Sydney becomes the latest renminbi hub

The People's Bank of China has agreed to a deal with the Reserve Bank of Australia that will see Sydney, Australia's largest city, become the latest hub for trading in the Chinese currency.

The two central banks signed a memorandum of understanding on Monday, agreeing to extend the Renminbi Qualified Foreign Institutional Investor program to Australia with an initial investment quota of 50 billion yuan ($8.16 billion). It is expected that a Sydney clearing bank for yuan will be appointed soon.

"Such arrangements signify that financial cooperation between China and Australia has taken a new step forward. It will benefit companies and financial institutions from both countries in terms of using the yuan in cross-border transactions, promoting bilateral trade and facilitating investment," said the PBOC in a statement posted on its website.

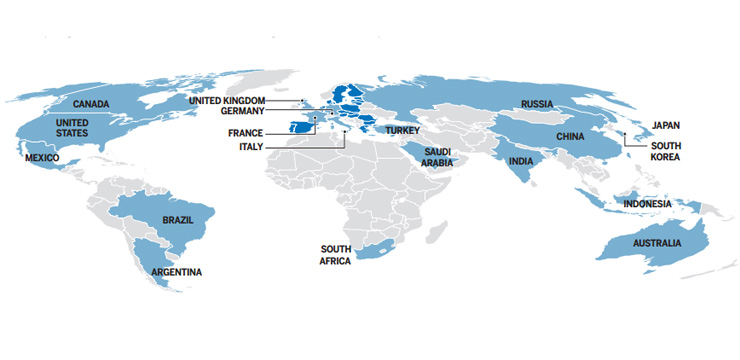

Starting in June this year, the PBOC designated yuan clearing banks in London, Frankfurt, Seoul, Paris, Luxembourg, Doha and Toronto, while China is strengthening efforts to promote the use of the yuan in international trade.

Statistics from the PBOC show that cross-border yuan settlement exceeded 4.8 trillion yuan in the first three quarters of 2014, up from 3.58 billion yuan in 2009.

Song Ke, a research fellow at the International Monetary Institute at Renmin University of China, said the Chinese government has accelerated the globalization of the yuan by pushing it forward around the world simultaneously, whereas the globalization process was initially carried out in neighboring countries and certain regions.

"Designating a yuan clearing bank in Sydney is more out of consideration for global strategic layout than economic considerations," Song said. "By establishing offshore yuan centers to facilitate the reflow of capital through trade settlement and financial investment, China is laying a solid foundation to further promote internationalization of the yuan and opening up of the capital market."

He said the next crucial step for yuan internationalization is capital account liberalization, which should be promoted steadily aligned with liberalization of the yuan's exchange rate.

Renminbi business in Australia is quite small. The best estimate suggests that only 1 or 2 percent of overall Australian trade might be conducted in renminbi, said Paul Bloxham, chief economist for Australia and New Zealand at HSBC Bank Australia, in September.

"The reason why it is still a fairly small proportion of Australia's overall trade is because most of what we exported is commodities. Most of those commodities are still priced in global markets in US dollar terms. There are some moves afoot for more pricing to be done in renminbi, but it hasn't happened in a big way yet. It's an area where there is probably more scope for greater use of renminbi," Bloxham said.

"At the moment, most commodities are priced in US dollars, but over time you would expect that renminbi might become a larger part of that story," he said.

UnionPay International, Bank of China and Australia Post signed an agreement in Canberra on Monday to jointly issue AusPost UnionPay dual currency cards.

Ge Huayong, chairman of China UnionPay & UnionPay International, said that as China is the largest source of international students and immigrants, the card will be issued to "cater to their demand and to seize the opportunities arising from the direct currency conversion agreement between China and Australia".

jiangxueqing@chinadaily.com.cn

Background