, media and telecom sectors

US rapped for stance on Japan

US Weekly

|

|