Brisbane Action Plan should be properly implemented by G20

By Zhu Qiwen (China Daily) Updated: 2015-09-03 09:38

|

|

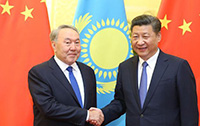

G20 finance ministers and central bank governors pose for the media during family photo in Istanbul, Feb 10, 2015. [Photo/Agencies] |

As G20 finance ministers and central bankers prepare to meet in Ankara on Thursday and Friday, global investors are nervously bracing themselves against the shocks of stock price swings, oil price fluctuations and currency volatility, along with the contraction in China's manufacturing activities.

The benchmark Shanghai Composite index fell by more than 4 percent on Wednesday morning after the release the previous day of two factory activity indexes that showed multi-year lows. This deepened the gloomy global outlook on China's economy, reinforcing the impression that Wall Street, and almost every other stock market in the world, gets a cold when Shanghai sneezes.

But should global policymakers accept this as a convenient explanation for the increasing global uncertainties?

At a moment when the global economy is bracing for both a weaker-than-expected recovery in advanced economies and a further slowdown in emerging economies, it is simply irresponsible to blame all the global troubles on China's difficulties in meeting its 7-percent annual growth target.

Rather than being swayed by eye-catching market moves, the leading global financial officials should focus on making the G20 meeting a chance to examine and address looming structural problems in the world economy. These underlying structural problems have clearly not been solved by the easy money that major central banks around the world have pumped out to fight the 2008 global financial crisis.

Last year, the G20 agreed in Brisbane, Australia, to launch new measures to increase the growth in their collective gross domestic product and create millions of new jobs over the next five years.

Yet, as the world economy is grinding along at the slowest annual growth rate since 2008, it is hard to believe that the G20's Brisbane Action Plan has been properly implemented.

Admittedly, concerns about China's economic slowdown and the Greek financial crisis have weighed on global policymakers' minds for a good reason during the first half of the year.

But it is misleading for G20 central bankers and financial ministers to focus their attention on China while ignoring the emerging anxieties over the consequences of the US Federal Reserve's intention to raise interest rates this year.

The transformation of China's growth pattern will never be easy and smooth. All the turbulence in the Chinese stock market and the Chinese economy should be deemed both as a cost that the country has to pay for economic transition, but also an incentive for the Chinese government to deepen reforms more quickly.

Though early government responses to the country's stock market woes since mid-June did not achieve the desired results, the latest efforts to shore up economic reforms and growth and promote the healthy development of the capital market have offered more reasons for confidence in the country's mid and long-term growth prospects.

For instance, the plan to set up a 60-billion-yuan fund ($9.4 billion) to support small-and medium-sized enterprises, which the Chinese government announced on Tuesday, is an emergency package, but it is one that will serve the long-term goal of promoting entrepreneurship and innovation as a new source of the country's economic growth.

It is important for the G20's central bankers and finance ministers to recognize that it will take time for China's reforms to tackle the long-term structural problems in the Chinese economy. Yet, they cannot just sit on their hands and wait as the inevitable tightening of the US monetary policy is set to ignite another global investor tantrum, with emerging markets again bearing the brunt.

Almost seven years on from the sudden collapse Lehman Brothers, the G20 must do more to prevent a slow-motion repeat of that global financial crisis by promoting structural reforms in all the major economies around the world.

The author is a senior writer with China Daily. zhuqiwen@chinadaily.com.cn