US subprime lenders targeted blacks, poor: report

Updated: 2008-01-16 15:25

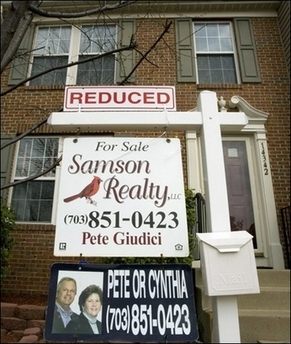

WASHINGTON -- US mortgage lenders targeted minorities and people with low incomes in recent years as the "best candidates" for subprime home loans, with devastating economic consequences, a report claimed Tuesday.

|

|

The report by the United for a Fair Economy (UFE) advocacy group said subprime mortgages, home loans issued to Americans with scant finances, were "ruthlessly hawked" and that a "solid majority of subprime loan recipients were people of color."

Hundreds of thousands of families lost their homes to foreclosure last year after failing to keep up with mortgage payments, a hefty chunk of which were subprime loans, amid a national housing downturn that shows no sign of easing.

Some economists believe the almost two-year-long housing slump could pitch the world's largest economy into a recession.

"The crisis has ruined many economic lives and many communities," the UFE report said, adding that "even a surface check of the demographics shows that, in city after city, a solid majority of subprime loan recipients were people of color."

UFE researchers said Detroit, Michigan has been hit by more foreclosure filings than any other city in the one hundred largest US metropolitan areas, and that it ranks third among cities with the largest black populations.

The report's authors said many blacks and poor Americans were deliberately targeted by lenders marketing a range of money-making home loans that were sometimes confusing for borrowers to understand.

|

|||

The Boston-based UFE, which released its findings to coincide with the January 15 birthday of Martin Luther King Jr, the US civil rights icon who was assassinated in 1968, said pre-payment penalties benefit lenders, but penalize borrowers from paying off a loan early.

The group said that although subprime loans were once a niche product, they had swelled during a years-long housing-boom to account for around 20 percent of all US mortgages.

|

|

|

||

|

||

|

|

|

|