Premier Li's visit provides Brazil with timely opportunities

By Stephan Mothe (China Daily USA) Updated: 2015-05-18 12:32As China's economic diplomacy has expanded to every corner of the world over the past decade, Latin America has been the recipient of much of that attention. Relations between China and the region have been strengthened and nowhere is this clearer than in Brazil.

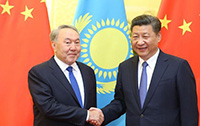

As China's largest trade partner in the region, Brazil received President Xi Jinping last year during the BRICS Summit.

Premier Li Keqiang's visit will come at a sensitive time for Brazil, which is currently being rocked simultaneously by an environmental, political and economic crisis.

Yet through it all, Brazil has been able to find a reliable partner in China. Trade flows between the countries totaled $83.3 billion in 2013 and $77.9 billion in 2014. The reduction is accounted for not by a fall in volume, but by the drop in the international price of commodities and the devaluation of the Brazilian reais. Although this development has eroded Brazil's trade surplus from $8.7 billion to $3.3 billion, everything seems to indicate that under stable prices and a stable currency, Brazil will continue to benefit from bilateral trade.

The assertion that a slowdown in China's economic growth does not bode well for Brazil may be overblown. Although much of the commerce between the countries centers on commodities, China's rapid urbanization and transition to a consumption-based economy presents Brazil with the perfect opportunity to diversify its exports.

Brazil's competitive agribusiness sector has already been taking advantage of the opening. Cotton and leather were Brazil's fastest growing exports to China in 2014, and poultry, beef and even pork are set to post strong growth in 2015.

Indeed, Brazil's Association for the Promotion of Exports took a delegation of representatives of 30 Brazilian agribusiness and food and beverage companies to participate in trade fairs in Guangzhou and Shanghai from May 4 to 8. Not coincidentally, Li will be accompanied by a coterie of 150 business executives from diverse sectors of the Chinese economy during his visit.

Aside from commerce, investments will also feature prominently on the agenda. Li is expected to sign a number of deals which were first discussed during Xi's visit last year. The emphasis of these investments will be infrastructure. The biggest beneficiaries will be Brazil's people and businesses.

Brazil desperately needs to upgrade its infrastructure, whose deplorable current condition results in inefficiency, uncertainty and prohibitive transportation costs within the country. It is likely that Chinese banks and companies will fill the vacuum. Railways, hydroelectric dams and electricity transmission lines are projects for which Chinese companies are especially well suited.

One project in particular would seem to fit neatly into China's One Belt, One Road initiative, based on historic Silk Road trade routes, which appears at first glance to promote Eurasian integration and development but also shows global promise. A transcontinental railway envisioned to link Brazil's Atlantic ports to Peru's Pacific ports could facilitate the integration of markets in the interior of the continent and improve the supply chain logistics of export-oriented enterprises. It would also reduce dependence on the Panama Canal, allowing China to add a land-based buckle to the "Belt".

No strategy is without risks - and the environmental impacts of building a railway or a dam in the Amazon rainforest must be taken into account - but by and large Brazil stands to benefit from these investments.

At the same time, its companies should seek opportunities in China, particularly in value-added categories such as food service and fashion, where strong Brazilian brands can stake their claim in the Chinese market. If they make the Chinese consumer a priority, they have a world to gain.

The author is a market analyst with Euromonitor International based in Rio de Janeiro, Brazil