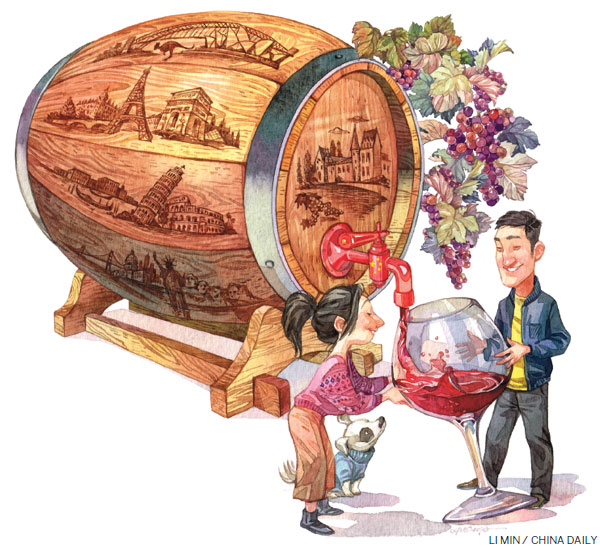

Stung by the government's austerity drive, the wine industry has been forced to re-evaluate how it does business.

Three years ago when the Chinese government ordered a stop to lavish spending by government officials, it was not just sales of ornately wrapped mooncakes and hard liquor that took a hard hit. Before long, too, it became clear that the wine boom bubble had burst. Until then, China's wine industry had been among the most stellar of many great economic performers, sales increases of less than 20 percent a year being the exception rather than the norm. But as the wine that government officials drank - at least that which taxpayers paid for - stopped flowing, so did the orders to wine traders, some of whom went out of business.

All of this has had a sobering effect on the industry, many of whose players realized that if the industry was to have a future it needed to rely on a broader consumer base than just big spenders. If learning that lesson was not hard enough, they now face the tough part: Putting into action a plan to market value-for-money wines to the Chinese masses.

Among those attempting to do that is COFCO (China National Cereals, Oils and Foodstuffs Corp), which has been forging links with respectable wineries abroad even as it builds its distribution channels at home.

"We are bringing in more affordable wines from well-known winemakers for ordinary Chinese people," says Li Shiyi, general manager of COFCO's imported wines business. "Most of our imported wines retail at between 60 yuan ($9) and 200 yuan."

Raymond Zhou:

Raymond Zhou: Pauline D Loh:

Pauline D Loh: Hot Pot

Hot Pot Eco China

Eco China China Dream

China Dream China Face

China Face