News

Award-winning Equity Bank unlocks SME growth

Updated: 2010-09-21 09:18

|

Large Medium Small |

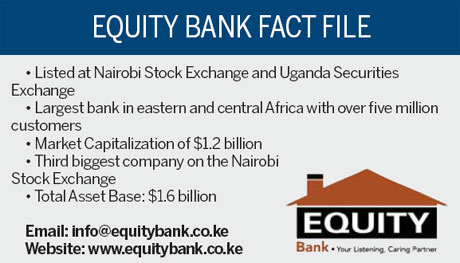

Loan with China Development Bank will give local entrepreneurs a major boost

|

|

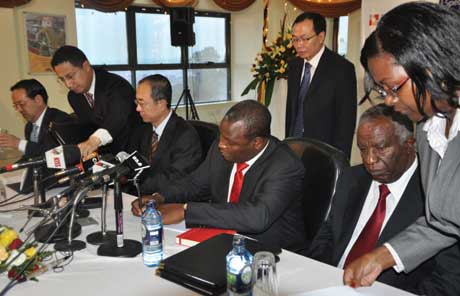

| Dr. James Mwangi, CEO of Equity Bank and China Development Bank officials sign an historic loan agreement. |

Small and medium enterprise (SME) operators in Kenya are expected to witness accelerated growth in their businesses after Kenya's Equity Bank and the China Development Bank (CDB) signed a $50 million loan agreement in Nairobi in support of the sector, which has been constrained by the lack of finance from financial institutions.

Equity Bank, Kenya's largest bank by customer base - home to more than 56 percent of bank accounts in Kenya and with more than 165 branches - has a strong foothold in the lower income segment of society.

Its unique business model that allows clients to transform their lives and livelihoods has won it several local and international accolades, including:

The Microfinance Bank of the Year in Africa (2008-09) - for assisting local communities and aspiring entrepreneurs to raise finance, ultimately contributing to their growth and development.

Africa Investor Series Awards 2009 (New York) - Top in the Ai 100 company category (2008-09) as the best performing company in Africa.

Africa Business Of the Year Award 2009 - Equity Bank's business model cited by world business leaders as a case study for sustainability in financial services.

Many changes in the banking sector in Kenya have been accredited to Equity Bank due to its approach to businesses that has literally forced large operators in banking in Kenya to try and follow suit.

Because of the informal nature of operators of SME businesses, access to credit facilities is a big challenge and therefore many rely on their savings for expansion of their businesses.

Lack of access to affordable credit is recognized as one of the key setbacks facing the development of the SME sector in Kenya. It is expected that the funds will provide a source of cheap loans for the sector that faces an insatiable thirst for access to credit and growth.

The loan facility signed with China Development Bank will be available to SME borrowers at interest rates of between 7 percent and 9 percent for periods ranging from three to seven years.

This effectively makes it the cheapest source of funding for the sector in Kenya.

First to get Chinese help

Equity Bank is the first beneficiary of the Chinese $50 million earmarked for the development of SMEs in Africa. It took three years for the two institutions to reach the SME loans agreement. The signing ceremony took place at Equity Bank's head office in Nairobi and was witnessed by CDB officials.

Equity Bank's Chief Executive Officer and Managing Director James Mwangi, who was named by London's Financial Times as one of the top world business leaders from 50 BRIC countries, said:

"We are proud as a bank and as Kenyans to be the first beneficiary of this support. This facility will allow us to grant our SME customers long-term facilities for development at affordable interest rates. The SME sector in Kenya faced the challenge of the high cost of credit, high bank charges and fees, limiting their potential to contribute to the country's Vision 2030, Kenya's economic blueprint."

CDB has been studying Equity Bank with a view to learning the much-acclaimed Equity Bank model of banking for possible lessons to be applied in China and sees the development of private SMEs as a key tool to generate and secure employment, fuel economic growth and stabilize society.

Governor of the CDB Jiang Chaoliang said the agreement was a sign of the south-to-south cooperation and collaboration to address the common challenges between the two institutions and countries.

"It is significant that Kenya and Equity Bank are the first beneficiaries of this SME fund for Africa. It reflects the growing relationship between Kenya and China," he said.

Multibillion estate project

Equity Bank has issued a credit facility worth $28.6 million to Thika Greens Ltd (TGL) for the construction of a golf estate in Kenya.

Metallurgical Construction Company of China is undertaking the construction project. TGL is owned by a group of 50 Kenyan investors, most of them in the real estate business.

The golf estate will be located in Thika town, 43 km east of Kenya's capital Nairobi. Construction is taking place on 1,135 acres of land and will incorporate a residential community with all associated facilities to support a viable suburb.

The project consists of two estates: Waterfalls Country Homes and Thika Greens Golf Estate.

Thika Greens Golf Estate will be a lifestyle estate built around an 18-hole championship golf course similar to the high-end estates found in Australia, South Africa and the US.

The project is expected to cost a staggering $650 million upon the completion of the construction of the houses and infrastructure on site.

In an interview with Kenya's weekly publication The Financial Post, TGL's Managing Director Charles Kibiru said the entire golf estate will have 4,000 housing units per milestone, considering that Kenya has a housing unit shortage of fifteen times that figure.

"Our vision is to replicate the project by setting up more golf estates in other major cities in Kenya like Mombasa, Kisumu, Nakuru and Machakos," he said.

Second phase launched

In its second phase which the MD said is due for launch this month, TGL has contracted DDV Design Group of South Africa, an architect firm which has designed a private member's club house overlooking an 18-hole championship golf course and a golf estate where 810 plots will be sold to the public.

"The Chinese Construction Company, MCC4, which we have contracted to undertake the construction will commence operations in July as we gear up to complete the project in two years' time," he said.

China Daily