Britain vote to leave in historic referendum decision

(Agencies) Updated: 2016-06-24 13:08

|

|

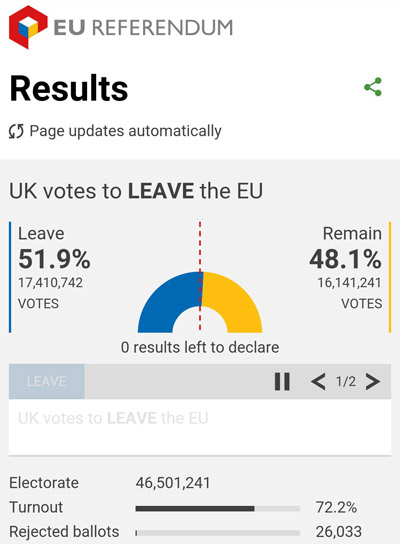

Screenshot from the BBC shows the results after all votes have been counted. |

LONDON - Britain has voted to leave the European Union, results from Thursday's referendum showed, a stunning repudiation of the nation's elites that deals the biggest blow to the European project of greater unity since World War II.

World financial markets plunged as complete results showed a near 52-48 percent split for leaving. The vote created the biggest global financial shock since the 2008 economic crisis, this time with interest rates around the world already at or near zero, stripping policymakers of the means to fight it.

The pound suffered its biggest one-day fall in history, plunging more than 10 percent against the dollar to hit levels last seen in 1985. The chief ratings officer for Standard & Poor's told the Financial Times Britain's AAA credit rating was no longer tenable.

Futures trading predicted massive opening losses on share markets across Europe. Britain's FTSE futures and Germany's Dax futures fell about 9 percent. The euro zone's Euro Stoxx 50 futures sank more than 11 percent.

The vote will initiate at least two years of divorce proceedings with the EU and cast doubt on London's future as a global financial capital.

The future of Prime Minister David Cameron - who gambled the fate of the nation on an outcome he predicted would be catastrophic - was doubtful at best.

Foreign Secretary Philip Hammond said Cameron would stay on, however: "What the country needs now is a sense of continuity and stability."

The euro slumped more than 3 percent against the dollar on concerns a Brexit vote will do wider economic and political damage to the world's biggest trade bloc, stripped of its second largest economy. Investors poured into safe-haven assets including gold, and the yen surged.

"We're in uncharted territory," an aide working in Cameron's office told reporters.

The Bank of England said it would take all necessary steps to secure monetary and financial stability. Global policymakers also prepared for action to stabilise markets, with Japanese Finance Minister Taro Aso promising to "respond as needed" in the currency market.

Yet there was euphoria among Britain's eurosceptic forces, claiming a victory they styled as a protest against the political establishment, big business and foreign leaders including U.S. President Barack Obama who had urged Britain to stay in.