Decade's growth beats all forecasts

Updated: 2011-09-13 07:51

(China Daily)

|

|||||||||||

|

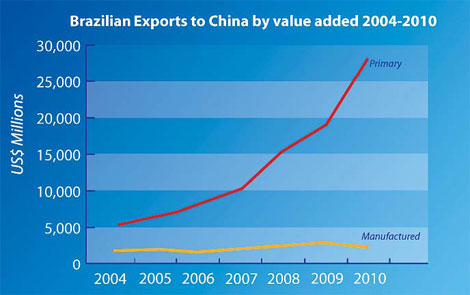

Illustrating how Brazil's export revenue has increased Source: Brazilian Ministry of Development, Industry and Trade (MDIC). Preparation: CEBC. |

It is fair to say that a key resource of growth has been the boom in trade with China

The warning signs of some economic overheating are there, but experts are insisting that Brazil is undergoing a positive expansion, not a credit bubble.

Brazil may not have been known historically for its macroeconomic brilliance, but it has done what many, only 15 years ago, would have said was the impossible.

A decade of growth has resulted in an enviable stability and progressive social policies that have allowed a wider distribution of wealth than ever before.

Unemployment, for example, by last April was at 6.4 percent, the lowest on record for the gigantic country.

In fact, Brazil's economy grew 7.5 percent in 2010, the fastest in a quarter century, while exports grew to a record $202 billion, exceeding the previous record set two years earlier. Imports also increased, though at a lower rate, giving the country a robust trade surplus of more than $20 billion.

Its currency, the real, has also taken off, gaining over 40 percent against the US dollar over the last three years. Money, and investors, have poured into Brazil, where the main interest rate is above 12 percent. The $35 billion in foreign direct investment in the first three months of 2011 was greater than total amount for 2010, and is a testament to the fact that investors see a good rate of return in Brazil.

But, it is not just foreign currency that has seen an influx, since work permits for white-collar jobs have risen 30 percent, this year alone. Hedge-fund managers, Wall Street bankers, and entrepreneurs are knocking at the door to get a share of the spoils.

China trade

One of the key sources of this growth, it is fair to say, has been the boom in trade with China.

Trade between the two countries was worth well over $50 billion in the last 12 months and, even though the overall economy may post a slower rate of growth this year, the China trade boom shows no sign of easing.

In this, the government policies have not hurt. Brazil's Finance Ministry says it has tried to ensure that macroeconomic management is secure. The finance minister, Guido Mantega, has said that he now needs to keep an even tighter hold on the economic reins for the near future.

The increased trade with China has been a blessing indeed, but, while the trade balance has improved significantly, the lion's share is from raw materials and commodities rather than high-value goods.

What this means is that the country needs to become more competitive and narrow the gap between exports of value-added goods and those of commodities. And, thanks to exports there is a great deal of excess cash and credit in the Brazilian economy, but this needs to be regulated and put to wiser use.

That cash, and easily available credit, cause inflation, which is another cause for higher interest rates, further fuelling the currency valuation and hurting Brazil's manufacturers.

In August, the finance minister emphasized his intention to keep a tight grip on spending, so he could find room to lower interest rates over the longer run. He also explained that he wants to change Brazil's current spending habits and invest more in much needed infrastructure projects over the next few years.

Speaking to the Brazilian newspaper Folha de So Paulo, Mantega explained, "We're going to establish a new relationship between fiscal and monetary policy. Fiscal policy will be more defensive, while the monetary policy will be more active."

He said he also expects inflation to ease off, taking some of the pressure off the economy.

The finance minister definitely does not want to risk Brazil's growth and economic success. He says he believes he is right in reacting to the growing number of complaints about the rate of growth and credit availability and how they could ultimately create a new economic bubble.

In spite of the optimism of many of his compatriots, Mantega simply acknowledged that, while there may be challenges ahead, he is sensibly preparing to deal with them.

Powerhouse

One of the optimists, and a man in the know, is Mario Garnero, of Brazil's pioneer merchant bank Brazilinvest. He has gone out of his way recently to insist that Brazil is in a strong position and not on the verge of a credit bubble.

At the beginning of August, Garnero stated that Brazil, along with its fellow BRIC countries (Russia, India and China), will be a powerhouse in the global economy for years to come.

"It's important that the markets see that Brazil is undergoing a robust credit expansion, not a credit bubble," Garnero commented in a speech to the 2011 Congress of the Society for International Development, in Washington, DC.

"When you consider that Brazilian households, on average, owe less than 50 percent of their yearly incomes, compared to 120 percent in major developed economies, you can appreciate (the fact) that Brazil is indeed far from succumbing to the financial pressures that caused the global credit crisis. Brazil had also tackled the question of reshaping its financial sector prior to the financial crisis, giving it a vital advantage over much of the globe's financial sectors," he added.

Brazil's banks will have to play a significant role in redirecting the country's finances by helping restructure those exports.

To make the change, and improve the commodity-goods mix, Brazil needs to get its manufacturers and investors to be more active overseas.

In China's case, the policy of investing in other economies and opening production lines abroad was aided by the fact that Chinese banks led the charge to new markets. They were already there, abroad, in situ, waiting to give the necessary support to existing and new Chinese clients.

Following those moves, Bradesco, and its state-controlled rival Banco do Brasil, have agreed to acquire stakes in Banco Espirito Santo Africa, a holding company that handles investments in Africa.

This joint venture will expand Brazilian banks' international operations and benefit Brazilian businesses operating, or wanting to operate, overseas.

Such a move can only help shore up the Brazilian government's goals of strengthening the country's multinationals and creating new markets for Brazilian products. And, one hopes this will be the start of a wider international push.

Domingos Figueiredo de Abreu, Bradesco's executive vice president, said recently, "We want our international offices to be a point of contact for Brazilian companies abroad, and for foreign investors looking at Brazil."

But they do not want to forget China: "Bradesco wants to be the home of Chinese capital in Brazil - for exporters and investors."

Quality Communication Productions contributed the story

China Daily

(China Daily 09/13/2011 page26)

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|