Newsmaker

Ex-Bank of Italy chief gets 4 yrs in jail

(Agencies)

Updated: 2011-05-29 07:39

|

Large Medium Small |

|

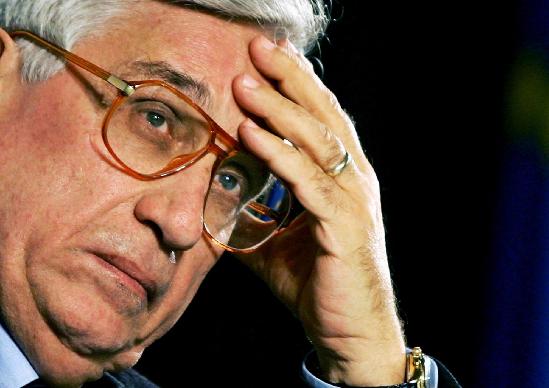

Bank of Italy Governor Antonio Fazio attends a meeting in Rome in this October 29, 2005 file photo. [Photo/Agencies] |

MILAN -- An Italian court sentenced Italy's former central bank governor Antonio Fazio on Saturday to four years in jail for market-rigging related to a 2005 takeover battle over Italian bank Banca Antonveneta.

A Milan court has also ordered Fazio -- who headed the Bank of Italy from 1993 to 2005 -- to pay a 1.5 million euro ($2.14 million) fine for his role in the takeover saga pitting Dutch Bank ABN AMRO against Italy's Banca Popolare Italiana (BPI).

Fazio's lawyer called the sentence "unjust" and said he would file an appeal, the Ansa news agency said.

"I'm confident I always acted for the good and I'm convinced this sentence should be amended," Ansa quoted Fazio as telling one of his lawyers.

Fazio was forced to resign in December 2005 amid allegations that he backed the domestic bid by BPI -- now part of Italy's Banco Popolare.

Former BPI Chief Executive Gianpiero Fiorani was sentenced on Saturday to one year and eight months in jail.

The court also fined insurer Unipol 900,000 euros and ordered the seizure of 39.6 million euros over the misconduct of two former employees in relation to the Antonveneta case.

Under Italian law, companies are held responsible for supervision failures.

Unipol said in an emailed statement it would have been impossible for the insurer to prevent what happened and called the sentence surprising.

"However, both the fine and the seizure are suspended until all stages of trial are completed," Unipol said.

Unipol's former chairman Giovanni Consorte was sentenced to three years in jail and a one million euro fine.

Fazio also faces charges of favouring market-rigging in a separate case involving Unipol's 2005 attempt to buy Italian bank Banca Nazionale del Lavoro (BNL). He denies the charges.

France's BNP Paribas bought BNL in 2006. Banca Antonveneta is now part of the Monte di Paschi di Siena group.

| 分享按钮 |