Uncertainty over EU referendum vote impacts UK economy: Think-tank

Updated: 2016-05-11 10:36

(Xinhua)

|

||||||||

|

|

A city worker walks through the City of London, Britain in this Dec 16, 2014 file photo. [Photo/Agencies] |

LONDON - Uncertainty over the outcome of the European Union (EU) membership referendum figures strongly in the forecasts for UK economic growth from the National Institute of Economic and Social Research (NIESR) which sees the economy growing by 2 percent overall in 2016.

The NIESR forecast comes ahead of the June 23 UK referendum on continued EU membership, and the London-based think-tank predicted that in the event of a vote to remain in the EU growth in the economy would pick up in the second half of 2016, and into 2017 with growth next year forecast to be 2.7 percent of GDP.

Professor Jagjit Chadha, the director of NIESR, told journalists at a press conference on Tuesday that in the event of an exit from the EU there is likely to be a short-run threat to exchange rate, asset prices and monetary and financial conditions generally which would be a challenger for policy makers.

Simon Kirby, senior fellow at NIESR, said that pronounced uncertainty was "impacting on the UK economy", explaining that the institute had developed a measurement to capture the rates of uncertainty.

Over the past three months since the announcement of the referendum date uncertainty had increased and was now at a level seen at the time of the euro area crisis in 2011-12.

"This uncertainty is most manifested in sterling, which has depreciated by 8 percent since the start of this year," said Kirby.

The implied volatility for sterling three-month options contracts showed that where the three-month contracts hit the referendum and post-referendum period there is a "dramatic spike in volatility, which must be to do with the fact that the UK is making a fundamental decision about its future", said Kirby.

The recent depreciation in sterling is largely attributed to the risk that the UK will vote to leave the EU and if there is a vote to remain in the EU, currently the forecast of polls, bookmakers and experts, sterling is expected to appreciate sharply in the third quarter, ending this year broadly where it started in 2015.

Once uncertainty over the EU referendum had ended, and assuming a vote to remain, NIESR forecast a pick-up in investment growth in the second half of this year and into 2017, as a consequence of that uncertainty disappearing and delayed investment decisions are implemented.

Improvements in the UK's most important exports market, the United Statets and the EU, are set to contribute modest improvement to GDP growth this year.

"What really is weighing on growth is a negative contribution from trade this year. A modest pick-up will continue to erode the negative output gap that will continue to persist in the UK economy," said Kirby.

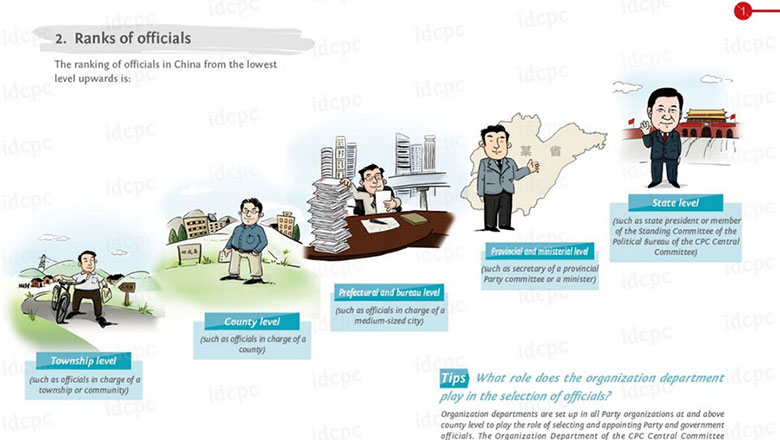

CPC creates cartoon to show how officials are selected

CPC creates cartoon to show how officials are selected

Top 5 expected highlights at CES Asia 2016

Top 5 expected highlights at CES Asia 2016

Business jet market hits air pocket

Business jet market hits air pocket

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Young golfers enjoy the rub of the green

Young golfers enjoy the rub of the green

71st anniversary of victory over Nazi Germany marked

71st anniversary of victory over Nazi Germany marked

Post-90s girl organizes others’ messy wardrobes

Post-90s girl organizes others’ messy wardrobes

Landslide hit hydropower station in SE China

Landslide hit hydropower station in SE China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|